Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

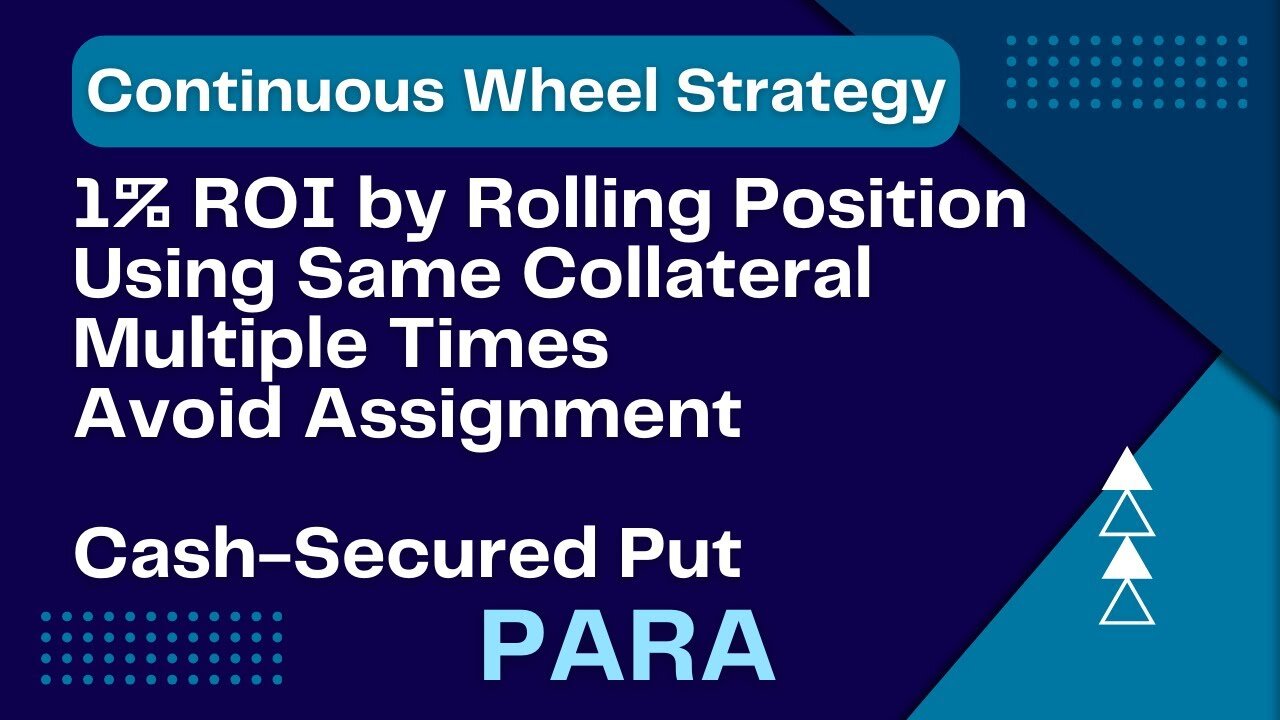

1% ROI - Rolling On-Going Cash Secured Put - Avoiding Assignment - Monitoring Extrinsic Value

1 year ago

25

Get Your FREE Account today at https://myatmm.com

We identified one of our cash secured put position that had an extrinsic value of close $0.10 or below to roll to a future expiration date. Pushed out 2 weeks and made a 1% ROI on the trade. By rolling the position we were able to re-utilize the same collateral once again to produce additional premium collected.

We used $1,350 as collateral.

Stock Involved:

Paramount (PARA)

NOT INVESTMENT ADVICE - EDUCATION AND ENTERTAINMENT PURPOSES ONLY!!!

Loading comments...

-

1:51

1:51

At-The-Money Options Trading Strategy

1 month agoCost Basis Proposed Records Clear Button Functionality - Wheel Strategy - Stock Market

261 -

11:07

11:07

Politibrawl

12 days agoRepublican rising star DESTROYS theatrical Democrat in front of the entire world

50.3K23 -

LIVE

LIVE

StoneMountain64

3 hours agoOnly game with BETTER desctruction than Battlefield?

166 watching -

Viss

5 hours ago🔴LIVE - Viss & Dr Disrespect Take on The 5 Win Minimum PUBG Challenge!

9.49K2 -

LIVE

LIVE

sophiesnazz

1 hour ago $0.32 earnedLETS TALK ABOUT BO7 !socials !specs

30 watching -

1:12:05

1:12:05

The Quartering

3 hours agoToday's Breaking News!

74.1K27 -

LIVE

LIVE

GritsGG

7 hours agoWin Streaking! Most Wins 3390+ 🧠

59 watching -

2:20:00

2:20:00

Tucker Carlson

4 hours agoDave Collum: Financial Crisis, Diddy, Energy Weapons, QAnon, and the Deep State’s Digital Evolution

111K86 -

1:06:56

1:06:56

Sean Unpaved

19 hours agoSwitch-Hitting Stories: Chipper on Baseball, Football, & the Game's Future

26.4K1 -

1:23:11

1:23:11

Timcast

5 hours agoTrump SLAMS Anti-American Museums, BANS Migrants For WOKE Views

143K89