Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

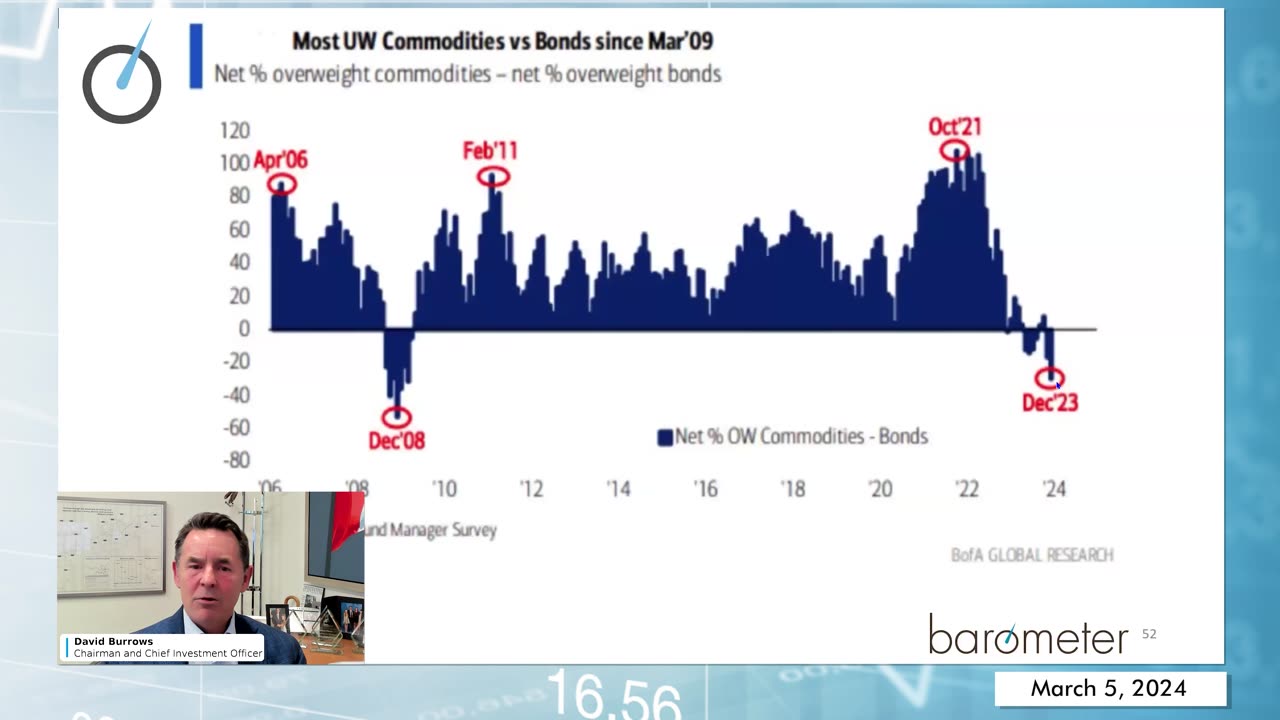

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

LIVE

LIVE

Candace Show Podcast

1 hour agoBREAKING NEWS! The Egyptian Military Was In Provo On 9/10. | Candace Ep 255

5,578 watching -

LIVE

LIVE

Redacted News

1 hour agoBREAKING! KASH PATEL'S FBI SHUTS DOWN CHARLIE KIRK ASSASSINATION FOREIGN INTEL PROBE BY JOE KENT

7,748 watching -

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SOLO RAIDING THE GALAXY

1,426 watching -

1:12:37

1:12:37

vivafrei

3 hours agoTexas A.G, Sues J&J over Autism Claims! VIva Goes Honeybadger on Liberals! Hasan Piker & MORE!

79.8K27 -

3:19:22

3:19:22

Barry Cunningham

3 hours agoPresident Trump Talks China | Mike Johnson Shutdown Day 30 | Reacting To JD Vance Questions At TPUSA

13.8K4 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | THURSDAY 10/30/25

1,178 watching -

14:54

14:54

The Kevin Trudeau Show Limitless

1 day agoThe Hidden Force Running Your Life

30.5K6 -

LIVE

LIVE

freecastle

5 hours agoTAKE UP YOUR CROSS- Do not be deceived: 'Bad company ruins good morals.

98 watching -

LIVE

LIVE

The HotSeat

2 hours agoWatching Them Implode.....Fun To Watch!!!

255 watching -

LIVE

LIVE

Owen Shroyer

1 hour agoOwen Report - 10-30-2025 - Trump Threatens To Bring Back Nuclear Bomb Testing

1,193 watching