Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

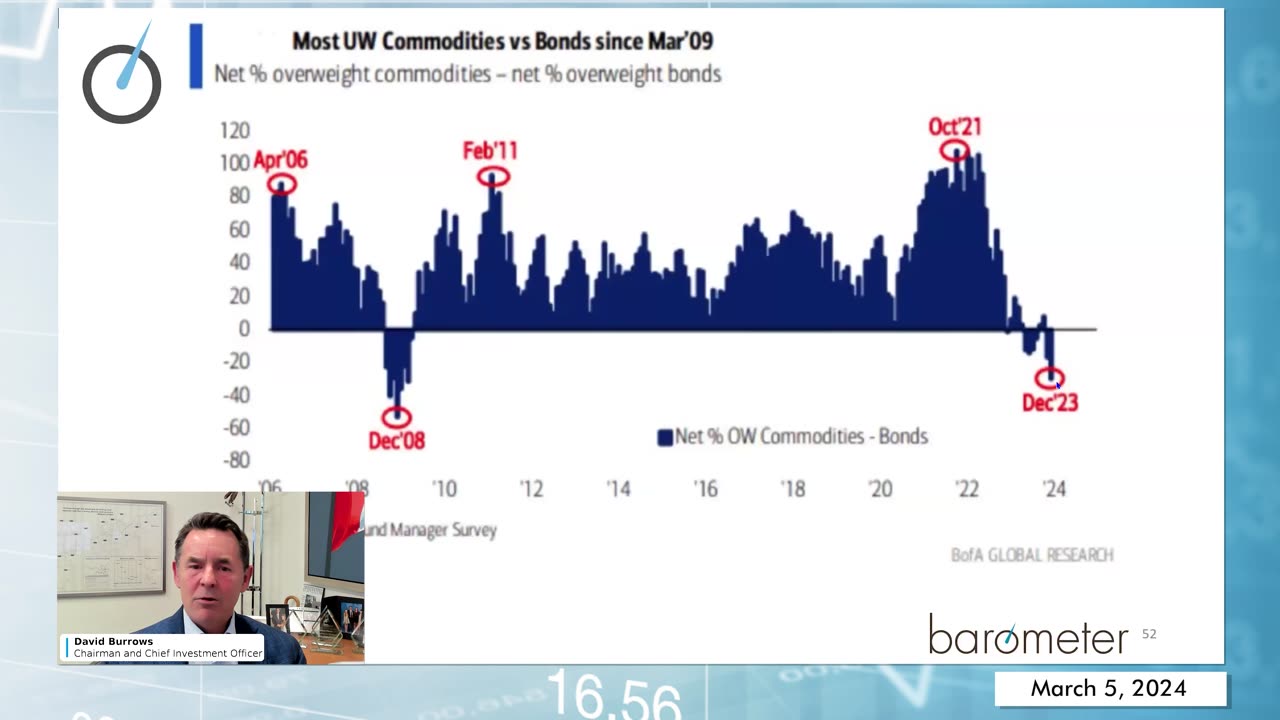

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

37:47

37:47

Welker Farms

1 day ago $4.57 earnedWEIGHT and COST Finally Revealed! Monster BIG BUD!

13.8K10 -

![I Can’t Believe How INTENSE This Got! | [REC] (2007) Reaction](https://1a-1791.com/video/fwe2/5e/s8/1/k/L/j/r/kLjrz.0kob-small-I-Cant-Believe-How-INTENSE-.jpg) 26:54

26:54

SouthernbelleReacts

2 days ago $12.25 earnedI Can’t Believe How INTENSE This Got! | [REC] (2007) Reaction

27.3K4 -

10:00

10:00

It’s the Final Round

19 hours ago $1.49 earned💰NFL Week 7 Best Bets🔥Player Prop Picks, Parlays, Predictions FREE Today October 19th

13.4K2 -

15:35

15:35

Demons Row

15 hours ago $2.90 earnedThe Worst Sgt-at-Arms I Ever Met 💀🔥 (and the Mistakes I Made as One)

21.6K5 -

9:34

9:34

Sideserf Cake Studio

1 day ago $1.83 earned484 Lego Bricks. 1 Hyperrealistic Cake.

21.6K3 -

22:42

22:42

marcushouse

1 day ago $6.98 earnedMassive Surprises From Starship Flight 11 Revealed! 🤯

24.3K10 -

14:08

14:08

Forrest Galante

12 hours agoPrivate Tour Of the World's Most Expensive Pet Show

139K11 -

13:50

13:50

Nikko Ortiz

22 hours agoStop Hurting Yourself For Views.

25.3K12 -

2:07:06

2:07:06

Side Scrollers Podcast

1 day agoDiaper Furry Streamer Gets ONLY ONE DAY Suspension + Hasan PLAYS VICTIM + More | Side Scrollers

54.8K23 -

56:38

56:38

DeProgramShow

2 days agoDeprogram with Ted Rall and John Kiriakou: "Jake Tapper on the Global Hunt for an Al Qaeda Killer”

15.3K5