Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

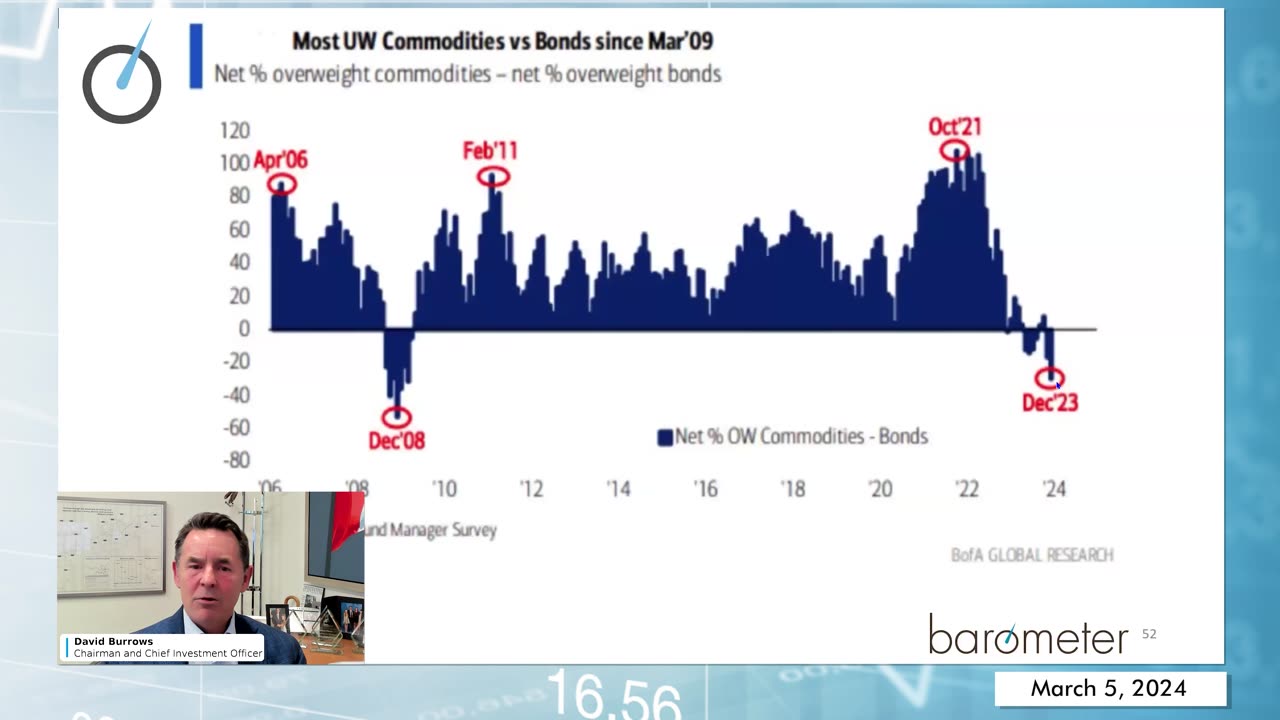

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

LIVE

LIVE

RanchGirlPlays

4 hours ago🔴 Red Dead Redemption: Let's go help De Santa 🤠

269 watching -

LIVE

LIVE

Man in America

11 hours agoWHAT?! Trump & the Fed are DISMANTLING the Global Banking Cartel!? w/ Tom Luongo

1,838 watching -

LIVE

LIVE

HELMET FIRE

1 hour agoDEADROP IS BACK!

238 watching -

LIVE

LIVE

I_Came_With_Fire_Podcast

6 hours agoLive Fire (No Exercise) with DAN NUNN!!!

319 watching -

1:57:20

1:57:20

Glenn Greenwald

7 hours agoBiden's Escalation Of The War In Ukraine With Scott Horton; Lee Fang On The Junk Food Industry Sabotaging RFK Jr.'s Plans & The Gaetz Situation | SYSTEM UPDATE #371

61.4K48 -

LIVE

LIVE

Toitle

1 hour agoLet's Game | TOITLE HEADS, POKE OUT | WE BE GRINDIN

204 watching -

LIVE

LIVE

Pepkilla

3 hours agoBlack ops 6 camo grinding ~

283 watching -

1:02:24

1:02:24

Havoc

4 hours agoSurprise Album Drops | Stuck Off the Realness Ep. 20

21.5K -

LIVE

LIVE

hockeymancb77

2 hours ago $0.92 earned2nd Rumble Stream!!! Friday night gaming! Come chat! Join the 7th man! Be Kind!

392 watching -

LIVE

LIVE

Mally_Mouse

4 hours agoLet's Play!! - Mario Party Jamboree

410 watching