Premium Only Content

Gulp: Retail Sales Fall Much More Than Expected In January

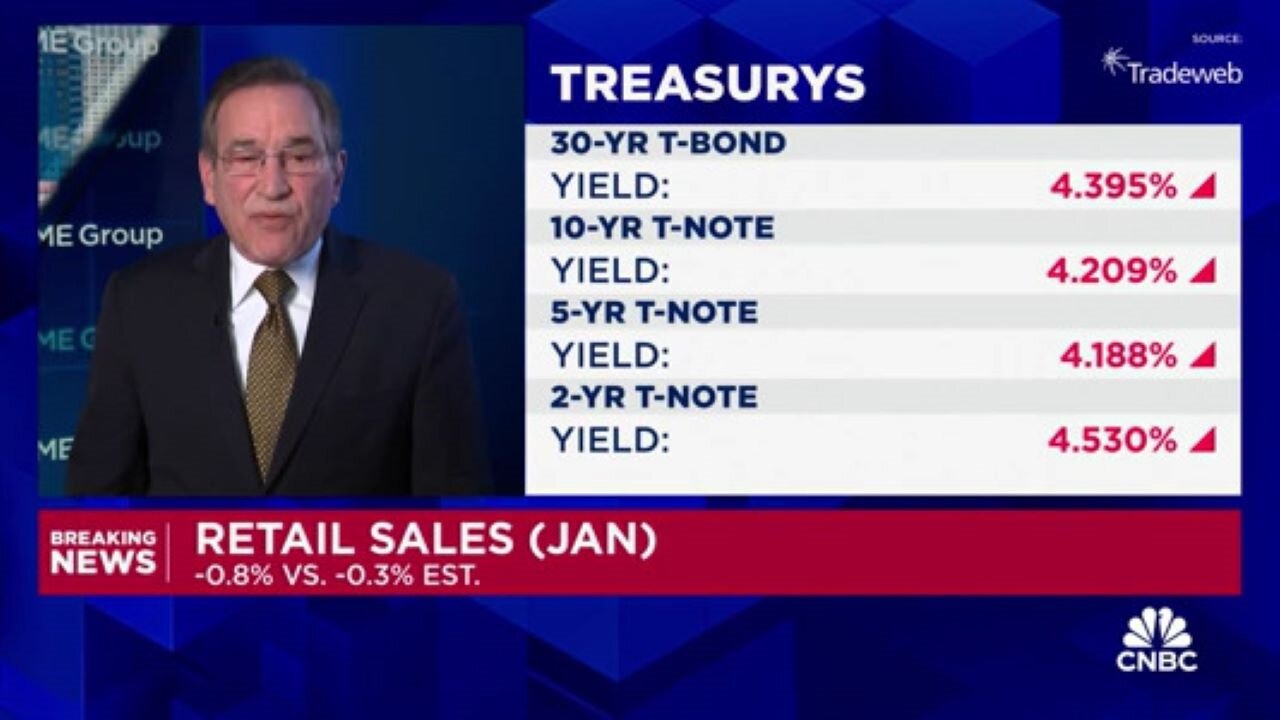

Advance retail sales declined 0.8% for the month following a downwardly revised 0.4% gain in December, according to the Census Bureau. A decrease had been expected: Economists surveyed by Dow Jones were looking for a drop of 0.3%, in part to make up for seasonal distortions that probably boosted December’s number. However, the pullback was considerably more than anticipated. Even excluding autos, sales dropped 0.6%, well below the estimate for a 0.2% gain. The sales report is adjusted for seasonal factors but not for inflation, so the release showed spending lagging the pace of price increases. On a year-over-year basis, sales were up just 0.6%.

There have been irreconcilable contradictions in recent economic reports, and this provides another. How did jobs increase in January by 355K while consumer spending dropped this much? If the economy is going as well as media outlets insist, why are all the same media outlets downsizing? I'm not suggesting a conspiracy -- if it were a conspiracy, these reports would align better. I think we've entered a flux period where a recession is brewing, and a few indicators still lag. One month of a sharp drop in retail sales does not a recession make, of course, but it's a concern. Consumer spending fell sharply in January, presenting a potential early danger sign for the economy, the Commerce Department reported Thursday.

• More at: CNBC - Retail sales tumbled 0.8% in January, much more than expected

https://www.cnbc.com/2024/02/15/retail-sales-january-2024-.html

-

3:55

3:55

NewsVids

2 days agoHere We GOOO: Insider Says Dan Bongino Took Day Off After Clashing With Pam Bondi Over Epstein Files

119 -

35:02

35:02

Steven Crowder

1 hour agoA Gay Lib and A Straight Conservative Debate Deporting Illegals | Talking with People

15.2K214 -

1:22:41

1:22:41

theoriginalmarkz

2 hours agoCoffee with MarkZ. 07/14/2025

13.9K4 -

LIVE

LIVE

The Big Mig™

4 hours agoSC Senate Candidate Mark Lynch To Primary RINO Lyndsey Graham

4,987 watching -

LIVE

LIVE

LFA TV

17 hours agoLFA TV ALL DAY STREAM - MONDAY 7/14/25

5,274 watching -

1:59:14

1:59:14

Badlands Media

6 hours agoBadlands Daily - July 14, 2025

21.1K15 -

LIVE

LIVE

Caleb Hammer

2 hours agoHe Needs To Divorce Her | Financial Audit

252 watching -

1:04:01

1:04:01

VINCE

3 hours agoIt Could All Go Down Today | Episode 84 - 07/14/25

212K232 -

LIVE

LIVE

Benny Johnson

2 hours ago🚨Ghislaine Maxwell BREAKS Silence! READY to TESTIFY on Epstein Client List | Biden Autopen BLOW-UP

11,168 watching -

1:14:59

1:14:59

Dear America

3 hours agoIs Bongino Out At The FBI? Is MAGA Ripping Apart? What Is Going On?!

116K148