Premium Only Content

February 10, 2024

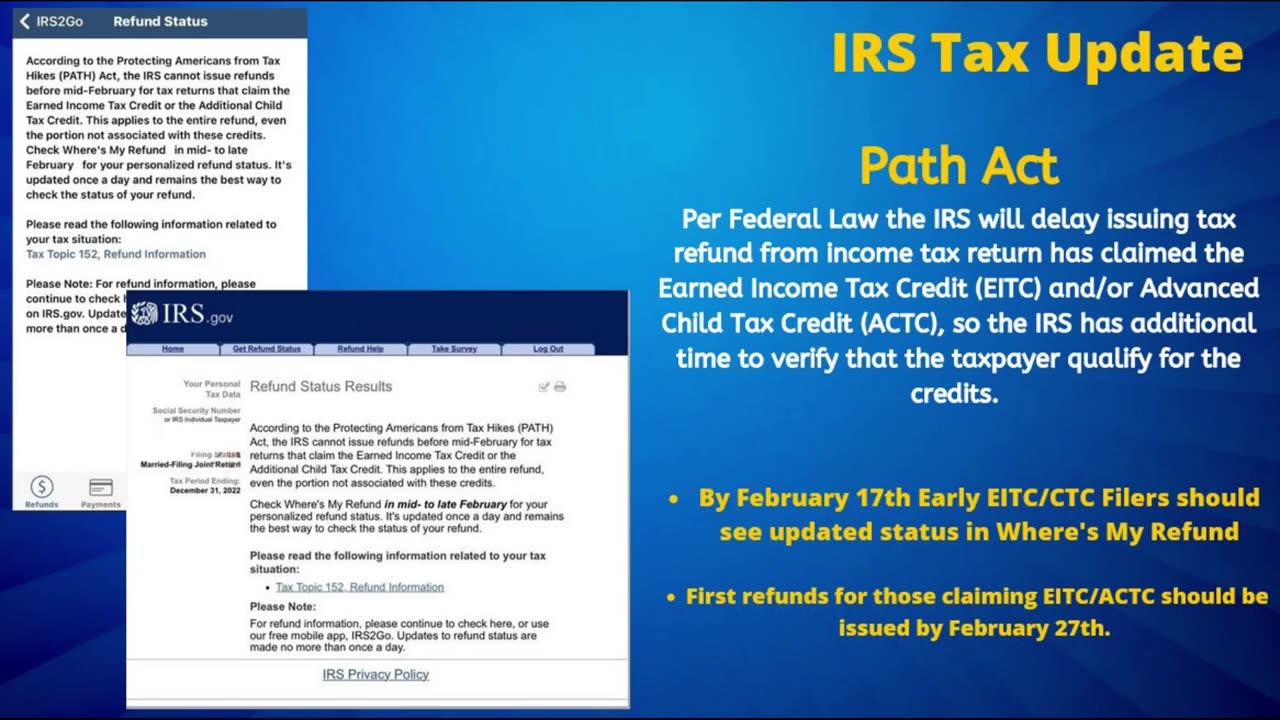

On todays IRS Tax Update we will take a look at the latest developments this tax season including the next batch of tax refunds scheduled for release by the IRS, from there we will take a look at those refund delays due to the Path act impacting many of our viewers and potential refund release dates along with new developments for those needing to complete ID verification, and why the wait to receive that ID verification notice in the mail maybe longer than originally anticipated. Now with IRS tax processing ongoing the next batch of direct deposit tax refunds has been released and will reach bank accounts by February 12th as confirmed by the refund status results seen here. Do note that where’s my refund status results may not always display the most up to date information even after a refund has been released by the IRS, so make you review your tax transcript to confirm your refund has in fact been released by locating the 846 code on your transcript. For those who are part of the February 7th batch, and do not receive that refund by February 12th in their bank accounts do contact the IRS to initiate a payment trace or fill out IRS form 3911, as well as confirming if the right bank account information is listed on your tax return. Now as of this recording no viewer who is expecting that ID verification notice has in fact received it, and at this point IRS phone representatives have been informing callers that it may take up to 8 weeks from the start of the tax season on January 29th to receive the letter in the mail. It also is being reported that IRS representatives have not confirmed to any viewer that the letter was already sent out at this time. As a reminder to confirm a notice has been sent, please check your tax transcripts and locate the 971 code with a recent date next to it. Also based on current IRS time frames allow up to 9 weeks after successfully completing ID verification to receive that tax refund.

This video is under Fair Use: Copyright Disclaimer under Section 107 of the Copyright Act in 1976, Allowance is made for "Fair Use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright status that might otherwise be infringing.

Disclaimer: This is for informational purposes only and is subject to change. Material provided should not be considered tax, accounting, or legal advice. Please consult a certified tax consultant for tax advice.

#TaxRefund #IRS #News #Taxes #TaxReturn #Tax #Refund #TaxSeason #youtube #video #new #newvideo #breaking news

-

23:25

23:25

MYLUNCHBREAK CHANNEL PAGE

7 hours agoMilitary Sites STOLE the Old World - Pt 2

47.3K23 -

LIVE

LIVE

Spartan (Pro Halo esports Player)

5 hours agoCloud9 $5k Tournament, Star Wars later on

501 watching -

33:39

33:39

Tactical Advisor

1 day agoNew Handguns | Vault Room Live Stream 026

18.1K6 -

20:07

20:07

Clownfish TV

12 hours agoMark Hamill's Sad Descent Into TDS...

11.5K31 -

LIVE

LIVE

GamerGril

3 hours agoScariest Game Ever? | SOMA Saturdays

205 watching -

LIVE

LIVE

sophiesnazz

4 hours ago $0.83 earnedSEASON 4 UPDATE !socials

79 watching -

1:16:59

1:16:59

T-SPLY

9 hours agoJudge And Protesters Try to Stop ICE Arrest In Court Hallway!

53K120 -

LIVE

LIVE

Odd Man Out

3 hours agoX4 Foundations - Chill, Chat and Current News Discussions

63 watching -

1:21:36

1:21:36

Michael Franzese

1 day agoSuge Knight Speaks On Diddy, Trump's Pardons, and the Biden's Lies… | LIVE

193K82 -

LIVE

LIVE

Major League Fishing

1 day agoLIVE MLF BFL All-American Championship!

758 watching