Premium Only Content

IRS TAX UPDATE - HOW TO ACCESS TAX TRANSCRIPTS, TOP TRANSCRIPT CODES, INSTRUCTIONS

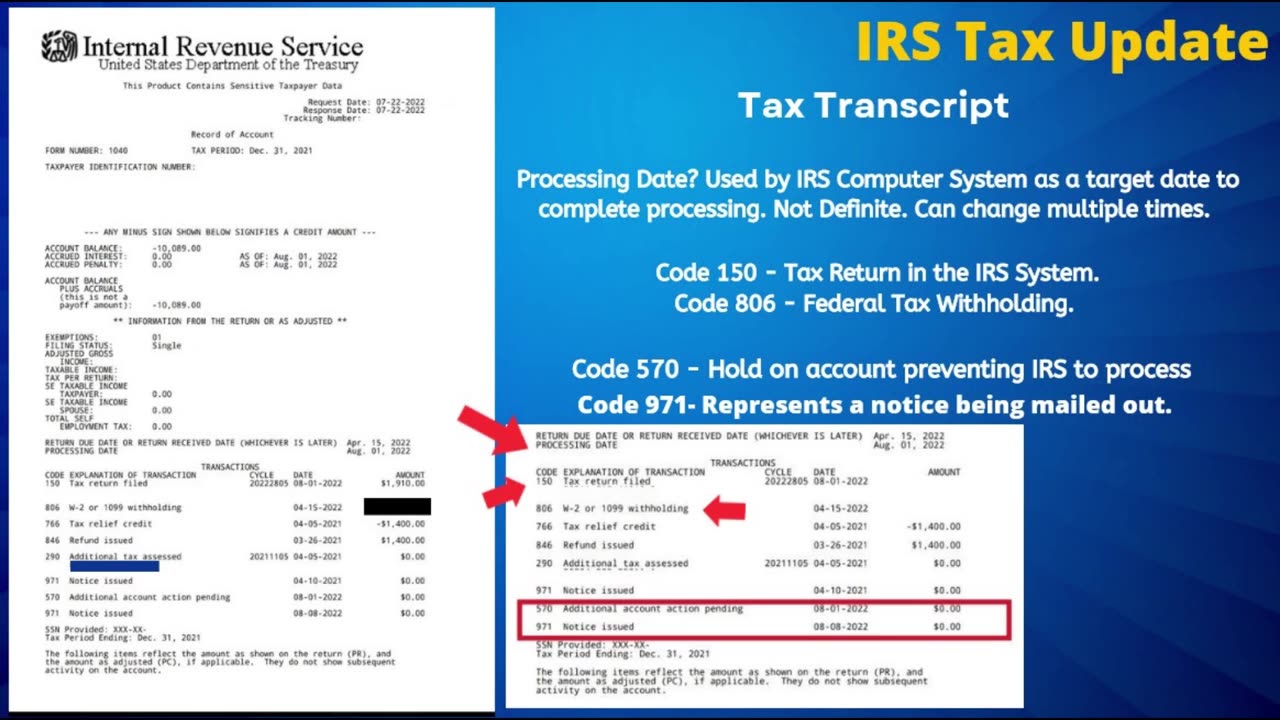

On today’s IRS Tax Refund update we’re going to take a look at how to exactly access those IRS tax transcripts which can provide you with more information on your tax refund status then simply checking Where’s my refund status results on the IRS website. From there we break down and decipher what to look for on that tax transcript as well as some of the most frequent codes to appear, and transcript codes that represent there is an issue with your tax return and ultimately tax refund. The first tax transcript code that represents an issue is the 570 code as shown here which indicates additional account action pending, now this means there is a hold on your account preventing the IRS to process. If you encounter this code you are likely to fall into 1 of 2 categories, the first is seeing the 570 and 971 codes with the same date which means the IRS has automatically corrected the issue discovered with your tax return such as a math error, and has cleared your refund for release, or if the two codes have separate dates within a short period of time from each other like seen on this image to the right, it means there is still an issue and that the IRS is sending you out a notice. Now the notice in question could simply state the IRS needs more time to process or it may be a request for specific information they need to continue the processing of your tax return. If you have not received your refund within 7 to 10 days of the date listed next to the 846 code for a direct deposit refund, check your tax transcripts once again and if you see this code the 841 refund cancelled code that means the refund in question was sent to a closed bank account or an invalid bank account often times because the wrong account number was entered on the return. If this is the case the IRS will issue out a paper check within 4 to 6 weeks of receiving it back as rejected along with sending out the CP 53 notice as seen here. The IRS will not resend the direct deposit a second time nor will they send it to another bank account even if you inquire.

-

LIVE

LIVE

Dr Disrespect

3 hours ago🔴LIVE - DR DISRESPECT - IMPOSSIBLE 5 CHICKEN DINNER CHALLENGE - FEAT. VISS

1,829 watching -

1:06:56

1:06:56

Sean Unpaved

17 hours agoSwitch-Hitting Stories: Chipper on Baseball, Football, & the Game's Future

9.28K -

LIVE

LIVE

StoneMountain64

2 hours agoOnly game with BETTER desctruction than Battlefield?

93 watching -

1:23:11

1:23:11

Timcast

3 hours agoTrump SLAMS Anti-American Museums, BANS Migrants For WOKE Views

112K73 -

5:46

5:46

Buddy Brown

1 day ago $2.24 earnedOklahoma Just Made the BOLDEST MOVE of our Time! | Buddy Brown

19.6K10 -

2:01:04

2:01:04

Steven Crowder

5 hours agoThe Gavin Newsom 2028 Campaign Begins... And It Sucks

307K234 -

11:25

11:25

Mike Rowe

1 day agoThe Funniest Mashup You've Ever Seen With My Mom, Peggy Rowe | Coffee With Mom

38.3K12 -

1:23:33

1:23:33

Steve-O's Wild Ride! Podcast

6 days ago $14.74 earnedRainn Wilson and Steve-O Break The Silence On Their Long Friendship | Wild Ride #263

67.5K30 -

1:00:17

1:00:17

VINCE

6 hours agoThe Trump Admin Isn't Having This... | Episode 107 - 08/20/25

225K152 -

JuicyJohns

6 hours ago $2.58 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢

72.6K