Premium Only Content

2024 IRS TAX REFUND UPDATE - NEW Tax Refunds Issued, Delays, Path Act, ID Verification, Transcripts

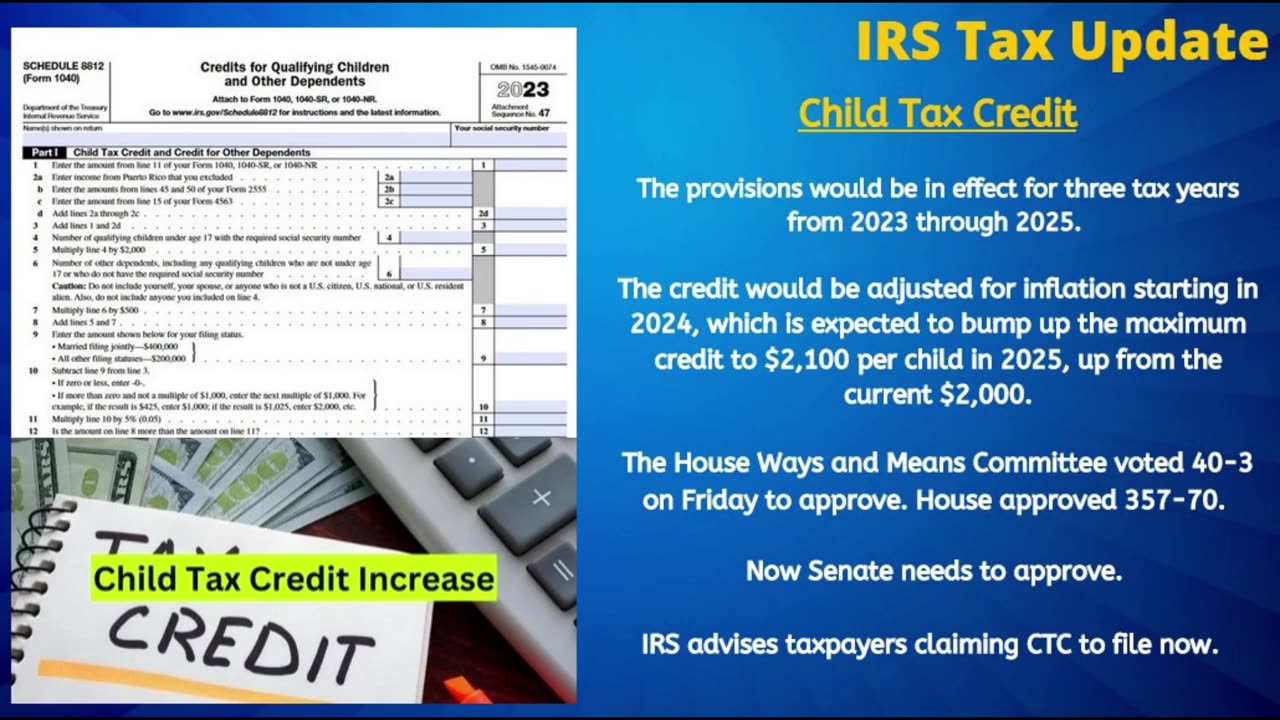

On today’s IRS Tax Refund Update as the IRS wraps up the first official week of the tax season, we are going to take a look at the latest including new developments for those encountering refund delays due to the need to complete ID verification. We also have reports from viewers who are now showing their tax returns have been approved and are now seeing a direct deposit refund date so we will check in on that, as well as new reports coming in from taxpayers seeing the first updates to their tax transcripts this season, and from there further developments on the child tax credit increase proposal currently in congress. Now the next batch of direct deposit tax refunds is scheduled to be released and transmitted by the IRS on February 5th as confirmed by the refund status results seen here. Now while most of those direct deposit refunds will reach bank accounts on the 5th if not before, do allow up until February 10th to receive that deposit in your account before contacting the IRS to initiate a payment trace if you have not received that refund. So far, we are continuing to see simple tax returns from those early filers being processed first, and as a reminder no refunds from tax returns claiming the Earned Income Tax Credit or Advanced Child Tax Credit are being released at this time due to the path act. However, based on IRS time frames the February 19th date is likely going to be the first date in which tax refunds on hold due to the Path act will be cleared to be released to taxpayers. It is also important to note that with February 19th being President’s Day and a federal holiday means there will be no bank processing that day, so as a result we could start to see direct deposit refunds for those claiming either the earned income tax credit or child tax credit start reaching bank accounts on Wednesday, February 21st.

-

LIVE

LIVE

The Big Mig™

4 hours agoTrump, NO More Voter Fraud It’s Time, LFG

3,979 watching -

LIVE

LIVE

The State of Freedom

6 hours ago#325 Running an America-First Campaign w/ Sammy Wyatt

134 watching -

1:50:16

1:50:16

Dear America

3 hours agoTrump Calls Putin MID-MEETING With World Leaders!! Did Trump just END THE WAR?!

83.4K54 -

LIVE

LIVE

GritsGG

3 hours agoWin Streaking! Most Wins 3390+ 🧠

139 watching -

2:03:23

2:03:23

Matt Kohrs

11 hours agoLIVE! Day Trading Futures & Options || Market Open

25.6K1 -

Wendy Bell Radio

7 hours agoThe Ultimate Alpha

55.1K36 -

LIVE

LIVE

Reidboyy

3 hours ago $0.25 earnedNEW FREE FPS OUT ON CONSOLE TODAY! (Delta Force = BF6 Jr.)

24 watching -

LIVE

LIVE

RoxomTV

19 days agoMAX KAISER & STACY HERBERT LIVE — Bitcoin Reborn | 24/7 from RoxomTV

70 watching -

2:07:52

2:07:52

Badlands Media

2 hours agoBadlands Daily: August 19

24.6K12 -

LIVE

LIVE

EXPBLESS

4 hours agoMessing Around In Elden Ring Finding All Caves And Hidden Secrets.

49 watching