Premium Only Content

6 Credit Card Trends That Need to DIE! (Amex, Chase, Capital One…)

🚨 Use code "MARK" to get Kudos for FREE and 5X your credit card rewards ▸ https://joinkudos.com/mark | Click "Show More" to see Ad Disclosure.

💳👇 VIEW CREDIT CARD OFFERS!

https://markscreditcards.com/offers

🛍 RAKUTEN - Earn More Cash Back!

https://markscreditcards.com/rakuten

👨💻 KUDOS – Earn Extra Cash Back!

https://joinkudos.com/mark

📲 MAXREWARDS - Manage credit cards & rewards!

Get Gold level for free with PROMO CODE = markr

https://markscreditcards.com/maxrewards

🏦 SOFI CHECKING & SAVINGS – Get $25! (or more w/ direct deposit)

https://markscreditcards.com/sofibanking

📊 GET FREE STOCKS FROM WEBULL

https://markscreditcards.com/webull

📊 GET FREE STOCKS FROM MOOMOO

https://markscreditcards.com/moomoo

🔐 AURA – Identity Theft Protection & More!

Get Your 2-Week Free Trial: https://markscreditcards.com/aura

00:00 - Intro

00:52 - Trend #1

3:02 - Trend #2

7:30 - Trend #3

9:34 - Trend #4

10:37 - Trend #5

12:33 - Trend #6

With all of the different travel and cash back credit cards we have in the U.S. market, it’s great to have so many choices. However, there are some trends we’re seeing that can be quite frustrating because they make you work harder to justify having a certain credit card.

Here are my Top 6 Credit Card Trends that need to end ASAP!

Trend 1: Coupon Book Style of Credits

Some perfect examples of this are the Amex Platinum Card, Chase Sapphire Reserve card, and the Amex Gold Card. Each of these have credits and benefits that act like coupons or discounts in certain spend categories or with particular merchants. They often require extra thought and a form of tracking on your part to make sure you’re using the benefits available to you in order to justify the annual fees of these cards.

Trend 2: Inconsistent Point Values

If you’ve ever looked at how to redeem Amex Membership Rewards points, you’ll see that there are many ways to do so. It’s nice to have a lot of flexibility, but the value you get can vary dramatically from one redemption type to another. For instance, redeeming Amex points for travel vs. cash back vs. online shopping can bring you more or less value.

Trend 3: Welcome Offer Games

Credit card issuers like American Express and Chase may show different signup bonus offers to different people (even at the same time)! This means you may or may not get a good (or the best) offer at any moment in time. Considering the high value of both Amex Membership Rewards Points (from the likes of the Amex Platinum Card, Amex Gold Card, or Amex Green card) and Chase Ultimate Rewards points (from the likes of the Chase Sapphire Reserve, Chase Sapphire Preferred, or either of the 2 main Freedom Cards – Chase Freedom Flex or Chase Freedom Unlimited), you want to take extra caution to get great offers!

Trend 4: Overly Complicated Welcome Offer Rules

Getting a credit card signup bonus today can be complicated with all of the different rules from different issuers. Here are a few examples of well-known rules:

- Amex Lifetime Rule

- Amex Family Rule

- Amex 1/5 Rule

- Amex 2/90 Rule

- Chase 5/24 Rule

- Chase 2/30 Rule

- Chase 1/30 Guideline

- Chase 24-Month Rule

- Chase 48-Month Rule

Learn more about these rules in these videos…

1. NEW RULES! How to Get 100% APPROVED for Amex Credit Cards (Amex Credit Card Application Rules 2024): https://youtu.be/G3ksdsf3PN0?si=fXeWWaONYcoJegtZ

2. How to get APPROVED for Chase Credit Cards! (Chase Application Rules): https://youtu.be/mlGWG5btFmc?si=dmtmQQqqTJX_buer

Trend #5: Multiple Hard Inquiries for 1 Application

Capital One is best known for this; they pull from all 3 bureaus for each credit card application you submit. Frankly, 1 hard pull per credit card application should suffice.

Trend #6: Not Disclosing Minimum Application Requirements

Publishing requirements for things like minimum income, credit score, etc. would be immensely helpful. Unfortunately, it’s an extremely rare practice, at least in the U.S.

Disclosure: The thoughts, opinions, and information presented are those of the creator. This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com, YourBestCreditCards.com, and others. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. Mark Reese is not a financial advisor.

#creditcard #creditcards #creditcardrewards

-

10:53

10:53

Mark Reese // Credit & Finance

11 months agoHow to Get FAST Business Funding in 3 Days (or Less!) | No Credit Check | Revenued Business Card

531 -

3:05:55

3:05:55

TimcastIRL

7 hours agoJimmy Kimmel Refuses To Apologize Over Charlie Kirk Comments, Blames Gun Violence | Timcast IRL

194K165 -

2:44:24

2:44:24

Laura Loomer

10 hours agoEP144: Trump Cracks Down On Radical Left Terror Cells

52.3K22 -

4:47:56

4:47:56

Drew Hernandez

12 hours agoLEFTISTS UNITE TO DEFEND KIMMEL & ANTIFA TO BE DESIGNATED TERRORISTS BY TRUMP

48.6K17 -

1:12:32

1:12:32

The Charlie Kirk Show

8 hours agoTPUSA AT CSU CANDLELIGHT VIGIL

94.2K61 -

6:53:45

6:53:45

Akademiks

10 hours agoCardi B is Pregnant! WERE IS WHAM????? Charlie Kirk fallout. Bro did D4VID MURK A 16 YR OLD GIRL?

82.5K7 -

2:26:15

2:26:15

Barry Cunningham

9 hours agoPRESIDENT TRUMP HAS 2 INTERVIEWS | AND MORE PROOF THE GAME HAS CHANGED!

146K93 -

1:20:27

1:20:27

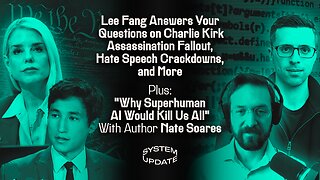

Glenn Greenwald

10 hours agoLee Fang Answers Your Questions on Charlie Kirk Assassination Fallout; Hate Speech Crackdowns, and More; Plus: "Why Superhuman AI Would Kill Us All" With Author Nate Soares | SYSTEM UPDATE #518

127K34 -

1:03:06

1:03:06

BonginoReport

11 hours agoLyin’ Jimmy Kimmel Faces The Music - Nightly Scroll w/ Hayley Caronia (Ep.137)

175K64 -

55:40

55:40

Donald Trump Jr.

14 hours agoThe Warrior Ethos & America's Mission, Interview with Harpoon Ventures Founder Larsen Jensen | Triggered Ep275

108K56