Premium Only Content

What's the Difference in an Inspection Versus an Appraisal

In this video, we clarify the essential differences between home inspections and appraisals during the home-buying process. Home inspections, performed by licensed inspectors, assess a property's condition, highlighting any issues for the buyer's consideration. In contrast, appraisals, conducted by certified appraisers, determine the property's fair market value to ensure the loan amount aligns with it. These steps are crucial in helping buyers make informed decisions and lenders manage risks. Don't forget to subscribe for more valuable insights! 🏡🔍📈

------------------------------------

Thinking About Buying? Explore Markets Here: https://www.natashacarrollrealty.com/...

Own a Home? Unlock Your Home Value: https://www.natashacarrollrealty.com/...

BOOK A CALL NOW: https://bit.ly/3P9GdhD

Subscribe and get notified with my new videos: https://bit.ly/natashacarrollrealty

------------------------------------

Natasha Carroll, MBA , Broker

☎️: 832-346-7631

📩: natashacarroll@natashacarrollrealty.com.com

💻: www.natashacarrollrealty.com

Timestamps:

00:00 - Introduction

00:02 - Home Inspections

00:07 - Inspection Process

00:19 - Components Examined

01:12 - Detailed Inspection

01:27 - Inspection Report

01:37 - Buyer's Responsibilities

01:46 - Appraisals

01:57 - Purpose of Appraisals

02:12 - Factors Considered

02:44 - Appraisal's Crucial Role

03:00 - Appraisal Value Impact

03:11 - Summary and Conclusion

Home inspections:

Home inspections are a crucial step in the home buying process.

During home inspections, licensed inspectors thoroughly examine the property.

These inspections help identify any existing issues or potential problems.

Buyers rely on home inspection reports to make informed decisions.

Inspectors assess various components, ensuring the property's condition is known.

Appraisals:

Appraisals are essential for determining a property's market value.

Certified appraisers evaluate properties to provide unbiased assessments.

Lenders require appraisals to ensure loans align with property values.

Appraisers consider factors like recent sales and property condition.

The appraisal process helps mitigate risks in the lending process.

Property condition:

Evaluating a property's condition is crucial when buying a home.

Home inspectors assess various elements, including the foundation and roof.

Issues like faulty wiring or plumbing leaks can impact a property's condition.

Understanding property condition helps buyers negotiate repairs with sellers.

Property condition is a significant factor in the decision to purchase a home.

Inspection report:

Inspection reports provide detailed findings from a home inspection.

These reports highlight issues and potential problems with the property.

Buyers use inspection reports to make informed decisions about purchases.

The report's clarity is crucial for understanding the property's condition.

Inspection reports can impact negotiations between buyers and sellers.

Market value:

Market value represents the estimated worth of a property.

Appraisers use market data and property specifics to determine value.

Lenders rely on market value to ensure appropriate loan amounts.

Factors like property size and local market trends affect market value.

Understanding market value is essential for both buyers and lenders in real estate transactions.

Texas real estate benefits from favorable tax laws, including no state income tax, which can be a significant advantage for both residents and businesses.

#HomeInspections #Appraisals #RealEstateAdvice

-

51:57

51:57

Professor Nez

4 hours ago🚨LAWFARE COLLAPSES? What NOBODY is Saying About Jack Smith Dismissing Trump Case

30.4K48 -

LIVE

LIVE

GussyWussie

7 hours agoReturning to one of the Best Zelda Games - Breath of the Wild

442 watching -

2:33:50

2:33:50

Wahzdee

4 hours agoMorning Grind: Arena Breakout vs Tarkov Showdown 🎮 - Wahzvember Day 25

47.2K2 -

0:41

0:41

World Nomac

19 hours agoThe side of Las Vegas they don't want you to know about

33.1K1 -

Film Threat

8 hours agoVERSUS: WICKED VS GLADIATOR II | Film Threat Versus

26.3K -

2:06:30

2:06:30

Barstool Yak

9 hours agoThe Yak with Big Cat & Co. Presented by Rhoback | The Yak 11-25-24

24.6K4 -

1:43:44

1:43:44

The Quartering

7 hours agoDr Disrespect Leaves Youtube For Rumble! With Rumble CEO Chris Pavlovski

112K64 -

50:55

50:55

Grant Stinchfield

4 hours ago $1.97 earnedMy Trip To The Emergency Room Exposed the Our Joke of a Health Care System

20.1K4 -

2:50:00

2:50:00

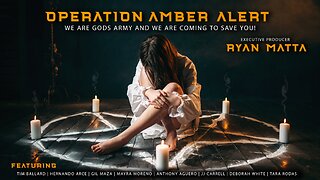

RyanMatta

1 day ago $3.00 earnedOPERATION AMBER ALERT | CHILD TRAFFICKING DOCUMENTARY | EXECUTIVE PRODUCER RYAN MATTA

17.4K20 -

14:14

14:14

TimcastIRL

1 day agoJoe Rogan ROASTS The View For Saying He BELIEVES IN DRAGONS In HILARIOUS MOCKERY

56.2K84