Premium Only Content

Deal Spotlight Episode 1 Part 2 – The guys cover the Eddy County and Matador in the Wolfcamp A.

This is the second part of the Matador in Eddy County Deal Evaluation.

Because of the enormous requests from investors evaluating oil and gas, we are starting a new series showing people how to assess oil and gas M&A or invest. Accredited investors, family offices, and E&P operators are our largest market, asking for these evaluation pieces of training.

We want your feedback and recommendations for deals.

Reach out to Stu and Michael at https://energynewsbeat.co/ to get your deal reviewed.

Highlights of the Podcast

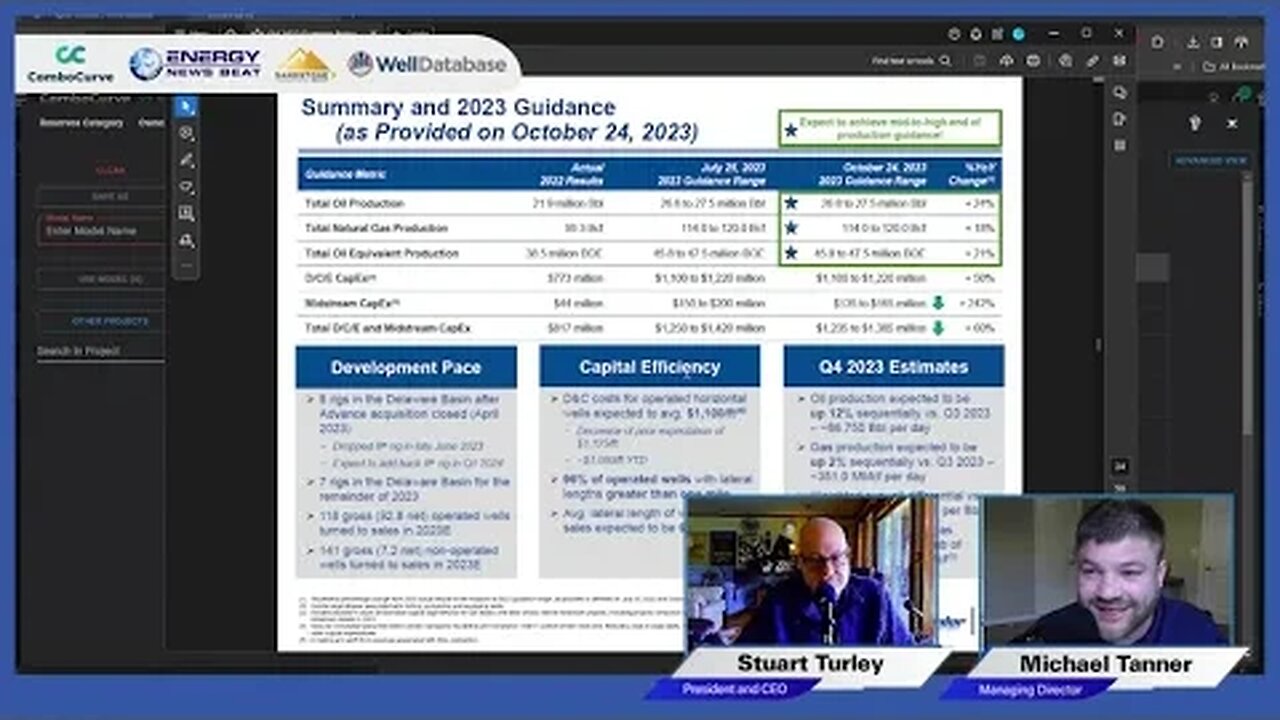

00:20 - Divided into two parts, focusing on the Matador deal.

00:45 - Explanation of setting up a new type curve for Wolfcamp A.

01:08 - Understanding production curves normalized to time zero.

09:15 - Discussion on the distribution of EURs (P10, P50, P90).

14:21 - Incorporating strip pricing and natural gas liquids (NGL) data.

16:37 - Creating individual forecasts for specific wells.

19:30 - Incorporating production taxes and ownership interests.

20:47 - Analyze cash flows and calculate the internal rate of return (IRR).

22:02 - Determining the potential acquisition cost and assessing deal value.

A shout-out to our sponsors! WellDatabase and ComboCurve.

*We do not offer investment advice; you must contact your tax professional to get the appropriate tax information for your investments. This is only for educational purposes.

-

2:48:00

2:48:00

TheSaltyCracker

5 hours agoYou're Being Hunted ReeEEStream 9-10-25

234K477 -

LIVE

LIVE

LFA TV

18 hours agoBREAKING: CHARLIE KIRK ASSASSINATED - WEDNESDAY 9/10/25

1,004 watching -

1:31:08

1:31:08

I_Came_With_Fire_Podcast

5 hours agoCheck Fire: God Bless Charlie Kirk

55K16 -

1:13:35

1:13:35

Glenn Greenwald

7 hours agoCharlie Kirk Assassinated; NATO Alleges Russian Drones Flew Over Poland, and More | SYSTEM UPDATE #512

252K263 -

1:46:28

1:46:28

Badlands Media

20 hours agoAltered State S3 Ep. 45: The Assassination of Charlie Kirk

123K12 -

8:56:53

8:56:53

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - THE FINALS - NEW SEASON 8 LAUNCH EVENT W/ THE SHOTTY BOYS

259K9 -

LIVE

LIVE

RealAmericasVoice

3 days agoHOME OF REAL NEWS

4,043 watching -

27:00

27:00

BonginoReport

8 hours agoRest In Peace Charlie Kirk - Nightly Scroll w/ Hayley Caronia (Ep.131) - 09/10/2025

245K377 -

1:20:06

1:20:06

Kim Iversen

8 hours agoRIP Charlie Kirk: When Words Fail, They Reach for Guns

174K308 -

2:47:04

2:47:04

DDayCobra

10 hours ago $17.22 earnedCharlie Kirk SHOT

152K62