Premium Only Content

Q4 Highlight - Value vs Growth

David gives the difference of being a value investor and investing in value as a style.

Enjoy this highlight clip from the Strong Valley Mid-Quarter Roundtable. If you have questions, submit your question at strongvalley.com/contact.

David Lebovitz and JPMorgan Asset Management are not affiliated and separate entities from Integrated Partners. Please be sure to read all disclosures in video description and on our website (www.strongvalley.com)

DISCLOSURES: Advisory services are offered through Integrated Partners, doing business as Strong Valley Wealth & Pension, a registered investment adviser. Securities are offered through M.S. Howells & Co. a registered broker/dealer and Member FINRA/SIPC. M.S. Howells & Co. is not affiliated with Integrated Partners or Strong Valley. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. Information is based on data gathered from what we believe are reliable sources. It is not intended to provide specific legal, tax, or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Opinions expressed are those of the speakers and not the entities listed above. Opinions are subject to change without notice and are not intended as investment advice or to predict future performance. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. There is no guarantee that any strategy will produce the desired results. Diversification does ensure a profit or avoid a loss in a declining market. Dollar-cost averaging does not guarantee a gain or avoid a loss. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. You cannot invest directly in an index. The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The Bloomberg Barclays U.S. Aggregate Bond Index (AGG) is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance. The Gross Domestic Product (GDP) is a comprehensive measure of U.S. economic activity. GDP measures the value of the final goods and services produced in the United States (without double counting the intermediate goods and services used up to produce them). Changes in GDP are the most popular indicator of the nation's overall economic health. The Consumer Price Indexes (CPI) program produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services (Source: U.S. Department of Labor). The NASDAQ Composite Index is a market capitalization price-only index that tracks the performance of domestic common stocks traded on the regular NASDAQ market as well as National Market System-traded foreign common stocks and American Depository Receipts. Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of the fund shares is not guaranteed and will fluctuate. The Federal Open Market Committee (FOMC) consists of twelve members--the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. The Dow Jones Industrial Average, (the Dow), is a stock market index that indicates the value of 30 large, publicly owned companies based in the United States, and how they have traded in the stock market during various periods of time. A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. They are most often used as inputs in the production of other goods or services, thus usually refers to a raw material used to manufacture finished goods The MSCI World Index is an index that tracks the performance of global stocks. Bonds are subject to increased loss of principal during periods of rising interest rates. Bond investments are subject to various other risks, including changes in credit quality, liquidity, prepayments, and other factors. Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage.

-

LIVE

LIVE

ReAnimateHer

21 hours ago $0.72 earnedScreams in the Fog | DBD Live

204 watching -

LIVE

LIVE

Grant Cardone

5 hours agoHow to Find Your First $1million Profit In Real Estate

1,178 watching -

This is the Ray Gaming

2 hours ago $0.11 earnedNew Shirt SaturRAY | Rumble Premium Creator

3.51K1 -

LIVE

LIVE

PenguinSteve

2 hours agoLIVE! The Return of the Battlefield 6!

65 watching -

54:54

54:54

iCkEdMeL

3 hours ago $52.53 earned🔴 BREAKING: Gunman Opens Fire at Tim Pool’s Home

78.7K45 -

3:27:43

3:27:43

GamingWithHemp

4 hours agoPlaying Metroid Prime 4 episode 1 A new beginning

5.1K -

2:30:55

2:30:55

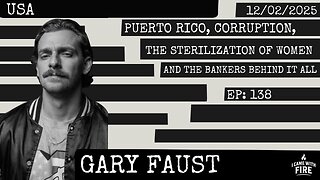

I_Came_With_Fire_Podcast

13 hours agoPuerto Rico, Corruption, Ther Sterilization of Women, and the Bankers Behind it All

26K18 -

![Mr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18](https://1a-1791.com/video/fwe2/96/s8/1/w/U/W/F/wUWFz.0kob-small-Mr-and-Mrs-X-DS-Pushing-Div.jpg) 54:40

54:40

X22 Report

7 hours agoMr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18

113K34 -

3:14:03

3:14:03

ttvglamourx

5 hours ago $3.13 earnedHAPPY SATURDAY !DISCORD

31.6K3 -

18:53

18:53

Wrestling Flashback

23 days ago $10.14 earned10 WWE Wrestlers Who Ruined Their Bodies Wrestling Too Long

40.7K4