Australian Laws for Small Businesses

1. Business registration and structure: Small businesses must register with the Australian Securities and Investments Commission (ASIC) and choose a business structure, such as a sole proprietorship, partnership, or company.

2. Taxation: Small businesses are subject to a range of taxes, including income tax, Goods and Services Tax (GST), and payroll tax. They must also register for GST if their annual turnover exceeds a certain threshold.

3. Employment: Small businesses must comply with the Fair Work Act 2009, which sets out the minimum wages and conditions of employment for all Australian workers.

4. Consumer protection: Small businesses must comply with the Australian Consumer Law (ACL), which protects consumers from unfair practices and misleading or deceptive conduct.

5. Workplace health and safety: Small businesses must comply with occupational health and safety laws, which vary from state to territory.

6. Environmental protection: Small businesses must comply with environmental laws, which regulate activities such as waste disposal and pollution control.

In addition to these general laws, there are also a number of laws that specifically apply to certain types of small businesses, such as those operating in the food and beverage industry or the retail sector.

It is important for small businesses to be aware of the laws that apply to them and to comply with all applicable requirements. Failure to comply with the law can result in penalties, fines, or even imprisonment.

-

2:07

2:07

KGTV

4 years agoSmall business owners upset over guidelines

240 -

3:59

3:59

homesteadleague

1 month agoCorporate Transparency Act & Your Small Business

19 -

24:01

24:01

jayberman1086

2 months agoThe Seven Risks of Small Business Ownership

2 -

2:13

2:13

Protect others

2 years agoProtect Small Business owners

82 -

0:08

0:08

anayaal

9 months agoBusiness Immigration to Australia

6 -

5:44

5:44

Wisdom for Dominion

7 years ago4 Laws for Building An International Business

-

29:07

29:07

fairtaxguys

1 year ago#370 The FAIRtax and Small Business

12 -

0:57

0:57

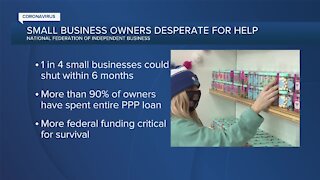

WXYZ

3 years agoSmall Business Survey

75 -

1:28

1:28

dentonpetersonpc

1 month agoHow To Make Sure Your Small Business Is ADA Compliant

1 -

16:45

16:45

Small Business Tax Savings Podcast

1 year agoDo You Need an LLC For Your Business?

2