Premium Only Content

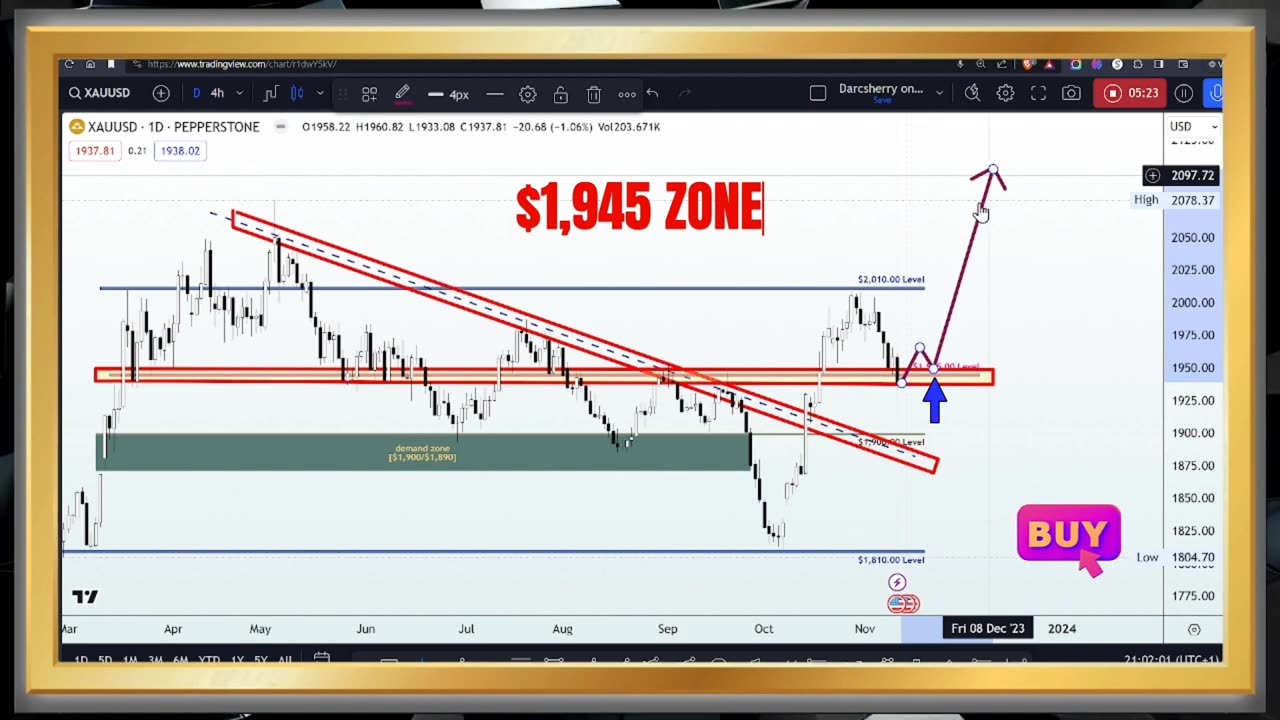

XAUUSD | GOLDSPOT | Good Weekly Analysis 13 November

XAUUSD | GOLDSPOT | New perspective | follow-up details

PEPPERSTONE:XAUUSD

1937.81 −20.68 −1.06%

Gold Spot / U.S. Dollar

Play Video

trendanalysis chartpattern xauusd xauusdsignals xauusdanalysis xauusdpriceaction priceactionanalysis trendcontinuationpatterns xauusdlong reversalpattern xauusdupdates

In this video, we delve into the recent surge in gold prices, driven by a combination of factors. On Friday, the U.S. dollar and Treasury yields experienced a decline following disappointing U.S. jobs data, solidifying expectations that the Federal Reserve will halt its interest rate hikes. The October job growth figures fell short of economists' projections, with only 150,000 jobs added compared to the anticipated 180,000. Additionally, wage inflation cooled, indicating a potential easing in labor market conditions.

It is crucial to note that if the labor market continues to deteriorate, the Federal Reserve will be unable to maintain its hawkish stance. This data reinforces the notion of a Fed pause, which has contributed to the rise in gold prices. Furthermore, the dollar index (.DXY) experienced a 1% drop, while the benchmark 10-year U.S. Treasury yields reached a low not seen in over a month, further bolstering gold's appeal.

In light of the ongoing Middle East conflict, investors are now pricing in a 95% chance that the U.S. central bank will keep interest rates unchanged in December, compared to the previous 80% prior to the release of this data. These insights are based on the CME FedWatch tool.

XAUUSD Technical Analysis:

In this video, we dissected the XAUUSD chart from a technical standpoint, analyzed the key levels, analyzed historical price moves, market behaviors, and buyer-seller dynamics, and uncovered potential trading opportunities.

The $2,010 zone will remain our center stage for this week. Its historical significance makes it a crucial point. If the bullish momentum is sustained then the breakout/retest of this zone will serve as a platform for new highs. However, if selling pressure persists below $2,010 just as it had done in the last 5 months, we could witness renewed selling pressure back into the demand zone at the $1,900 zone.

Dive into the latest Gold market dynamics! Discover how escalating Middle East tensions and renewed decline in 10-year Treasury yields and their impact. Stay informed for strategic investment decisions.

#GoldMarket #SafeHavenAssets #USDebt 📺🔔💼

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

-

LIVE

LIVE

ZWOGs

12 hours ago🔴LIVE IN 1440p! - EFT w/ crgoodw1n, Kingdom Come Deliverance, Splitgate 2, & More! - Come Hang Out!

1,504 watching -

30:09

30:09

Afshin Rattansi's Going Underground

1 day agoCurtis Yarvin: ‘Trump 47 is 10x More Powerful than Trump 45’ & the TOXIC US-Israel Relationship

29.4K34 -

3:48:08

3:48:08

Drew Hernandez

10 hours agoTRUMP HINTS DEMS COULD HAVE PLANTED FAKE EVIDENCE & MANIPULATED EPSTEIN FILES

54.6K32 -

LIVE

LIVE

Eternal_Spartan

13 hours agoThe Legend of Zelda: Majoras Mask Ep. 5 | USMC Vet | Come Join the Best Chat on Rumble!!!!

89 watching -

3:44:24

3:44:24

Barry Cunningham

7 hours agoBREAKING NEWS: LIVE COVERAGE OF NEW YORK POLICE OFFICERS UNDER SIEGE!

99.1K70 -

2:51:25

2:51:25

The Pascal Show

5 hours ago $2.01 earnedBREAKING! Active Shooter In Midtown Manhattan NYC Multiple People Shot!

25.2K4 -

10:25

10:25

MattMorseTV

10 hours ago $11.36 earnedVance just DROPPED a NUKE.

47.3K45 -

5:05:09

5:05:09

Jokeuhl Gaming and Chat

8 hours agoDARKTIDE - Warhammer 40k w/ Nubes and AoA

22.5K2 -

2:53:08

2:53:08

Shoriantrax

4 hours agoLIVE: Hardcore Chaos in Tarkov – Loot, Die, Repeat!

13.5K -

John_Goetz

5 hours agoJohn Gets Gaming - Medal of Honor Vanguard Part 2

8.91K