Premium Only Content

VFIAX: Your Key to Becoming an Investing Millionaire

Limited-time exclusive deal: Get 12 Free Stocks on Webull (valued up to $3,000) and get 5% APY on your cash:

https://a.webull.com/i/CharlieChangEx...

In this video, I go over how you can invest correctly and retire as a millionaire using a special index fund called VFIAX. Putting money into index funds is personally my favorite way to invest because it allows me to invest passively so I can focus my time and energy on other important things that generate income.

In my opinion, this is one of the top and best index funds you can buy in 2023 and beyond.

► My FREE webinar on how to invest in stocks: https://www.charliechang.com/investin...

► Join my FREE newsletter: https://www.hustleclub.co/

► Daily advice and BTS on my Instagram:

/ charlie__chang

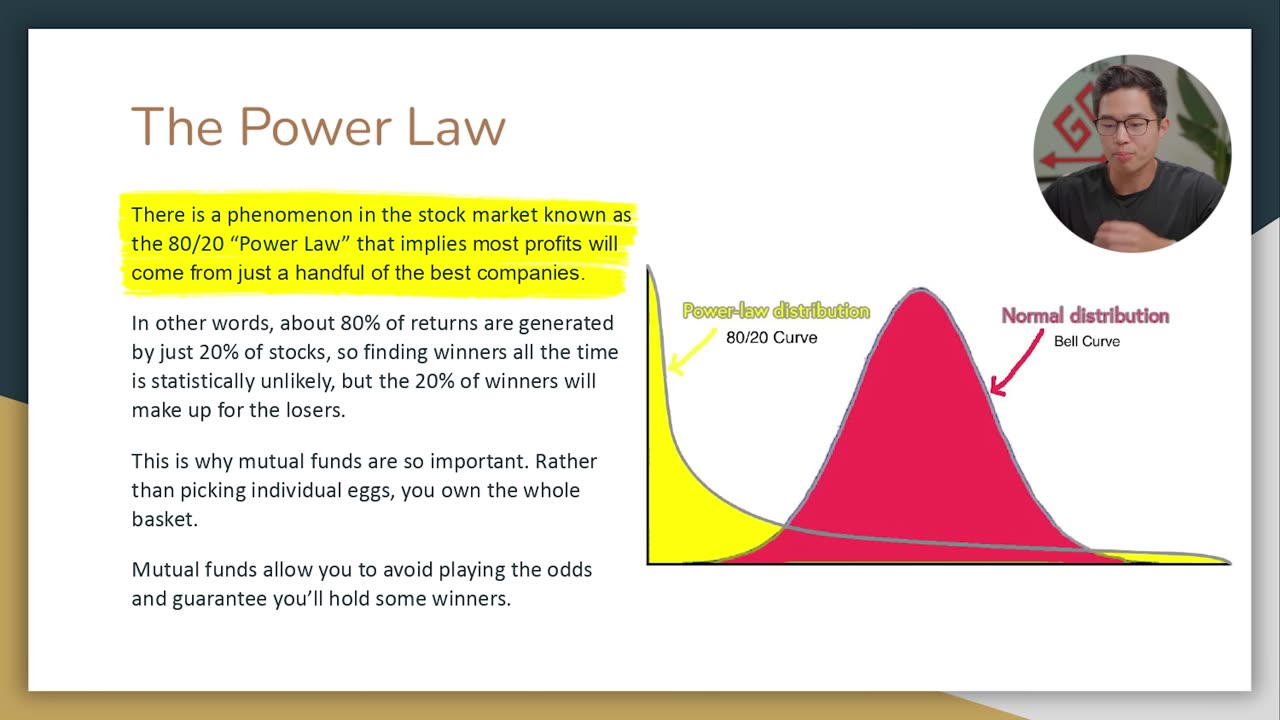

Be sure to watch the entire video because I'll show you my exact strategies for investing in stocks and index funds like VFIAX. When it comes to investing, the bottom line is you want to be diversified and play the long game. It may be tempting to buy all the "sexy" stocks from companies that you probably use, but most of the time this isn't the best investing strategy. No one can predict the future, but history tells us that the people who are successful invest diversely and over a long time. Any great mutual, index fund, or ETF will make you a millionaire as long as you start buying as soon as you can and let your money compound over time.

If you want your money to grow and not lose to inflation, then you need to invest it. It doesn't matter if it's stocks, crypto, self-improvement books, businesses, or whatever it is you want to put your money to work; and VFIAX is one of the best ways of investing and compounding your money.

If you want to learn more about investing, check out my other videos!

Stocks + Investing Playlist:

• Stocks + Investing

"7 Top Dividend Stocks That Pay Me $1,100 per Month":

• 7 Top Dividend Stocks That Pay Me $1,...

"How to Buy Treasure Bills for Beginners 2023 (Easy 5% APY)":

• How to Buy Treasury Bills For Beginne...

Note - I may have an interest in these companies. My recommendations are just a suggestion to do further research - I encourage you to do your own research about each company and make a decision for yourself, whether or not you want to invest in that particular company. This video should not be considered financial advice. Do NOT buy a stock just because it was on this video. This video is just my own analysis of VFIAX as well as other stocks mentioned in the video.

I hope you guys found this video helpful, and if you did please SHARE it with a friend or family member who you think could benefit and also LIKE and subscribe for more videos like this in the future!

Thank you so much for watching, and happy investing!

-Charlie

#Millionaire #Stocks #Investing

Timeline:

0:00 - Intro

0:43 - What Is VFIAX?

1:23 - What Are Mutual Funds?

1:52 - The Power Law

2:41 - Don't Be A Stock Picker

3:40 - Where To Invest In Index Funds

5:02 - Diversification

5:59 - Actively Managed Funds

6:27 - Expense Ratios

7:06 - Compound Interest

8:29 - Compounding With VFIAX

8:51 - Indexes

9:40 - A Deeper Look Inside VFIAX

10:57 - VFIAX vs VOO

11:18 - VFIAX vs VTI

12:01 - Main Takeaways

13:25 - Conclusion

Disclaimer: Some of the links above may be affiliate links, which means that if you click on them I may receive a small commission. The commission is paid by the retailers, at no cost to you, and this helps to support our channel and keep our videos free. Thank you!

Paid Sponsorship. User experience may vary. The opinions expressed herein are those of Charlie and not those of Webull or its affiliates. This is not a recommendation or solicitation to buy or sell securities, nor a guarantee of future performance or success. Webull Financial LLC is a member of FINRA and SIPC. All investments involve risk. More info at webull.com/disclosures.

In addition, I am not a financial advisor. Charlie Chang does not provide tax, legal or accounting advice. The ideas presented in this video are for entertainment purposes only. Please do your own due diligence before making any financial decisions.

-

1:13:26

1:13:26

Russell Brand

4 hours agoShooting RAMPAGE In NYC + Trump HUMILIATES Starmer During UK Visit - SF622

142K36 -

10:21

10:21

Colion Noir

7 hours agoCaught On Camera: Armed Veteran With AR-15 Shoots Man Who Fires Into Crowd With Drum Magazine

17.4K18 -

20:37

20:37

Degenerate Jay

5 hours agoThe Fantastic Four: First Steps Review - Fantastic Or Failure?

2.9K2 -

6:43:48

6:43:48

JuicyJohns

7 hours ago $2.91 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢 !loadout

59.3K2 -

1:01:52

1:01:52

Sean Unpaved

4 hours agoRyne Sandberg's Legacy, Madden's 99 Club, NIL's Locker Room Heat, & Wilkins' Kiss-and-Run

22.7K1 -

6:29

6:29

Clickbait Wasteland

18 hours ago $0.67 earnedCUOMO vs ZOHRAN: Who do New Yorkers Want as the Next Mayor?

15.8K11 -

22:10

22:10

IsaacButterfield

11 hours ago $0.99 earnedUnhinged White Woman Hates White People

18.7K24 -

1:04:05

1:04:05

Timcast

4 hours agoThe TAMURA Conspiracy, Theory Says Blackstone WAS The Target Over Israel, NOT NFL

166K108 -

2:15:27

2:15:27

Steven Crowder

7 hours agoNYC Shooting Exposes Massive Hypocrisy From Mamdani & the Left

382K429 -

1:36:20

1:36:20

The Mel K Show

5 hours agoMORNINGS WITH MEL K - An Engaged Fed Up Citizenry is Finally Moving the Needle Towards Accountability 7-29-25

44.9K21