Premium Only Content

Bank of America, Chase and Wells Fargo delays Amazon lay off

Bank of America, Chase and Wells Fargo delays Amazon lay off workers

Bank of America customers complain of deposit issues: What to know

Several major U.S. banks, including Bank of America and Chase, were experiencing deposit delays Friday morning.

The Federal Reserve alerted banks early Friday that a processing issue at a national network for processing transactions (Automated Clearing House) was causing the deposit delays.

According to Downdetector, Bank of America, Chase and Wells Fargo have experienced a surge of reported outages since Friday morning.

Bank of America users posted on X, formerly known as Twitter, the message that the bank sent out via their mobile app.

"Some deposits from 11/3 may be temporarily delayed due to an issue impacting multiple financial institutions," the message read. "Your accounts remain secure, and your balance will be updated as soon as the deposit is received. You do not need to take any action."

A user on Downdetector commented that their company sent out the following email: "We're aware of delays in one of the banking networks that manages ACH deposits for multiple organizations and businesses. Direct deposits and debits did not appear in accounts as expected," the email read. "Banks are working urgently to post the transactions today. We'll continue to post updates on status. No further action is required."

JPMorgan Chase discloses multiple investigations by U.S. regulators

FTX founder Sam Bankman-Fried convicted of defrauding cryptocurrency customers

JPMorgan CEO Jamie Dimon to sell 1 million shares of the bank

Amazon trials humanoid robots to 'free up' staff

16,000 Amazon workers have joined a Slack channel and launched a petition to fight CEO Andy Jassy’s mandate to return to the office

Amazon to lay off 9,000 more workers

The cuts are on top of previous layoffs that began in November and extended into January. That round affected more than 18,000 employees.

$40,000,000,000 in Unrealized Losses Hits JPMorgan Chase As Bank of America, Wells Fargo and Citigroup Face Exposure to US Treasuries: Report

The new numbers were located in a footnote on the firm’s third-quarter financial supplement and were higher than an expected $34 billion loss.

The news follows a new quarterly report from Bank of America revealing it now has a total of $131.6 billion in unrealized losses.

Although Wells Fargo and Citigroup have also reported third-quarter earnings, they have yet to reveal the latest stats on their own unrealized losses.

In Q2 of this year, Wells Fargo said it had $40 billion in unrealized bond market losses, while Citigroup had $25 billion in paper losses.

-

1:08:09

1:08:09

Unknown Truth

1 day agoBREAKING: Ripple to Drop Cross Appeal Against SEC, Ending XRP Lawsuit

96 -

46:55

46:55

The Connect: With Johnny Mitchell

20 hours ago $4.39 earnedInside A Mexican Sicario Training Camp: How The Jalisco New Generation Cartel Trains It's KILLERS

34.8K5 -

3:57

3:57

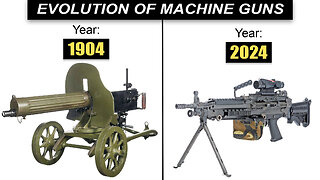

Data illusion

5 days ago $0.42 earnedEvolution Of Machine Guns

20.4K -

LIVE

LIVE

Boxin

34 minutes agoToday We start Fable 2! The Gargoyles will die!

139 watching -

18:09

18:09

SouthernbelleReacts

1 day ago $1.83 earnedThis Movie Crawled Into My Soul 👁 | Sinister (2012) | First Time Reaction (PREVIEW)

39K7 -

28:35

28:35

marcushouse

22 hours ago $2.67 earnedSpaceX’s Wild New Plan to Launch Starship Fast… and NASA’s Booster Test Ended With a BOOM!

26.2K5 -

LIVE

LIVE

Whiz

14 hours agoThe Finals World Tour is Intense!

43 watching -

LIVE

LIVE

Jokeuhl Gaming and Chat

5 hours agoEmpyrion on Dorkitos - Rebuilding After the Crash

74 watching -

LIVE

LIVE

Lofi Girl

2 years agolofi hip hop radio 📚 - beats to relax/study to

991 watching -

8:01

8:01

MattMorseTV

1 day ago $11.91 earnedNYC Democrat is in HOT WATER.

59.4K110