Premium Only Content

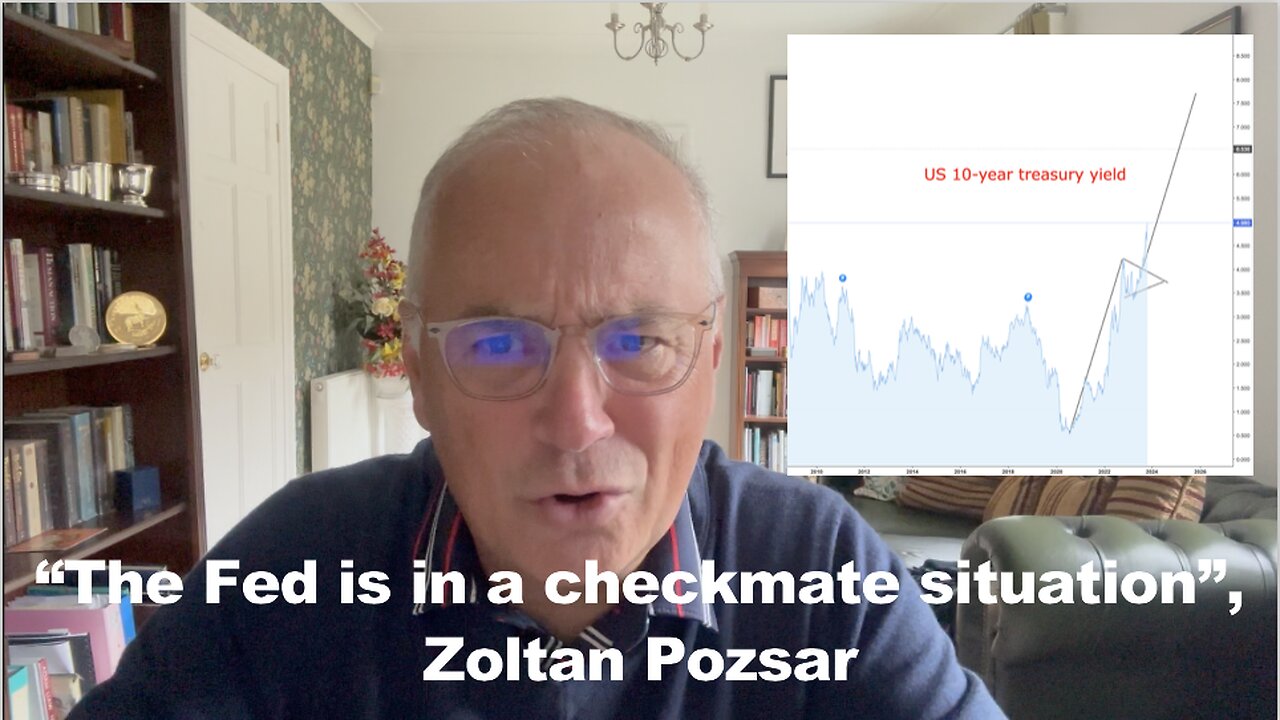

The Fed is About to Succumb to Higher Treasury Yields.

#federalreserve #interestrates #credit #economy

Keep your possessions safe with The Dirtyman Safe - Use the maneco10 promo code to get a 10% discount: https://www.dirtymansafe.com/

Where to Buy Precious Metals:

In the U.K. but will ship worldwide:

Use promo code maneco64sov to get a 5% discount on "various dates" sovereigns at https://www.goldinvestments.co.uk/

For all other products use promo code maneco64 separately for a 0.5% discount

In North America:

Are you looking for ways to protect your wealth during these uncertain times? Learn how to develop a customized strategy to safeguard your assets with ITM Trading's expert Gold and silver analysts team. Learn more ➡️ https://learn.itmtrading.com/maneco64 or call 866-989-4368. US mailing address required.

Miles Franklin Precious Metals Investments: send an email to [email protected] and mention Mario or maneco64 or call on 1-800-822-8080

In the U.K. and U.S.

GlintPay App, Save and Spend in Gold - Use referral code marioGlint79

https://glintpay.com/

SUPPORT the Channel:

https://wideawake.clothing/?sca_ref=4111775.wgYmKdIDoj

Teespring Store: https://www.youtube.com/channel/UCAvSnci_3qHF_7c2LQnP_wg/store

PayPal: https://www.paypal.me/maneco64

Patreon: https://www.patreon.com/maneco64

maneco64 blog: www.maneco64.net

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. Your investment and other financial decisions are solely your responsibility. It is imperative that you conduct your own research and seek professional advice as necessary. I am merely sharing my opinions.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase. However, I only recommend products or services that I believe in.

Today we will look at why Central banks around the world and in particular the Federal Reserve are under immense pressure to reverse their QT or quantitative tightening policies.

This policy is leading to a massive problem in the bond market and the bond market is the heart of our debt-based system which pumps blood or credit into the economy.

As the Fed and others like the Bank of England continue to sell the bonds they hold as a result of all the QE they did from 2009 to 2021 it drives long-term yields higher and increases the cost of not only issuing new debt for governments but also carrying existing debt.

We will look at why the Fed will most probably blink and basically reverse its QT policy and this is not just me saying it but people like Zoltan Pozsar and Luke Gromen.

-

22:43

22:43

Nikko Ortiz

13 hours agoGhost Of Tabor Is Like Fent...

7.65K1 -

17:44

17:44

The Pascal Show

13 hours ago $0.72 earnedNOW LAPD IS LYING?! TMZ Doubles Down On Source's "Celeste Rivas Was FROZEN" Claims

4.64K1 -

18:05

18:05

GritsGG

14 hours agoThis Duo Lobby Got a Little Spicy! We Have Over 20,000 Wins Combined!

5.18K -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

223 watching -

37:08

37:08

MetatronGaming

2 days agoWarhammer Shadow of The Horned Rat DOS Version is FANTASTIC! 1995

13.9K1 -

2:03:36

2:03:36

FreshandFit

12 hours agoAkaash Replies to FreshandFit w/ Girls

189K23 -

1:07:49

1:07:49

Man in America

12 hours agoBANNED TECH: The Tesla Secrets Rockefeller Crushed to Keep You Sick w/ Linda Olsen

39.9K7 -

4:40:43

4:40:43

Drew Hernandez

1 day agoCANDACE OWENS ASSASSINATION PLOT?

45.7K21 -

1:05:15

1:05:15

Inverted World Live

10 hours agoOne Big Happy Thanksgiving | Ep. 147

83.7K5 -

2:44:12

2:44:12

TimcastIRL

9 hours agoCandace Owens OFF AIR, Warns France Trying To KILL HER, Says Feds CONFIRM RECEIPT | Timcast IRL

227K188