Premium Only Content

#310 Financial Literacy

Financial literacy refers to the knowledge and understanding of various financial concepts and practices necessary to make informed and effective decisions about money. It includes a wide range of topics related to personal and household finances, investments, and economic factors. Being financially literate can significantly impact one's ability to manage money, plan for the future, and make informed financial decisions. Here are some key aspects of financial literacy:

Budgeting: Understanding how to create and maintain a budget is a fundamental aspect of financial literacy. This involves tracking income, expenses, and managing a spending plan to ensure that one's financial goals are met.

Saving and Investing: Knowledge about saving money and making informed investment decisions is crucial for building wealth over time. This includes understanding different investment options like stocks, bonds, mutual funds, real estate, and retirement accounts.

Debt Management: Being aware of how to manage debt responsibly, including credit cards, loans, and mortgages, is an essential part of financial literacy. This includes understanding interest rates and payment terms.

Financial Planning: Developing a comprehensive financial plan that considers short-term and long-term goals, such as retirement, education, and emergency funds, is crucial for achieving financial security.

Taxes: Understanding the basics of tax planning can help individuals and businesses reduce their tax liability legally and efficiently.

Insurance: Knowing how different types of insurance work, such as health, life, auto, and property insurance, is important for protecting against unexpected financial setbacks.

Estate Planning: Estate planning includes understanding wills, trusts, and other strategies for managing assets and passing them on to heirs.

Credit Scores: Knowing how credit scores work and how to maintain a good credit rating is important when seeking loans or credit.

Financial Security: Recognizing the importance of an emergency fund and having financial safeguards in place to deal with unexpected expenses and financial crises.

Economic Awareness: Staying informed about economic factors and their potential impact on personal finances, such as inflation, interest rates, and market trends.

Financial literacy can have a significant impact on an individual's quality of life and financial well-being. It empowers people to make better financial decisions, plan for their future, and avoid common financial pitfalls. Many countries and organizations offer resources, educational programs, and tools to improve financial literacy among their populations, recognizing its importance in promoting economic stability and individual prosperity.

www.antharas.co.uk/ companies website or top book distributors!

-

8:04

8:04

AV

1 year ago#1149 Press release - Pension funds can fire up the UK economy

331 -

2:55:16

2:55:16

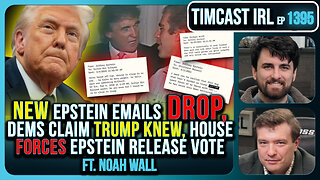

TimcastIRL

5 hours agoNEW Epstein Emails Drop, Dems Claim TRUMP KNEW, Congress Forces Epstein Release Vote | Timcast IRL

232K89 -

1:19:53

1:19:53

Barry Cunningham

4 hours agoBREAKING NEWS: PRESIDENT TRUMP RE-OPENS THE UNITED STATES GOVERNMENT!

23.1K5 -

20:47

20:47

The White House

4 hours agoPresident Trump Signs Senate Amendment to H.R. 5371

20.8K25 -

LIVE

LIVE

Drew Hernandez

21 hours agoNEW EPSTEIN EMAIL DROP FULLY POLITICIZED

1,352 watching -

1:44:01

1:44:01

Tucker Carlson

3 hours agoTucker Carlson on the Israel First Meltdown and the Future of the America First Movement

37.7K293 -

LIVE

LIVE

Alex Zedra

3 hours agoLIVE! Phasmaphobia New Map!

559 watching -

2:16:06

2:16:06

Laura Loomer

5 hours agoEP155: Jihad Makes Its Move On The White House

31.2K39 -

2:18:47

2:18:47

TheSaltyCracker

5 hours agoDem's Epstein Drop Backfires ReeEEStream 11-12-25

87.2K184 -

17:08

17:08

Demons Row

5 hours ago $3.18 earnedMost Dangerous Motorcycle Clubs That Ever Existed 💀🔥

26.6K2