The Future is Digital Says Westpac CEO

Your future is digital and Westpac’s is even higher profits. Once again, the commercial in confidence excuse was trotted out around disclosure of the cost of the Australia Post community representation contracts that are allowing the banks to close many of their regional branches. In 2018 the amount was public information so what's changed? Westpac has taken the question on notice.

Almost a quarter of Australians cannot do digital banking. Either they lack access or the necessary skills to go online for their banking. I asked Westpac why the bank is turning its back on these Australians. The way Westpac's CEO Peter King views this is that 96% of their own customers are engaging with them digitally so all is well.

Has Westpac looked at the fact they're pushing people online who don't actually have the capability to stay safe and secure on that platform? Instead of directly answering my question, Peter King said the three biggest scam losses are through investment scams, romance scams and business email compromises. Banks are doing everything they can, he said, to prevent this by blocking suspicious payments and educating customers.

Westpac is enthusiastic in its push towards digital. In Townsville for example, where Westpac has shut its doors, the bank conducted education sessions to help customers adapt to the digital transition. Clearly there are factors that limit digital banking in regional Australia. Westpac's answer isn't to reverse the closures, it's to improve its banking app to do everything. The bank intends to shoehorn people into the digital economy whether they like it or not. Peter King believes this shift is much broader than just banking because all government and essential services will become digital too.

Will there still be cash? Peter King thinks that cash will still exist in the economy but its use will decline. Cash made up 70% of all transactions in 2007. That figure is now 13% and trending down. Where telecommunications or power are cut off, Westpac would get cash into an affected area by flying it in. Telecommunications is obviously critical.

Finally, I asked if Westpac's data might not be accurate. It isn't capturing all cash transactions. Once cash is circulating there is no way to track it, so perhaps they're not seeing the real picture of cash use in the economy. I was told the Reserve Bank undertakes surveys into how cash is used and in Westpac's view there is less call for cash making it less important in the scheme of things. Online banking and Bank@Post will replace bank branches, particularly in regional areas where Westpac and the other big banks are pulling away from in person services.

Profits over personal touch is what's in store for customers in the digital economic future. In a move we're seeing across the corporate and political sectors, the Big Four are making the data fit the narrative so they can achieve their goals. Where's the care factor?

Transcript: https://www.malcolmrobertsqld.com.au/the-future-is-digital-says-westpac-ceo/

-

57:32

57:32

rethinkingthedollar

9 months ago🔴 The Future Of Banking Starts In 2024 | The People's Talk Show

21 -

0:39

0:39

VoicesForFreedomNZ

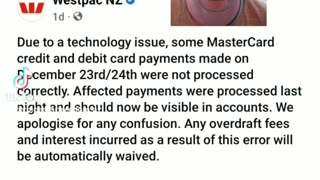

9 months agoWestpac tech issue probes that cash is cool

311 -

10:33

10:33

Ever Eden

3 months agoEVER SOMETHING TO SAY: Bankwest going Digital

857 -

8:00

8:00

WhatTheFuck

1 year agoWTF 82 - ANZ Backlash as ATMs will no longer be dispensing cash.

3071 -

1:14:08

1:14:08

ExCandidates

6 months agoRebecca Lloyd Interview - Director ID Update & the Future of Australia - XCandidates Episode 93

6323 -

4:36

4:36

Daily Insight

4 months agoOn Your Bike Woolworths CEO

1602 -

2:08:09

2:08:09

The Discernable® Interviews

1 year agoRobert Barwick: Banks That Run The World

86 -

1:24

1:24

B.C. Begley

1 year agoPwC Australia acting CEO to face state parliament

35 -

8:11

8:11

Asher Press

7 months agoAustralia Post Flies in the Face of a Cashless Agenda!

270 -

3:03

3:03

Conspiracy Chronicle

2 months agoShocking Revelation: Australian Banks Ban Cash Withdrawals in City Branches!

2201