Premium Only Content

Financial Analyst Cautions on U.S. Dollar's Future, Expects Gains for Bitcoin Holders

Global financial services firm Jefferies has issued a warning about the potential collapse of the U.S. dollar, suggesting that this scenario could prove beneficial for those holding bitcoin. The firm, a prominent global investment bank, is headquartered in the United States and has a global presence.

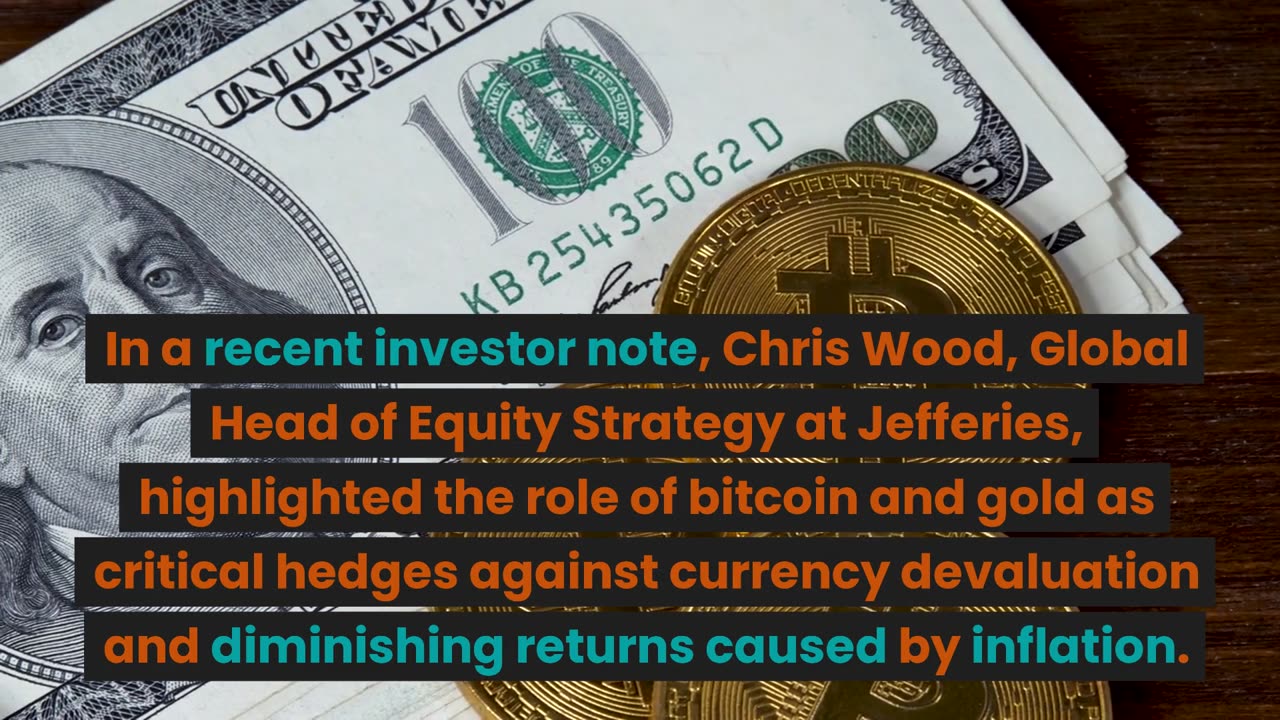

In a recent investor note, Chris Wood, Global Head of Equity Strategy at Jefferies, highlighted the role of bitcoin and gold as critical hedges against currency devaluation and diminishing returns caused by inflation. Wood, who received recognition as the Best Strategist in the Asia region by Asiamoney in 2020, pointed out that the Federal Reserve has been aggressively reducing its balance sheet while rapidly increasing interest rates to combat rising inflation. He speculated that the Fed might be compelled to pivot toward a dovish stance in response to a potential U.S. recession, grappling with a colossal $33 trillion U.S. debt burden.

Wood expressed concern that G7 central banks, with a particular focus on the Federal Reserve, may find it challenging to exit unconventional monetary policies smoothly. This predicament could lead to continued expansion of central bank balance sheets in various forms. In such a scenario, he warned that the U.S. dollar's paper standard might ultimately collapse, benefiting holders of both gold and bitcoin.

Wood's advice to investors is to view their holdings in gold and bitcoin as a form of insurance rather than short-term trades. He further suggested that long-term global investors, such as pension funds, allocate 10% of their portfolios to bitcoin, particularly if they are U.S. dollar-based.

In addition, Wood noted that bitcoin has become an investible asset for institutional investors, with secure custody arrangements for digital assets in place. It is now considered an alternative store of value in comparison to traditional assets like gold.

-

3:34:06

3:34:06

This is the Ray Gaming

4 hours ago $0.29 earnedCould you be? Would you be? Won't you be my RAYBOR? | Rumble Premium Creator

20.8K -

1:46:52

1:46:52

JahBlessGames

5 hours ago🎉Come een' and come tru' - VIBES | MUSIC | GAMES

39.5K -

38:47

38:47

MattMorseTV

7 hours ago $12.09 earned🔴Tulsi just CLEANED HOUSE.🔴

59.2K97 -

6:24:06

6:24:06

Reolock

8 hours agoWoW Classic Hardcore | WE'RE BACK!!

25.1K1 -

3:46:13

3:46:13

SynthTrax & DJ Cheezus Livestreams

10 hours agoShell Shock Live - The Scorched Earth Remake/Upgrade - 4pm PST / 7pm EST - RUMBLE GAMING

43.6K -

2:56:57

2:56:57

Illyes Jr Gaming

6 hours agoBack to Black .....Ops 6 w/ ILLYESJRGAMING

27.8K1 -

1:07:59

1:07:59

BonginoReport

9 hours agoBoston Mayor Defies Trump, Protects Illegals - Nightly Scroll w/ Hayley Caronia (Ep.115)

128K90 -

40:45

40:45

Donald Trump Jr.

10 hours agoPeace by Peace: Solving One Problem After Another | Triggered Ep.268

74.6K64 -

5:19:04

5:19:04

FrizzleMcDizzle

7 hours ago $1.80 earnedRemnant 2 - Dark Souls-like Shooter?!

23.4K -

4:54:15

4:54:15

FoeDubb

5 hours ago🏰KINGDOM MENU: 🎮DELTA FORCE PEW PEWS WITH THE BROS 👑CRGOODWiN & 👑BSPARKSGAMING DILLY DILLY!!

14.8K1