Premium Only Content

#238 Cut the Bleeding

"Cut the bleeding" in financial terms:

Assess the Financial Situation: The first step is to thoroughly assess the financial situation. Identify the sources of financial losses or drains on resources. This could include reviewing income, expenses, debt, and investment performance.

Create a Budget: Develop a detailed budget that outlines income and all expenses. Identify areas where expenses can be reduced or eliminated to improve cash flow.

Prioritize Expenses: Categorize expenses into essential and non-essential categories. Focus on reducing or cutting non-essential expenses first. Essential expenses include things like rent/mortgage, utilities, groceries, and debt payments.

Negotiate with Creditors: If you have outstanding debts, consider negotiating with creditors to lower interest rates, extend repayment terms, or explore debt consolidation options.

Increase Income: Explore opportunities to increase your income, such as taking on part-time work, freelancing, selling assets, or seeking a higher-paying job.

Emergency Fund: Building or tapping into an emergency fund can help cover unexpected expenses and prevent further financial bleeding during tough times.

Review Investments: Assess your investment portfolio and consider rebalancing or reallocating assets to align with your financial goals and risk tolerance.

Seek Professional Help: If your financial situation is particularly complex or dire, consider consulting a financial advisor, accountant, or bankruptcy attorney for guidance.

Cut Unnecessary Business Costs: In a business context, "cutting the bleeding" often involves scrutinizing operational expenses, renegotiating contracts, optimizing inventory, and evaluating the efficiency of various business processes.

Monitor Progress: Continuously monitor your financial situation and make adjustments as necessary. Regularly reviewing your financial health can help prevent future financial crises.

The specific actions you take will depend on your unique financial circumstances. The goal is to stop the financial losses and create a sustainable financial plan that puts you on a path toward financial stability and growth. It's important to act promptly when facing financial challenges to prevent further damage to your financial health.

www.antharas.co.uk/ companies website or top book distributors!

#BusinessStrategy

#Entrepreneurship

#Leadership

#Management

#Marketing

#Finance

#Startups

#Innovation

#Sales

#SmallBusiness

#CorporateCulture

#Productivity

#SelfDevelopment

#SuccessStories

#PersonalBranding

#Networking

#Negotiation

#BusinessEthics

#TimeManagement

#GrowthStrategies

#MarketAnalysis

#BusinessPlanning

#FinancialManagement

#HumanResources

#CustomerExperience

#DigitalTransformation

#Ecommerce

#SocialMediaMarketing

#BusinessCommunication

-

14:15

14:15

AV

5 months ago#1151 Press release - AUKUS real-time AI trials

81 -

7:35

7:35

Tactical Advisor

1 day agoNEW Springfield Prodigy Compact (FIRST LOOK)

285 -

16:45

16:45

IsaacButterfield

1 day ago $0.25 earnedWoke TikToks Are DESTROYING The World

1.14K7 -

1:09:27

1:09:27

State of the Second Podcast

12 hours agoThis is Why We Don’t Trust Politicians (ft. @stones2ndsense)

492 -

10:19

10:19

Chrissy Clark

9 hours agoCNN’s BILLION Dollar Defamation Trial

564 -

1:00:27

1:00:27

Trumpet Daily

16 hours ago $3.21 earnedCongress Humiliates Itself - Trumpet Daily | Jan. 15, 2025

4.08K9 -

1:49:46

1:49:46

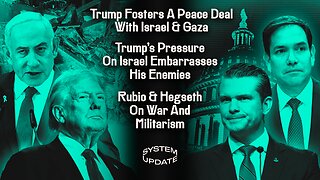

Glenn Greenwald

1 day agoTrump Fosters A Peace Deal With Israel & Gaza; Trump's Pressure On Israel Embarrasses His Enemies & Provides Foreign Policy Clues; Rubio & Hegseth On War And Militarism | SYSTEM UPDATE #389

84.6K157 -

1:28:46

1:28:46

Donald Trump Jr.

16 hours agoOut of this World: Breaking News Investigation on Secret Alien Aircrafts, Live with Ross Coulthart & Lue Elizondo | TRIGGERED Ep.207

305K445 -

1:39:31

1:39:31

Space Ice

12 hours agoSpace Ice & Redeye: Battlefield Earth & Rob Schneider

66.3K4 -

1:33:38

1:33:38

Flyover Conservatives

1 day agoAMANDA GRACE | Prophetic Warnings Ignored: What Happens When Leaders Defy God | FOC Show

54.5K17