Premium Only Content

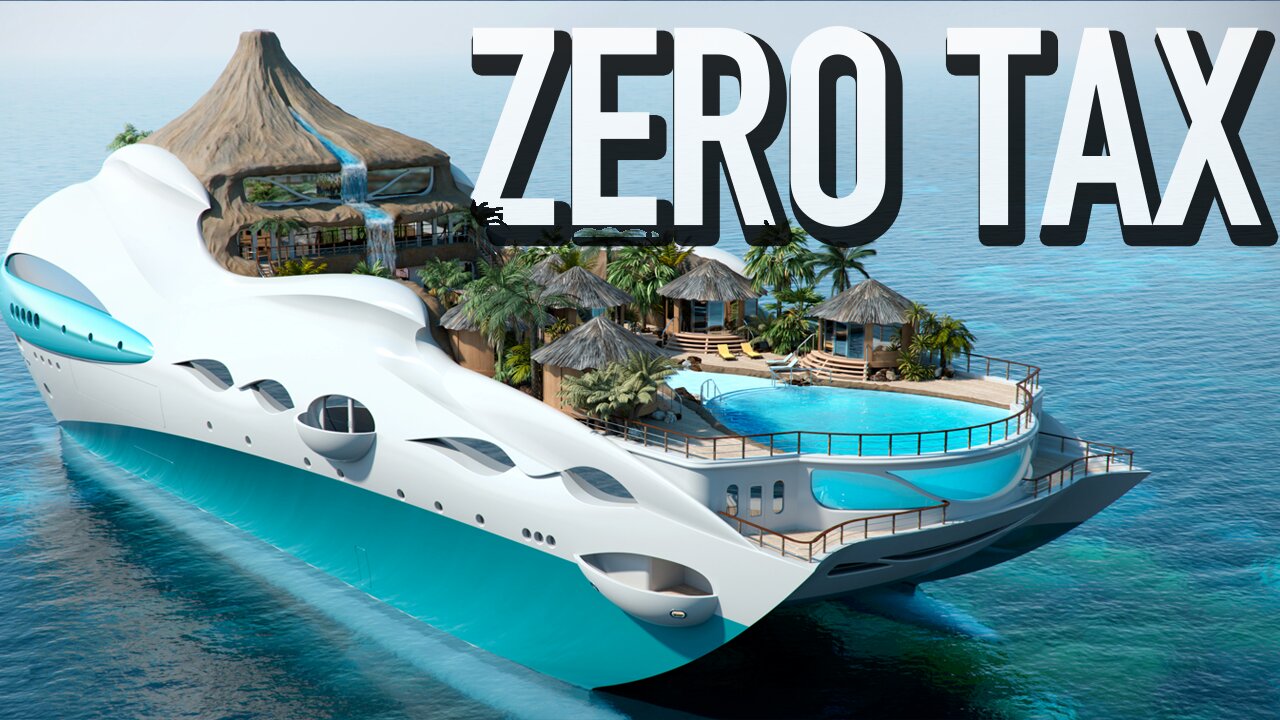

The Secret Way Rich People AVOID Paying Taxes By Living At Sea

Rich people are avoiding taxes by living on the ocean full time through little known tax loopholes that no one is talking about.

This unique approach involves luxury floating apartments, endless travel, and a zero tax bill each year. Here's how it works:

* Residence Rules and Tax Exemption: Most countries have residency-based tax laws. For instance, in the U.K., spending fewer than 183 days a year exempts you from local taxes on overseas income. This includes waters within 12 nautical miles of the coastline.

* Floating Tax Havens: These are ships that sail in international waters, spending minimal time in any country's national waters. This keeps passengers outside of tax jurisdiction during their stay.

* Types of Floating Tax Havens:

* Residential Ships: Like the World Cruise Liner, offering a blend of cruise and private residence. Passengers can establish a zero tax status if set up correctly.

* Private Yachts: An option for those who prefer privacy and can't invest in a shipboard apartment. Yachts offer comfort and the potential for tax savings in certain regions.

* Requirements for Residential Ships:

* Personal wealth of at least ten million dollars.

* References from two current ship residents.

* Pass background checks.

* Yearly income of up to nine hundred thousand dollars for food and maintenance.

* Investment and Costs: The World offers luxury apartments ranging from $4,300 to $6,200 per sq. ft. Cabins range from $1.8 to $15 million. Facilities include sports, spa, library, and more.

* The World's Itinerary: The ship spends around two-thirds of the year at sea, visiting exotic locations worldwide.

* Floating City Project: The Freedom Ship, a future project, aims to house 50,000 people and offer a more affordable alternative.

* Private Yachts: An option for those seeking privacy and comfort. Yachts can be a cost-effective means to explore tax-saving opportunities.

Remember, there are important considerations:

* U.S. citizens must give up their citizenship due to tax obligations.

* No permanent legal status may mean limited access to healthcare, tax treaties, or pensions.

* Setting up tax-free status requires legal and tax expertise, and may not be foolproof against aggressive tax enforcement.

Discover how the world's quiet elites live tax-free on the open seas. Don't miss out on this intriguing tax strategy.

Music:

Dream It - TrackTribe

The Duel - Bensound

Til I Hear'em Say - NEFFEX

-

LIVE

LIVE

Exploring With Nug

4 hours agoWoman With Dementia Found Alive After Missing In Woods!

137 watching -

LIVE

LIVE

Mally_Mouse

1 hour agoLet's Play!! -- Jackbox: Trivia Murder Party!!

280 watching -

1:24:33

1:24:33

Savanah Hernandez

3 hours agoThe Culture Has Shifted & Accountability Is Coming

12.2K8 -

1:09:10

1:09:10

PMG

1 day ago $4.58 earned"HHS Whistleblower Speaks Out After 300,000 Migrant Children Go Missing"

32.4K7 -

1:40:48

1:40:48

The Quartering

5 hours agoMystery Drones Spraying Chemicals, Firing Bullets & Everyone's Lying!

80.2K28 -

2:59:59

2:59:59

vivafrei

21 hours agoConversation with a Lefty: "Pastor Ben" Talking Daniel Perry, MAGA & Much More! Viva Frei Live

102K90 -

12:21

12:21

Silver Dragons

5 hours agoSilver Price Pushed Down - Is There Any Hope in 2025?

33.2K4 -

LIVE

LIVE

tacetmort3m

15 hours ago🔴 LIVE - THIS GAME IS ABSOLUTE CINEMA - INDIANA JONES AND THE GREAT CIRCLE - PART 3

192 watching -

1:58:49

1:58:49

The Charlie Kirk Show

6 hours agoThe New Jersey Drone Mystery + "Only" 26 J6 Informants + Pop Culture Power Hour | Kelly | 12.13.24

139K71 -

29:49

29:49

Brewzle

6 hours agoThis Distiller Is The Mad Scientist Of Corn

27K4