Premium Only Content

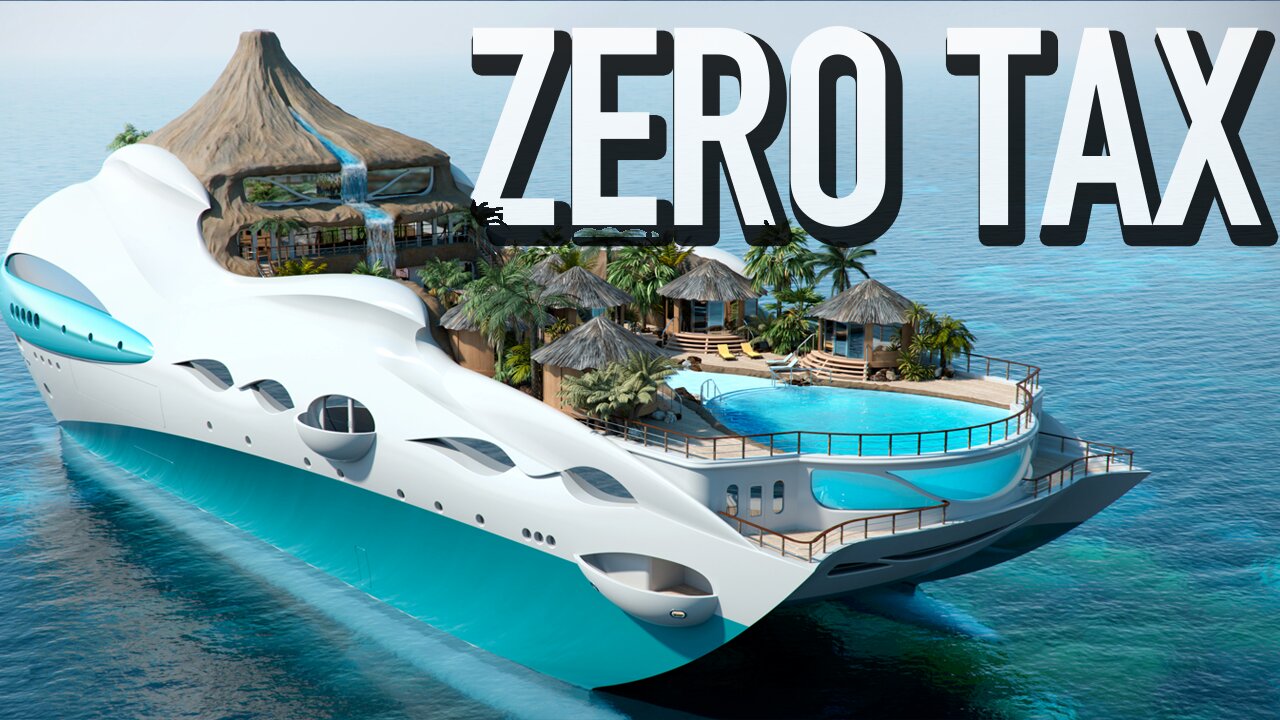

The Secret Way Rich People AVOID Paying Taxes By Living At Sea

Rich people are avoiding taxes by living on the ocean full time through little known tax loopholes that no one is talking about.

This unique approach involves luxury floating apartments, endless travel, and a zero tax bill each year. Here's how it works:

* Residence Rules and Tax Exemption: Most countries have residency-based tax laws. For instance, in the U.K., spending fewer than 183 days a year exempts you from local taxes on overseas income. This includes waters within 12 nautical miles of the coastline.

* Floating Tax Havens: These are ships that sail in international waters, spending minimal time in any country's national waters. This keeps passengers outside of tax jurisdiction during their stay.

* Types of Floating Tax Havens:

* Residential Ships: Like the World Cruise Liner, offering a blend of cruise and private residence. Passengers can establish a zero tax status if set up correctly.

* Private Yachts: An option for those who prefer privacy and can't invest in a shipboard apartment. Yachts offer comfort and the potential for tax savings in certain regions.

* Requirements for Residential Ships:

* Personal wealth of at least ten million dollars.

* References from two current ship residents.

* Pass background checks.

* Yearly income of up to nine hundred thousand dollars for food and maintenance.

* Investment and Costs: The World offers luxury apartments ranging from $4,300 to $6,200 per sq. ft. Cabins range from $1.8 to $15 million. Facilities include sports, spa, library, and more.

* The World's Itinerary: The ship spends around two-thirds of the year at sea, visiting exotic locations worldwide.

* Floating City Project: The Freedom Ship, a future project, aims to house 50,000 people and offer a more affordable alternative.

* Private Yachts: An option for those seeking privacy and comfort. Yachts can be a cost-effective means to explore tax-saving opportunities.

Remember, there are important considerations:

* U.S. citizens must give up their citizenship due to tax obligations.

* No permanent legal status may mean limited access to healthcare, tax treaties, or pensions.

* Setting up tax-free status requires legal and tax expertise, and may not be foolproof against aggressive tax enforcement.

Discover how the world's quiet elites live tax-free on the open seas. Don't miss out on this intriguing tax strategy.

Music:

Dream It - TrackTribe

The Duel - Bensound

Til I Hear'em Say - NEFFEX

-

8:12

8:12

Mini Money Docs™

1 month agoChuck E. Cheese: The Most CURSED Chain in America Just Won’t Die.

15 -

LIVE

LIVE

The Bubba Army

23 hours agoMinneapolis Shooter Story Unfolds! - Bubba the Love Sponge® Show | 8/28/25

1,856 watching -

LIVE

LIVE

JuicyJohns

1 hour ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢

25 watching -

LIVE

LIVE

GritsGG

55 minutes agoWin Streaking! Most Wins 3485+ 🧠

58 watching -

16:58

16:58

marcushouse

14 hours ago $3.11 earnedSpaceX Starship Flight 10: What Really Happened! 🚀

37.6K13 -

3:47

3:47

Blackstone Griddles

14 hours agoCampground Meal Planning on the Blackstone Camping Griddle

10K1 -

28:13

28:13

Her Patriot Voice

14 hours ago $1.17 earnedIs Flag Burning Free Speech?

11K15 -

17:51

17:51

TheRoyaltyAutoService

16 hours ago $0.54 earnedIs Flat Rate Ruining The Auto Repair Industry?!

12.3K7 -

2:02:05

2:02:05

BEK TV

1 day agoTrent Loos in the Morning - 8/28/2025

12.8K -

26:00

26:00

DeVory Darkins

1 day ago $12.23 earnedDemocrat Mayor HUMILIATES himself during painful interview as Trump makes SHOCKING Announcement

44.4K100