Everything was in Decline in 2019 , Mike in the Night was hard, Truther Movement Civil Wars,

In 2019, the global economy faced a multitude of challenges that significantly impacted various sectors, including banking, housing, inflation, and job losses. These issues were interlinked, exacerbating the overall economic strain. This essay will delve into each of these areas to elucidate how they collectively contributed to the economic turbulence of that year.

The banking sector played a pivotal role in the economic landscape of 2019. One of the primary concerns was the persistently low interest rates. Central banks, including the Federal Reserve in the United States and the European Central Bank, maintained historically low policy rates to stimulate economic growth following the aftermath of the 2008 financial crisis. While this policy had positive effects in the initial recovery phase, by 2019, it had unintended consequences.

Low interest rates compressed banks' net interest margins, the difference between interest earned on loans and interest paid on deposits. This put pressure on their profitability, as they struggled to generate sufficient income from lending operations. Consequently, banks were more cautious about lending, particularly to riskier borrowers. This limited access to credit for individuals and businesses, stifling investment and consumption.

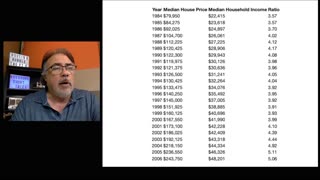

The housing sector also grappled with its own set of challenges. In many regions, housing prices had soared to unsustainable levels, fueled by a combination of factors including low interest rates, speculative investments, and a lack of affordable housing options. This created a precarious situation where a significant portion of the population was priced out of the market, making it difficult for first-time homebuyers to enter the market.

Simultaneously, the high prices posed a threat to financial stability. The potential for a housing market correction loomed large, which could lead to a cascade of adverse effects across the economy. Many households were over-leveraged, with mortgage debt levels far exceeding their disposable income. In the event of a downturn, these households were vulnerable to default, potentially triggering a wave of foreclosures and further exacerbating the housing crisis.

Inflation was yet another pressing concern in 2019. While moderate inflation is generally seen as a sign of a healthy economy, persistently low inflation rates were a cause for worry. Central banks target a certain level of inflation to ensure price stability and stimulate economic activity. However, in 2019, many advanced economies struggled to meet their inflation targets.

Several factors contributed to this predicament. Globalization and technological advancements kept a lid on wage growth, as companies faced competition from lower-cost labor markets and automation. Additionally, the rise of e-commerce and increased price transparency through online platforms exerted downward pressure on prices. As a result, central banks found themselves in a challenging position, with limited tools at their disposal to spur inflation.

Job losses were a significant fallout of these economic challenges. The cautious lending environment and limited investment opportunities due to low interest rates led to a slowdown in business expansion. Companies, uncertain about future economic conditions, hesitated to hire new employees or invest in capacity expansion. This, in turn, translated into a rise in unemployment rates in many regions.

Furthermore, the housing market struggles directly impacted employment in related industries such as construction, real estate, and mortgage lending. As housing demand weakened, these sectors experienced a contraction, leading to job losses and underemployment. This created a vicious cycle, as reduced income and job insecurity further dampened consumer spending, perpetuating the economic challenges.

In conclusion, 2019 was marked by a confluence of economic issues that reverberated across various sectors. The banking sector grappled with low interest rates, affecting profitability and access to credit. The housing market faced challenges from soaring prices and the threat of a potential correction. Inflation remained stubbornly low, posing difficulties for central banks. Job losses were a direct consequence of these economic headwinds, with a range of industries feeling the impact. These issues were deeply intertwined, exacerbating the economic challenges of the year. Addressing these concerns required a coordinated and multi-faceted approach from policymakers, central banks, and other stakeholders to navigate the complexities of the global economy.

#mikeinthenight #mikemartins

-

3:10:22

3:10:22

Mike Martins Channel

1 year agoMike in the Night E487, MASS SGHOOTING IN GERMAN CHURCH, LynniePoo! hospital Nightmare, There is 2 Genders Get over it already, is it all by Design? Markets Defaulting , Banks Defaulting, Housing Crashing, Supreme Cannon !

3004 -

24:58

24:58

discerntv

11 months ago15 Banks Collapsing All Around Us

11.7K -

![[With Subtitles] Credit Crisis Hits Worst Level Since Great Recession As Millions Of Americans Go Bankrupt](https://hugh.cdn.rumble.cloud/s/s8/1/S/S/n/G/SSnGr.0kob-small-Credit-Crisis-Hits-Worst-Le.jpg) 13:22

13:22

RAVries

2 months ago[With Subtitles] Credit Crisis Hits Worst Level Since Great Recession As Millions Of Americans Go Bankrupt

7056 -

1:24:23

1:24:23

RAVries

6 months agoThe Scary Parallels Between The Great Depression And Today | When the World Breaks

1.31K5 -

3:45

3:45

SRU

1 year agoHome Sales Plummet 20.2%, The “Housing Recession” Is Here, With No Positives, Many Will Never Own...

65 -

14:55

14:55

HousingBubble2withRandyPatrick

1 year agoThe Decline in Housing Affordability - Worse Than 2005: Housing Bubble 2.0 - US Housing Crash

19 -

1:09

1:09

The Last Capitalist in Chicago

1 year ago $0.05 earnedWhat will happen if interest rates fall below 3% or 4%?

151 -

13:36

13:36

HousingBubble2withRandyPatrick

1 year agoHousing Bubble 2.0 - Major Home Price Declines Predicted - 15% to 30% - US Housing Crash

128 -

1:27:36

1:27:36

Peak Prosperity

5 months agoIs Recession on the Way?

3.37K3 -

10:20

10:20

Beyond The Told

4 months agoThe Looming Economic Shifts of 2024

19