Premium Only Content

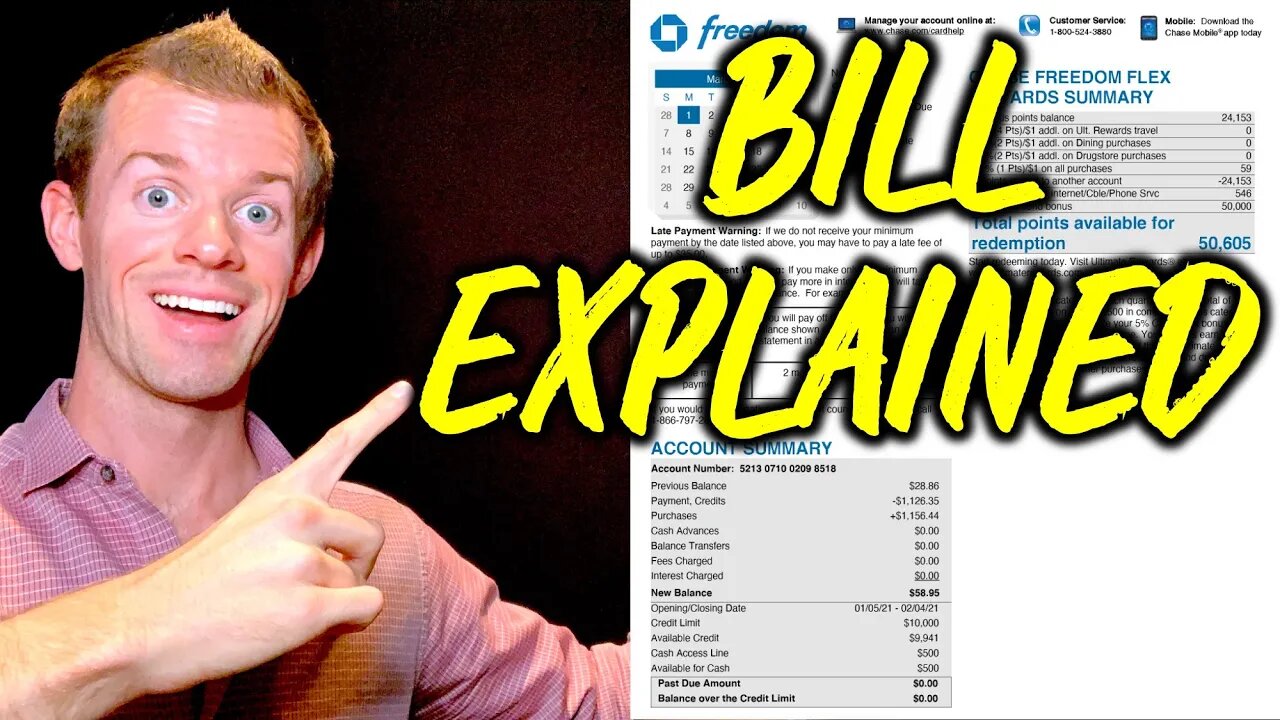

CREDIT CARDS 101: Credit Card Statement Explained

Learn how to understand your credit card bill! Includes when to pay credit card bill to avoid interest, credit cards basics like billing cycles & due dates, credit card APR explained, and more! Click “Show More” to see Ad Disclosure.

📲 MAXREWARDS - Manage credit cards & rewards!

Get Gold level for free with PROMO CODE = markr

http://markscreditcards.com/maxrewards

💳👉VIEW CREDIT CARD OFFERS!

http://markscreditcards.com/offers

🛍 RAKUTEN - Earn Cash Back!

http://markscreditcards.com/rakuten

‼️ GET FREE STOCKS FROM WEBULL when you open an account & deposit $100:

http://markscreditcards.com/webull

CREDIT CARD STATEMENT: TERMS TO KNOW

1. STATEMENT: Your monthly bill, which shows how much you spent, when payment is due, interest, fees, and more.

2. BILLING CYCLE: A period of time, usually lasting 28-31 days, during which your recent charges are arranged into a statement (i.e. your bill). It’s simply bank’s way of grouping your purchases together so you can see them all in 1 place and make 1 payment to pay them off (or multiple payments over time, with interest). It consists of an Opening Date & Closing Date and can be different for every card.

3. OPENING DATE: The first day of your billing cycle.

4. CLOSING DATE: The last day of your billing cycle. With most banks, your card balance on the Close Date is what gets reported to the bureaus to calculate your utilization (known exceptions incl. U.S. Bank).

5. PREVIOUS BALANCE: The balance from your previous statement.

6. PAYMENTS, CREDITS: Payments you’ve made & credits received since your previous statement.

7. PURCHASES: Total amount of all purchases made during the statement billing cycle.

8. CASH ADVANCES: A short-term cash loan taken from your credit card. Fees & interest are charged, and the loan must be paid back.

9. BALANCE TRANSFERS: Balances that you transferred to your card from another account.

10. FEES CHARGED: Fees incurred during the statement billing cycle. May include: annual fees, late payment fees, foreign transaction fees, cash advance fees, overlimit fees, etc.

11. INTEREST CHARGED: Interest charged from previous statement balances that were not paid off in full by the due date.

12. NEW BALANCE: The amount due from your current statement. This is the amount you want to pay in full by the due date to get an on-time payment & avoid interest charges.

13. CREDIT LIMIT: The maximum amount you can spend on the card.

14. AVAILABLE CREDIT: The remaining amount of your credit limit that is available for purchases at any point in time. It can change daily and is calculated like this:

Credit Limit – Current Balance = Available Credit

15. CASH ACCESS LINE: The maximum amount of cash you can access from your credit card via a Cash Advance.

16. AVAILABLE FOR CASH: The remaining amount of your Cash Access line that is available for Cash Advances.

17. PAST DUE AMOUNT: The amount from your previous statement(s) that was not paid off in full by the due date.

18. BALANCE OVER THE CREDIT LIMIT: The total amount you spent above your credit limit. Some banks may allow you to spend beyond your credit limit, but may charge fees and/or deny certain transactions.

19. MINIMUM PAYMENT DUE: The smallest amount you can pay to get an on-time payment and avoid fees. However, interest will be charged on the portion that you don’t pay by the Payment Due Date.

20. PAYMENT DUE DATE: The final day you can submit a payment for it to be considered on time and avoid penalties. Only the Minimum Payment is required, but in order to avoid interest charges, you need to pay off your full statement balance (i.e. “New Balance”). The 25 days between the Opening & Closing dates is called the Grace Period. You can pay your bill on any of those days for it to be considered on time, and you’ll avoid interest charges, too.

21. PAYMENTS AND OTHER CREDITS: The payments you made and credits received during the billing cycle.

22. PURCHASES: The purchases you made during the billing cycle.

23. INTEREST CHARGES: How much interest was charged due to:

- Purchases made in previous billing cycles that were not paid off in full by due date.

- Cash Advances that were performed.

- Balance Transfers that were performed.

24. APR: Represents the cost of borrowing on a credit card. It stands for Annual Percentage Rate and is the rate of interest you’ll pay on unpaid balances over the course of a year.

Disclosure: This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. Mark Reese is not a financial advisor.

#creditcards101 #creditcardsexplained #creditcardsforbeginners

-

21:30

21:30

Mark Reese // Credit & Finance

10 months agoThese 9 Mistakes Will Make You HATE Amex (A Warning to Everyone)

53 -

1:02:24

1:02:24

Sean Unpaved

2 hours agoGridiron to Diamond: Rookie QBs, Madden 99s, Salary Caps & NIL's Ripple Effect

18.4K -

25:24

25:24

Scary Mysteries

6 hours agoSTRANGE & SCARY Mysteries of The Month - July 2025

3.44K -

1:02:02

1:02:02

Timcast

3 hours agoTrump BULLIES Europe Into MONSTER Trade Deal, Europe COPING Over Trump MASTERCLASS

134K75 -

2:07:13

2:07:13

Steven Crowder

5 hours ago🔴Game Over: Trump's EU Trade Victory Shows How Stupid "Experts" Really Are

366K193 -

20:03

20:03

Neil McCoy-Ward

2 hours agoTHE UK 🇬🇧 JUST ENDED 140 YEARS OF FREE SPEECH! (How Did It Come To THIS?!)

13.2K10 -

1:56:26

1:56:26

The Charlie Kirk Show

3 hours agoTHE CHARLIE KIRK SHOW IS LIVE 07.28.25

63.1K16 -

5:39:28

5:39:28

JuicyJohns

6 hours ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢 !loadout

69.7K1 -

52:11

52:11

Anthony Pompliano

3 hours agoWhy Bitcoin Will EXPLODE During The AI Era

21.2K4 -

1:06:00

1:06:00

The Rubin Report

4 hours agoMajor Company’s Must-See Ad May Be the Official Death of Woke

47.7K69