Premium Only Content

biden-mccarthy-debt-talks-politicians-react-to-scott-2024-more-america-decides

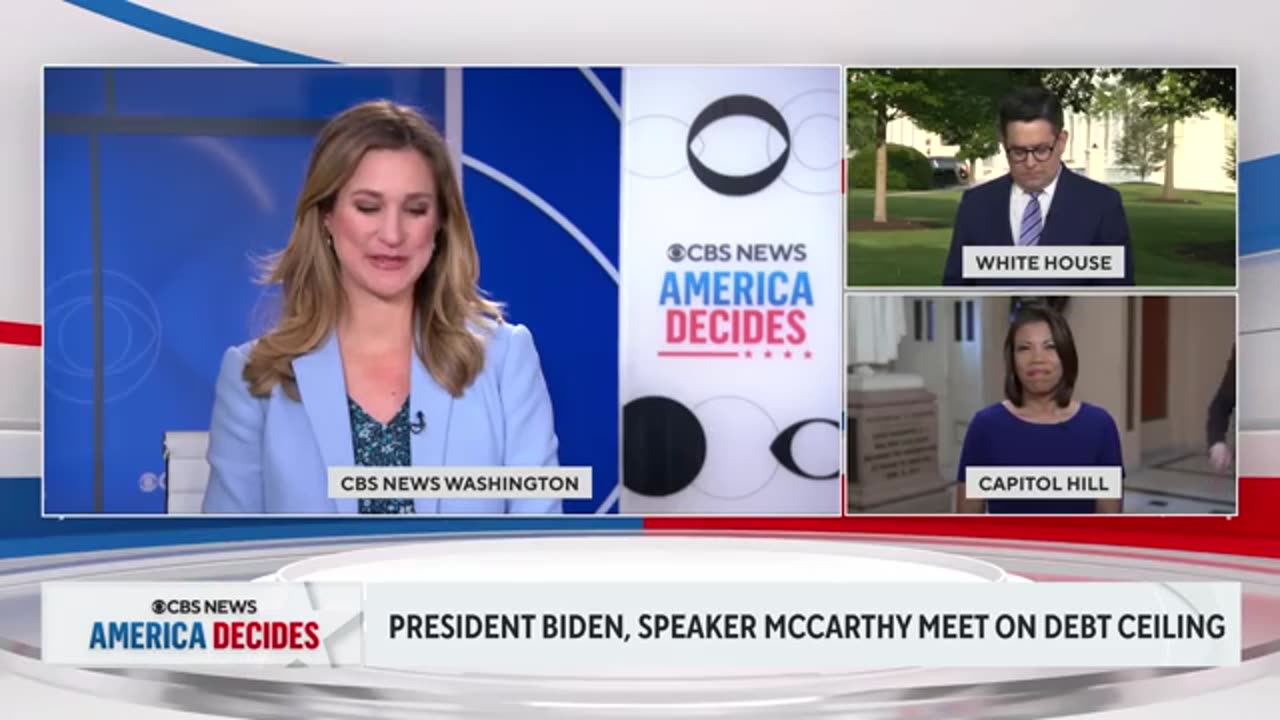

President Biden and Speaker Kevin McCarthy expressed optimism on Monday that they could break the partisan stalemate that has prevented action to avert a default on the nation’s debt, but remained far apart on a deal to raise the debt limit as Democrats resisted Republicans’ demands for spending cuts in exchange.

The two met face to face at the White House for the second time in two weeks in a show of good will after a weekend of behind-the-scenes clashes among negotiators, punctuated by a move by Republicans on Friday to halt the talks and accusations by both sides that the other was being unreasonable.

With Mr. Biden back from a summit meeting in Japan, the tenor appeared to have changed considerably.

“We don’t have an agreement yet,” Mr. McCarthy told reporters at the White House after the meeting. “But I did feel like the discussion was productive,” he said, adding later that he believed the tone of the talks was “better than any other time we’ve had discussions.”

“I believe we can still get there,” Mr. McCarthy said. “I believe we can get it done.”

He said he expected to speak with Mr. Biden daily until a deal could be struck.

With a default looming as soon as June 1, both Mr. Biden and Mr. McCarthy began their latest meeting sounding upbeat about finding common ground in an effort to avoid economic catastrophe and left dispatching their top advisers to hammer out an agreement in the coming days.

“We still have some disagreements, but I think we may be able to get where we have to go,” Mr. Biden said as the two sat down in the Oval Office. “We both know we have a significant responsibility.”

Mr. Biden said in a brief statement after the meeting that the talks were “productive.”

“We reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement,” he added, saying that he and his negotiating team would continue talking with Mr. McCarthy and his.

Still, the two sides remained at loggerheads. The White House has called Republicans’ demands for spending cuts extreme, while Mr. McCarthy and his aides have accused White House officials of being unreasonable.

The number of legislative days for Congress to vote to raise the debt ceiling before the projected deadline is rapidly dwindling. Treasury Secretary Janet L. Yellen on Monday reiterated her warning to Congress that the United States could exceed its authority to borrow to pay its bills as soon as June 1. She said in an interview with NBC’s “Meet the Press” over the weekend that the odds of the government being able to hold out until mid-June — when a substantial amount of quarterly tax revenue is expected to roll in, giving the Treasury more breathing room to cover its obligations — were “quite low.”

And Republicans hinted that no deal was likely to materialize until a default was truly imminent. When asked on Monday evening what it would take to break the deadlock, Mr. McCarthy replied simply: “June 1.”

Chief among the outstanding issues is how much to spend overall next fiscal year on discretionary programs and how long any spending caps should be in place. Republicans want to allow military spending to increase while cutting other programs. But they have shown some flexibility around how long they would seek to cap spending overall, coming down from their initial demand of a decade to six years.

That is longer than Mr. Biden wants. White House officials have proposed holding both military and other spending — which includes education, scientific research and environmental protection — constant over the next two years.

“These are tough issues,” said Representative Patrick T. McHenry, Republican of North Carolina and a key ally of Mr. McCarthy who has been involved in the talks and attended the White House meeting. “A directive to cut spending year over year is the toughest thing to do in Washington, D.C. But that is the speaker’s directive to his negotiating team. It is our expectation to be able to get that.”

Hard-right members of Mr. McCarthy’s conference have continued to pressure the speaker not to accept anything less than the spending cuts that House Republicans passed in their debt limit bill last month, which would have amounted to a reduction of an average of 18 percent over a decade.

“Republicans must #HoldTheLine on the debt ceiling to bring spending back to reality and restore fiscal sanity in DC,” the House Freedom Caucus wrote on Twitter. “We spend $100+ billion more than federal tax revenues EVERY MONTH. Washington has a spending problem, not a revenue problem.”

Mr. McCarthy expressed confidence that he could keep his conference largely united around whatever deal he strikes with Mr. Biden, telling reporters at the Capitol before the meeting that he believed it would draw the support of both Democrats and Republicans.

“I firmly believe what we’re negotiating right now, a majority of Republicans will see that it is a right place to put us on a right path,” he said.

But he also hinted that members of his conference should prepare to accept a final product that falls short of what some lawmakers have demanded.

“I don’t want you to think at the end of the day, the bill that we come up with is going to solve all this problem,” he said. “But it’s going to be a step to finally acknowledge our problem and put one step in the right direction. And we’re going to come back the next day and get the next step.”

Once negotiators agree to a deal, it will take time to translate it into legislative text. Mr. McCarthy has promised that he will give lawmakers 72 hours to review the bill, and said on Monday that he believed negotiators would need to agree to a compromise this week in order to pass legislation raising the debt ceiling before the projected June 1 deadline.

Lawmakers in the House were still left uncertain about when they would need to be present to cast a vote to avert a default. The House, as of Monday evening, was set to depart Washington beginning on Thursday afternoon ahead of the Memorial Day weekend.

The two sides have found some agreement in talks in the past week, including on clawing back some unspent funds from previously approved Covid-19 relief legislation.

Senior administration officials said Project NextGen, the Biden administration’s $5 billion Covid vaccine development program, could be among the casualties of those cuts. The program, modeled in part on the Trump administration’s Operation Warp Speed, is an effort to find different forms of vaccines that scientists believe will offer more durable protection against the coronavirus.

But many other issues have yet to be resolved, including tightening work requirements for able-bodied adults without dependents for certain safety social net programs. The bill passed by House Republicans contained stricter requirements for recipients of Temporary Assistance for Needy Families and food stamps, and is a key demand of conservatives in the House.

Mr. McCarthy said on Monday that he would continue to push for their inclusion in whatever deal he strikes with Mr. Biden, and White House negotiators have shown openness to finding some compromise on the issue.

Carl Hulse contributed reporting.

Show more

Jim Tankersley

May 31, 2023, 6:38 p.m. ETMay 31, 2023

May 31, 2023, 6:38 p.m. ET

Jim Tankersley

Some key parts of the debt-limit deal don’t appear in its text.

Image

Negotiators for Speaker Kevin McCarthy and President Biden agreed to deals that do not appear in the legislative text of the bill suspending the debt limit.

Negotiators for Speaker Kevin McCarthy and President Biden agreed to deals that do not appear in the legislative text of the bill suspending the debt limit.Credit...Doug Mills/The New York Times

The reason the House is voting on the debt-ceiling agreement between President Biden and Speaker Kevin McCarthy on Wednesday, as opposed to earlier in the week, is that Mr. McCarthy is holding to a pledge to allow representatives 72 hours to read the text of a bill before voting on it.

But interestingly enough, some of the agreement’s most important provisions aren’t found anywhere in the 99-page bill.

In brokering an agreement to raise the debt limit and curb some federal spending growth, negotiators for Mr. Biden and Mr. McCarthy cut a series of side deals. Those deals will effectively allow Republicans to claim they are making deep cuts to certain spending categories while allowing Democrats to mitigate the pain of those cuts in actual appropriations bills.

They also contain one of the biggest political wins for Mr. McCarthy in negotiations: a $20 billion cut over two years to the enforcement budget at the I.R.S., which Mr. Biden beefed up.

Neither the White House nor House Republicans have published a full accounting of the agreements that do not appear in legislative text. But private conversations with administration officials, coupled with fact sheets circulated by both sides to their allies, help round out the picture. The side deals include:

Allowing appropriators to repurpose $10 billion a year in 2024 and 2025 from the I.R.S. That money was supposed to pay for a crackdown on companies and high earners who evade taxes. Administration officials have suggested the crackdown will not be affected — for now — because the I.R.S. will effectively take the repurposed money out of a pot designated for enforcement later on this decade.

Steering another $11 billion per year from unspent funds from a previous Covid relief bill to other programs.

Designating $23 billion a year in nondefense discretionary spending as “emergency” spending, which basically exempts it from the caps in the deal, and tacking on another $10 billion outside the caps through spending that is not considered “discretionary.”

In all, that adds up to an additional $54 billion in discretionary spending for each of the two years under the caps. In other words, the side deals allowed Democrats to support another $108 billion in spending above and beyond the cap levels, in a way Republicans are basically ignoring when they talk about the spending cuts in the deal.

Show more

ADVERTISEMENT

SKIP ADVERTISEMENT

Carl Hulse

May 22, 2023, 8:11 p.m. ETMay 22, 2023

May 22, 2023, 8:11 p.m. ET

Carl HulseChief Washington correspondent

Asked what it will take to break the negotiating deadlock, McCarthy said, “I think June 1,” meaning the deadline for a default. A default may have to be imminent for a deal to be struck.

Image

Credit...Kenny Holston/The New York Times

Katie Rogers

May 22, 2023, 8:05 p.m. ETMay 22, 2023

May 22, 2023, 8:05 p.m. ET

Katie RogersWhite House correspondent

Biden has released a statement on the “productive” meeting with McCarthy: “We reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement. While there are areas of disagreement, the Speaker and I, and his lead negotiators Chairman McHenry and Congressman Graves, and our staffs will continue to discuss the path forward.”

Catie Edmondson

May 22, 2023, 7:56 p.m. ETMay 22, 2023

May 22, 2023, 7:56 p.m. ET

Catie EdmondsonCongressional correspondent

McCarthy reiterates a key idea he alluded to at the White House: His members should not expect this final compromise bill to be a panacea. “We will continue to work on the parts that we can’t come to an agreement on” even after negotiations are done,” he said.

Carl Hulse

May 22, 2023, 7:54 p.m. ETMay 22, 2023

May 22, 2023, 7:54 p.m. ET

Carl HulseChief Washington correspondent

McCarthy rules out immigration provisions as part of any deal. A blow to conservatives.

ADVERTISEMENT

SKIP ADVERTISEMENT

Catie Edmondson

May 22, 2023, 7:51 p.m. ETMay 22, 2023

May 22, 2023, 7:51 p.m. ET

Catie EdmondsonCongressional correspondent

“We’re interested in closing this thing out,” said Representative Patrick T. McHenry of North Carolina. “We’ve been circling on the same number of things we’ve been circling on” since Wednesday.

Katie Rogers

May 22, 2023, 7:51 p.m. ETMay 22, 2023

May 22, 2023, 7:51 p.m. ET

Katie RogersWhite House correspondent

The president will not give remarks tonight, according to an administration official.

Carl Hulse

May 22, 2023, 7:51 p.m. ETMay 22, 2023

May 22, 2023, 7:51 p.m. ET

Carl HulseChief Washington correspondent

McCarthy cites an old Congressional negotiating adage. Nothing is agreed to until everything is agreed to.

Catie Edmondson

May 22, 2023, 7:47 p.m. ETMay 22, 2023

May 22, 2023, 7:47 p.m. ET

Catie EdmondsonCongressional correspondent

McCarthy says he will “never” put a clean debt ceiling increase on the House floor, saying it is time for lawmakers to “change the direction” of federal spending.

ADVERTISEMENT

SKIP ADVERTISEMENT

Katie Rogers

May 22, 2023, 7:25 p.m. ETMay 22, 2023

May 22, 2023, 7:25 p.m. ET

Katie RogersWhite House correspondent

For what it’s worth, White House officials involved in the negotiations said earlier today that they expected an outcome like this: an acknowledgment that the clock is ticking, but without much in the way of a breakthrough except a promise for more communication.

Catie Edmondson

May 22, 2023, 7:23 p.m. ETMay 22, 2023

May 22, 2023, 7:23 p.m. ET

Catie EdmondsonCongressional correspondent

Representative Patrick McHenry of North Carolina, a key McCarthy ally who attended the meeting, cautioned that it would not be easy to resolve the central issue of spending caps. “A directive to cut spending year over year is the toughest thing to do in Washington, but that is the speaker’s directive to his negotiating team,” McHenry said.

Image

Credit...Doug Mills/The New York Times

Katie Rogers

May 22, 2023, 7:16 p.m. ETMay 22, 2023

May 22, 2023, 7:16 p.m. ET

Katie RogersWhite House correspondent

McCarthy also adds that he is against a short-term debt-ceiling increase.

Carl Hulse

May 22, 2023, 7:16 p.m. ETMay 22, 2023

May 22, 2023, 7:16 p.m. ET

Carl HulseChief Washington correspondent

McCarthy says he and Biden will talk every day until they reach a deal.

ADVERTISEMENT

SKIP ADVERTISEMENT

Katie Rogers

May 22, 2023, 7:15 p.m. ETMay 22, 2023

May 22, 2023, 7:15 p.m. ET

Katie RogersWhite House correspondent

“We both agree we want to be able to come to an agreement,” McCarthy said. So far, I’m not hearing substantial areas of movement beyond an expressed desire not to go into default.

Image

Credit...Doug Mills/The New York Times

Katie Rogers

May 22, 2023, 7:13 p.m. ETMay 22, 2023

May 22, 2023, 7:13 p.m. ET

Katie RogersWhite House correspondent

McCarthy also reiterates the obvious: House Republicans will not agree to raise taxes as a way to reduce the deficit, as Biden has proposed.

Carl Hulse

May 22, 2023, 7:13 p.m. ETMay 22, 2023

May 22, 2023, 7:13 p.m. ET

Carl HulseChief Washington correspondent

McCarthy says no Pentagon cuts. That complicates the picture since it means any cuts will have to come from a smaller portion of the federal budget -- areas that include education, environmental protection and other federal programs.

Katie Rogers

May 22, 2023, 7:11 p.m. ETMay 22, 2023

May 22, 2023, 7:11 p.m. ET

Katie RogersWhite House correspondent

McCarthy and his chief negotiator, Rep. Patrick McHenry of North Carolina, both point to the spending bill House Republicans passed recently as a viable negotiation option. This bill, of course, is a non-starter.

ADVERTISEMENT

SKIP ADVERTISEMENT

Katie Rogers

May 22, 2023, 7:11 p.m. ETMay 22, 2023

May 22, 2023, 7:11 p.m. ET

Katie RogersWhite House correspondent

“I believe we can get it done,” McCarthy adds but again returns to his well-worn grievance that the president did not invite him to the White House for months as the debt-limit issue loomed.

Katie Rogers

May 22, 2023, 7:10 p.m. ETMay 22, 2023

May 22, 2023, 7:10 p.m. ET

Katie RogersWhite House correspondent

A week or so before the United States is scheduled to go into default for the first time in history, McCarthy said that he “does not like the idea that you are governed by chaos. You are governed by a deadline.”

Katie Rogers

May 22, 2023, 7:05 p.m. ETMay 22, 2023

May 22, 2023, 7:05 p.m. ET

Katie RogersWhite House correspondent

But the top line is that there is no agreement tonight.

Carl Hulse

May 22, 2023, 7:05 p.m. ETMay 22, 2023

May 22, 2023, 7:05 p.m. ET

Carl HulseChief Washington correspondent

McCarthy says tone was best of any of previous meeting upon exiting the White House.

ADVERTISEMENT

SKIP ADVERTISEMENT

Katie Rogers

May 22, 2023, 7:05 p.m. ETMay 22, 2023

May 22, 2023, 7:05 p.m. ET

Katie RogersWhite House correspondent

Outside of the White House, McCarthy said that he and the president had a “productive” meeting and it was the best one they have had since their debt ceiling talks began.

Katie Rogers

May 22, 2023, 7:00 p.m. ETMay 22, 2023

May 22, 2023, 7:00 p.m. ET

Katie RogersWhite House correspondent

The meeting between Biden and McCarthy has ended. The speaker will be heading out to talk to reporters shortly, according to the White House.

Carl Hulse

May 22, 2023, 6:50 p.m. ETMay 22, 2023

May 22, 2023, 6:50 p.m. ET

Carl HulseChief Washington correspondent

McCarthy and his lieutenants will have some tricky scheduling decisions to make if no deal materializes in the coming days. The House is scheduled to leave Friday for a Memorial Day recess and Republicans will have to contend with the optics of lawmakers heading out of town with no deal a week from a default. However, holding them here with nothing to vote on could aggravate them to no end and threaten any eventual deal.

Katie Rogers

May 22, 2023, 6:24 p.m. ETMay 22, 2023

May 22, 2023, 6:24 p.m. ET

Katie RogersWhite House correspondent

McCarthy said that he and the president had a “very productive” discussion while Biden was traveling back from Japan on Sunday. “At the end of the day, we can find common ground, make our economy stronger, take care of this debt, but more importantly get this government moving again to curb inflation, make us less dependent upon China, make our appropriations system work, when we get done.”

ADVERTISEMENT

SKIP ADVERTISEMENT

Katie Rogers

May 22, 2023, 6:10 p.m. ETMay 22, 2023

May 22, 2023, 6:10 p.m. ET

Katie RogersWhite House correspondent

Biden adds that, despite disagreements, he is optimistic that both sides can “get where we have to go” and hash out a deal.

Katie Rogers

May 22, 2023, 6:10 p.m. ETMay 22, 2023

May 22, 2023, 6:10 p.m. ET

Katie RogersWhite House correspondent

In the Oval Office, Biden warns that, if the United States defaults on its debt, “the American people would have a real kick in their economic well-being. As a matter of fact, the rest of the world would, too.” He says he and McCarthy both believe that the deficit should be reduced. “We need to cut spending.”

Video

Video player loading

Alan Rappeport

May 22, 2023, 5:59 p.m. ETMay 22, 2023

May 22, 2023, 5:59 p.m. ET

Alan RappeportEconomic policy correspondent

President Biden and Speaker McCarthy have started their meeting at the White House.

Video

Video player loading

CreditCredit...Doug Mills/The New York Times

Catie Edmondson

May 22, 2023, 5:26 p.m. ETMay 22, 2023

May 22, 2023, 5:26 p.m. ET

Catie EdmondsonCongressional correspondent

Speaker McCarthy has left the Capitol and is en route to the White House to meet with President Biden.

Image

Credit...Kenny Holston/The New York Times

ADVERTISEMENT

SKIP ADVERTISEMENT

Alan Rappeport

May 22, 2023, 5:13 p.m. ETMay 22, 2023

May 22, 2023, 5:13 p.m. ET

Alan RappeportEconomic policy correspondent

Goldman Sachs analysts are noting that Treasury Secretary Janet Yellen sounds more confident that the Treasury will hit the X-date in early June, pointing to the fact that she now describes this as “highly likely” rather than “likely” in her prior letter. “There is also no mention of the possibility that the Treasury might not exhaust funds until ‘a number of days or weeks later’ than early June, which had been included in the prior letters,” the analysts note.

Alan Rappeport

May 22, 2023, 4:53 p.m. ETMay 22, 2023

May 22, 2023, 4:53 p.m. ET

Alan RappeportEconomic policy correspondent

When will the U.S. run out of cash? The answer is complicated.

Image

A woman with white hair standing behind a lectern while three men to her right look on.

Treasury Secretary Janet L. Yellen warned Congress and business leaders that the Treasury Department could deplete its cash reserves by June 1.Credit...Shuran Huang for The New York Times

In letters to Congress and warnings to business leaders about the catastrophic consequences if the United States defaults on its debt, Treasury Secretary Janet L. Yellen has repeatedly offered an important caveat.

She cannot give the exact date when the federal government will run out of cash.

The United States reached its statutory $31.4 trillion debt limit on Jan. 19, forcing the Treasury Department — which borrows huge sums of money to pay the nation’s bills — to begin using accounting maneuvers known as extraordinary measures to conserve cash and avoid breaching the cap.

On Sunday, Ms. Yellen reiterated warnings that the Treasury Department could deplete its cash reserves by June 1. Still, the exact day when the United States will reach the so-called X-date is nearly impossible to determine.

While Treasury has the most sophisticated cash management system in the world and employs teams of highly trained economists, its coffers are a blur of payments going out and tax revenues coming in.

When its cash balance runs painfully low — as was the case on Wednesday, when the Treasury General Account started the day with less than $100 billion — pinpointing the X-date becomes even harder to predict. In many respects, that is because the moment that a default would occur is a moving target.

Show more

Carl Hulse

May 22, 2023, 4:29 p.m. ETMay 22, 2023

May 22, 2023, 4:29 p.m. ET

Carl HulseChief Washington correspondent

Speaker McCarthy says he will brief reporters on the talks with President Biden upon returning to the Capitol after the White House meeting.

ADVERTISEMENT

SKIP ADVERTISEMENT

Alan Rappeport

May 22, 2023, 4:23 p.m. ETMay 22, 2023

May 22, 2023, 4:23 p.m. ET

Alan RappeportEconomic policy correspondent

Yellen warns again that the U.S. could default as soon as June 1.

Image

Janet Yellen speaks from behind a lectern with her hand raised and while wearing a dark suit with American flags in the background.

Treasury Secretary Janet L. Yellen said that a failure to raise the debt limit would force the government to confront difficult choices about how to meet the nation’s financial obligations.Credit...Yuri Gripas for The New York Times

Treasury Secretary Janet L. Yellen reiterated on Monday that the United States could be unable to pay its bills as soon as June 1, an announcement that maintains pressure on the White House and congressional leaders as they negotiate how to raise the nation’s debt limit.

The warning to Congress comes as President Biden and Speaker Kevin McCarthy are set to meet on Monday afternoon at the White House to try and resolve the impasse. Representatives for Mr. Biden and Mr. McCarthy have been engaged in talks over the past week to devise a plan that would cap federal spending and reduce the deficit while raising the $31.4 trillion borrowing cap.

Ms. Yellen warned that the nation’s finances remain in a precarious state, saying that it was “highly likely” the United States would run out of cash by early June, rather than her previous letters, which called that time-frame “likely.”

“With an additional week of information now available, I am writing to note that we estimate that it is highly likely that Treasury will no longer be able to satisfy all of the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1,” Ms. Yellen wrote.

In her previous letter, issued a week ago, Ms. Yellen offered the caveat that her estimates could be off because of the unpredictability of incoming government tax revenue. She said that the actual date that Treasury will exhaust the so-called extraordinary measures that she is using to delay a default “could be a number of days or weeks later.”

On Monday, Ms. Yellen did not suggest that there might be more time and she warned that failing to lift the debt limit would be disastrous for the economy.

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests,” Ms. Yellen said.

The nation’s cash balance has been running perilously low. On Sunday, Ms. Yellen dismissed hopes that the so-called extraordinary measures that she has been using to delay a default would be sufficient to maintain normal government operations beyond mid-June.

Republicans have refused to raise the debt limit without spending cuts, forcing Democrats to the negotiating table to avoid a default that could cause a recession and financial crisis. The two sides remain far apart on key issues, including on caps for federal spending, new work requirements for some recipients of federal antipoverty assistance and funding meant to help the Internal Revenue Service crack down on tax evasion by high earners and corporations.

The Treasury secretary said over the weekend that a failure to raise the debt limit would force the government to confront difficult choices about how to meet the nation’s financial obligations. Benefits payments to retirees and veterans are likely to be disrupted, and the uncertainty could cause interest rates to surge and stock prices to plunge.

The Biden administration has downplayed the idea that it could essentially ignore the debt limit and continue borrowing by invoking the 14th Amendment, which says that the validity of U.S. debt shall not be questioned. Although the administration’s lawyers have studied the idea, officials believe that the expected legal challenges and uncertainty would destabilize markets.

“There can be no acceptable outcomes if the debt ceiling isn’t raised,” Ms. Yellen said on “Meet the Press” on NBC.

Show more

Joe Rennison

May 22, 2023, 4:20 p.m. ETMay 22, 2023

May 22, 2023, 4:20 p.m. ET

Joe RennisonFinancial markets and trading correspondent

The S&P 500 gave up its earlier gains in the final hour of trading, slipping 0.3 percent to close level with where it started the day. Investors’ nervousness was also evident in the market for U.S. government debt, with the yield on 4-week Treasury “bills” rising markedly. That yield, which shows the rising cost of borrowing for the government in the short term, has risen 1.4 percentage points since the start of the month, to around 5.5 percent.

S&P 500

4,337.44

0.4

Dow

34,006.88

0.13

Nasdaq

13,271.32

0.45

As of 5:16 p.m. Eastern time Data delayed at least 15 minutes Source: FactSet

Carl Hulse

May 22, 2023, 4:11 p.m. ETMay 22, 2023

May 22, 2023, 4:11 p.m. ET

Carl HulseChief Washington correspondent

With the Senate off on a pre-Memorial Day recess, only the House is in session this week. Senators could be called back to vote on 24 hours notice, if there was a deal to consider. But that does not seem at all likely at this point.

Image

Credit...Kenny Holston/The New York Times

ADVERTISEMENT

SKIP ADVERTISEMENT

Alan Rappeport

May 22, 2023, 4:08 p.m. ETMay 22, 2023

May 22, 2023, 4:08 p.m. ET

Alan RappeportEconomic policy correspondent

Wall Street analysts remain relatively unfazed. In its most recent note to clients, Goldman Sachs economists predicted with 70 percent confidence that a deal to extend the debt limit to early 2025 along with spending caps would be reached, likely this week or soon before June 1. Capital Alpha Partners predicted with 60 percent odds that a deal could be struck as soon as today.

Carl Hulse

May 22, 2023, 4:00 p.m. ETMay 22, 2023

May 22, 2023, 4:00 p.m. ET

Carl HulseChief Washington correspondent

Flashing a broad smile, Kevin McCarthy today told reporters on Capitol Hill that he didn’t think the government would default — because if it was imminent the Senate could simply pass the House Republican bill. But since there is little chance of that happening, his idea was not really a solution.

Image

Credit...Kenny Holston/The New York Times

Katie Rogers

May 22, 2023, 3:59 p.m. ETMay 22, 2023

May 22, 2023, 3:59 p.m. ET

Katie RogersWhite House correspondent

The Republican-led pause on Friday surprised White House officials who have been working to hash out a deal, several officials told me today. This has led to greater confusion, they said, about what McCarthy ultimately wants out of these talks. Today’s meeting is meant to provide clarity, but the two sides are still very far apart.

Katie Rogers

May 22, 2023, 3:59 p.m. ETMay 22, 2023

May 22, 2023, 3:59 p.m. ET

Katie RogersWhite House correspondent

It is true that Democrats have pushed the White House to use the 14th Amendment, but people on the president’s team see it as a drastic move that may have damaging repercussions for the global economy, even if the president has the constitutional authority to pull that lever.

Katie Rogers

May 22, 2023, 3:57 p.m. ETMay 22, 2023

May 22, 2023, 3:57 p.m. ET

Katie RogersWhite House correspondent

The president spoke publicly after the last meeting with McCarthy and may do so again tonight, according to people familiar with the schedule, but nothing has been finalized.

ADVERTISEMENT

SKIP ADVERTISEMENT

Alan Rappeport

Catie Edmondson

May 22, 2023, 3:51 p.m. ETMay 22, 2023

May 22, 2023, 3:51 p.m. ET

Alan Rappeport and Catie Edmondson

A potential solution evokes old budget fights: Spending caps.

Image

President Biden and House Republican leaders seemed likely to use spending caps as a potential path forward in the debt limit negotiations.

President Biden and House Republican leaders seemed likely to use spending caps as a potential path forward in the debt limit negotiations.Credit...Tom Brenner for The New York Times

As negotiators for the White House and House Republican leaders struggle to reach a deal over how to raise the nation’s debt limit, a solution that harks back to old budget fights has re-emerged as a potential path forward: spending caps.

Putting limits on future spending in exchange for raising the $31.4 trillion borrowing cap could be the key to clinching an agreement that would allow Republicans to claim that they secured major concessions from Democrats. It could also allow President Biden to argue that his administration is being fiscally responsible while not caving to Republican demands to roll back any of his primary legislative achievements.

The Biden administration and House Republican leaders have agreed in broad terms to some sort of cap on discretionary federal spending for at least the next two years.

But they are hung up on the details of those caps, including how much to spend on discretionary programs in the 2024 fiscal year and beyond, and how to divide that spending among the government’s many financial obligations, including the military, veterans affairs, education, health and agriculture. Although caps that limit spending around current levels will help slow the growth of the nation’s debt, they will not cure the government’s reliance on borrowed money.

The Congressional Budget Office said this month that annual deficits — the gap between what America spends and what it earns — are projected to nearly double over the next decade, totaling more than $20 trillion through 2033. That deficit will force the United States to continue to rely heavily on borrowed funds.

Show more

Madeleine Ngo

May 22, 2023, 3:49 p.m. ETMay 22, 2023

May 22, 2023, 3:49 p.m. ET

Madeleine NgoEconomic policy correspondent

As negotiations continue, some Democrats have raised the possibility of invoking the 14th Amendment, which would effectively challenge the constitutionality of the nation’s debt limit. Under the theory, the government would be required to continue issuing new debt, even if Congress fails to raise the borrowing cap before the country runs out of cash to pay all of its bills.

Image

Credit...Kenny Holston/The New York Times

Madeleine Ngo

May 22, 2023, 3:53 p.m. ETMay 22, 2023

May 22, 2023, 3:53 p.m. ET

Madeleine NgoEconomic policy correspondent

But it is unclear if the White House would carry out such a move. Republicans would likely mount legal challenges, and it could lead to a surge in short-term borrowing costs if investors demanded a premium to buy debt that could be invalidated by a court.

Madeleine Ngo

May 22, 2023, 3:54 p.m. ETMay 22, 2023

May 22, 2023, 3:54 p.m. ET

Madeleine NgoEconomic policy correspondent

President Biden has said he believes he could invoke the 14th Amendment, but he was uncertain if such a challenge could succeed in time to avoid a default. “I think we have the authority,” Mr. Biden said on Sunday. “The question is could it be done and invoked in time.”

Joe Rennison

May 22, 2023, 3:48 p.m. ETMay 22, 2023

May 22, 2023, 3:48 p.m. ET

Joe RennisonFinancial markets and trading correspondent

With half an hour left of the trading day, the S&P 500 has risen 0.2 percent — a quiet day — with investors largely shrugging off the political posturing ahead of today’s meeting. That comes after stock markets wobbled on Friday when Republicans walked out of negotiations, pointing to the gently rising consternation over the outcome of these talks.

ADVERTISEMENT

SKIP ADVERTISEMENT

Catie Edmondson

May 16, 2023, 3:49 p.m. ETMay 16, 2023

May 16, 2023, 3:49 p.m. ET

Catie Edmondson

Congress is running out of legislative days to act on the debt ceiling.

Image

The ornate Capitol Hill building is pictured under a blue sky with light clouds.

Capitol Hill on Tuesday.Credit...Haiyun Jiang/The New York Times

Congressional leaders negotiating over a deal to raise the debt ceiling and avoid the first default in the nation’s history are working against an unforgiving force: the legislative calendar.

President Biden and Speaker Kevin McCarthy’s meeting on Tuesday afternoon to try to break their impasse over increasing the cap comes just over two weeks before the projected “X-date” of June 1 — the day the Treasury Department has projected it could no longer pay the United States government’s debts.

Even if they are able to reach a deal, Mr. McCarthy and Senator Chuck Schumer, Democrat of New York and the majority leader, would need to navigate legislation reflecting that agreement through their respective chambers — and the days left to do so are rapidly dwindling.

At least for now, the House is scheduled to be in session — present in the Capitol and ready to vote — for only six more days before the end of the month. The Senate is set for just five, and is scheduled to be out of Washington beginning on Monday ahead of the Memorial Day weekend.

House and Senate leaders could cancel lawmakers’ scheduled recesses, scuttling Memorial Day plans and keeping them in Washington to vote on a deal. But Mr. Biden’s schedule is another complication: He’s set to depart for Japan on Wednesday to attend the Group of 7 meeting, and afterward plans to travel to Australia.

All that leaves precious little time for striking a deal, enshrining it in legislation, maneuvering it past procedural hurdles and cobbling together the votes to clear it for Mr. Biden’s signature.

Senators are prepared to cut short their Memorial Day recess and return to Washington if it becomes necessary to approve a deal on the debt limit, Senator John Thune of South Dakota, the second-ranking Republican, told reporters on Tuesday.

“Members are prepared for all kinds of different scenarios right now,” he said, noting that “the stakes get really high” if negotiators cannot strike a deal by this weekend.

Mr. Schumer called a default the “nightmare scenario.”

“We all know these things are fast approaching the closer we get to June 1,” he said. “Congress cannot, under any circumstances, fail its obligation to protect the full faith and credit of the United States.”

Karoun Demirjian contributed reporting.

Show more

Jeanna Smialek

May 16, 2023, 1:50 p.m. ETMay 16, 2023

May 16, 2023, 1:50 p.m. ET

Jeanna Smialek

Here are some untested ways the United States could work around the debt limit.

Image

Bills of money packed tightly into blocks at the Bureau of Engraving and Printing at Fort Worth, Texas.

The government typically funds itself by issuing debt in the form of financial securities called bonds and bills.Credit...Adam Perez for The New York Times

Move over, trillion-dollar coin. There’s a new debt limit workaround in town — and this one sounds more sophisticated, which some of its proponents have suggested could make it more likely to work.

For years, the idea of a trillion-dollar coin has been the most creative proposal to get around the cap on how much the federal government can borrow. Debt limit skeptics argued that the United States could mint a large-denomination coin, deposit it in the government’s account at the Federal Reserve and use the resulting money to pay the country’s bills. The maneuver would exploit a quirk in U.S. law that gives the Treasury secretary wide discretion when it comes to minting platinum coins.

But there have always been challenges with the idea. Treasury has expressed little appetite, it is unclear whether the Fed would take the coin and it just sounds absurd.

Now, some are arguing for a fancier-sounding alternative: premium bonds.

The government typically funds itself by issuing debt in the form of financial securities called bonds and bills. They are worth a set amount after a fixed period of time — for example, $1,000 in 10 years — and they pay “coupons” twice a year in between. Typically, those coupon rates are set near market interest rates.

But in the premium bond idea, the government would renew old, expiring bonds at higher coupon rates. Doing so would not technically add to the nation’s debt — if the government previously had a 10-year bond worth $1,000 outstanding, it would still have a 10-year bond worth $1,000 outstanding. Investors, however, would pay more to hold a bond that pays $7 a year than one that pays $3.50, so promising a higher interest rate would allow Treasury to raise more money.

But even some proponents of premium bonds acknowledge that it could face legal challenges or damage the United States’ reputation in the eyes of investors. Plus, their design and issuance would have to happen fast.

Show more

ADVERTISEMENT

SKIP ADVERTISEMENT

Alan Rappeport

May 16, 2023, 11:40 a.m. ETMay 16, 2023

May 16, 2023, 11:40 a.m. ET

Alan Rappeport

What is the debt limit?

Image

Janet Yellen stands behind a podium in an ornate, gold room, U.S. and other flags behind her.

Treasury Secretary Janet L. Yellen at the Treasury Department in April.Credit...Yuri Gripas for The New York Times

President Biden and Speaker Kevin McCarthy are set to meet again on Monday to discuss lifting the debt ceiling. Which raises a lot of questions, including what the debt limit actually is and why the United States has one.

Here’s everything you need to know about the debt limit.

What is the debt limit?

The debt limit is a cap on the total amount of money that the United States is authorized to borrow to fund the government and meet its financial obligations.

Because the federal government runs budget deficits — meaning it spends more than it brings in through taxes and other revenue — it must borrow huge sums of money to pay its bills. Those obligations include funding for social safety net programs, interest on the national debt and salaries for members of the armed forces.

Approaching the debt ceiling often elicits calls by lawmakers to cut back on government spending. But lifting the debt limit does not actually authorize any new spending — in fact, it simply allows the United States to spend money on programs that have already been authorized by Congress.

When was the debt limit reached?

The United States officially hit its debt limit on Jan. 19, prompting the Treasury Department to use accounting maneuvers known as extraordinary measures to continue paying the government’s obligations and avoid a default. Those measures temporarily curb certain government investments so that the bills can continue to be paid.

Treasury Secretary Janet L. Yellen has warned lawmakers that the United States could run out of cash by June 1 if the borrowing cap isn’t raised or suspended.

How much debt does the United States have?

The national debt crossed $31 trillion for the first time last year. The borrowing cap is set at $31.381 trillion.

Why does the United States have a debt limit?

According to the Constitution, Congress must authorize government borrowing. In the early 20th century, the debt limit was instituted so that the Treasury would not need to ask Congress for permission each time it had to issue debt to pay bills.

During World War I, Congress passed the Second Liberty Bond Act of 1917 to give the Treasury more flexibility to issue debt and manage federal finances. The debt limit started to take its current shape in 1939, when Congress consolidated different limits that had been set on different types of bonds into a single borrowing cap. At the time, the limit was set to $45 billion.

While the debt limit was created to make government run more smoothly, many policymakers believe that it has become more trouble than it’s worth. In 2021, Ms. Yellen said she supported abolishing the debt limit.

What happens if the debt limit is not raised or suspended?

If the government exhausts its extraordinary measures and runs out of cash, it would be unable to issue new debt. That means it would not have enough money to pay its bills, including interest and other payments it owes to bondholders, military salaries and benefits to retirees.

No one knows exactly what would happen if the United States gets to that point, but the government could default on its debt if it is unable to make required payments to its bondholders. Economists and Wall Street analysts warn that such a scenario would be economically devastating, and could plunge the entire world into a financial crisis.

Will military salaries, Social Security benefits and bondholders be paid?

Various ideas have been raised to ensure that critical payments are not missed — particularly payments to the investors who hold U.S. debt. But none of these ideas have ever been tried, and it remains unclear whether the government could actually continue paying any of its bills if it can’t borrow more money.

One idea that has been proposed is that the Treasury Department would prioritize certain payments to avoid defaulting on U.S. debt. In that case, the Treasury would first pay the bondholders who own U.S. Treasury debt, even if it delayed other financial obligations like government salaries or retirement benefits.

So far, the Treasury seems to have ruled that out as an option. Ms. Yellen has said that such an approach would not avoid a debt “default” in the eyes of markets.

“Treasury systems have all been built to pay all of our bills when they’re due and on time, and not to prioritize one form of spending over another,” Ms. Yellen told reporters earlier this year.

Show more

Share full article

Site Index

Site Information Navigation

© 2023 The New York Times Company

NYTCoContact UsAccessibilityWork with usAdvertiseT Brand StudioYour Ad ChoicesPrivacy PolicyTerms of ServiceTerms of SaleSite MapHelpSubscriptions

We've updated our terms

We encourage you to review our updated Terms of Sale, Terms of Service, and Privacy Policy. By continuing, you agree to the updated Terms listed here.

-

LIVE

LIVE

Reolock

5 hours agoWoW Classic Hardcore | WE'RE BACK!!

112 watching -

3:46:13

3:46:13

SynthTrax & DJ Cheezus Livestreams

7 hours agoShell Shock Live - The Scorched Earth Remake/Upgrade - 4pm PST / 7pm EST - RUMBLE GAMING

25.6K -

2:56:57

2:56:57

Illyes Jr Gaming

3 hours agoBack to Black .....Ops 6 w/ ILLYESJRGAMING

15.7K1 -

1:07:59

1:07:59

BonginoReport

6 hours agoBoston Mayor Defies Trump, Protects Illegals - Nightly Scroll w/ Hayley Caronia (Ep.115)

115K81 -

40:45

40:45

Donald Trump Jr.

7 hours agoPeace by Peace: Solving One Problem After Another | Triggered Ep.268

63.7K57 -

LIVE

LIVE

FrizzleMcDizzle

4 hours ago $1.31 earnedRemnant 2 - Dark Souls-like Shooter?!

123 watching -

LIVE

LIVE

FoeDubb

2 hours ago🏰KINGDOM MENU: 🎮DELTA FORCE PEW PEWS & 👑CHILL CONVO DILLY DILLY!!

13 watching -

11:43:31

11:43:31

GritsGG

14 hours agoWin Streaking! Most Wins 3390+ 🧠

65.6K -

1:08:29

1:08:29

TheCrucible

6 hours agoThe Extravaganza! Ep. 24 (8/19/25)

83.4K20 -

4:22:25

4:22:25

sophiesnazz

7 hours ago $0.92 earnedLETS TALK ABOUT BO7 !socials !specs

22.1K