Premium Only Content

How To Make $2000 Per Day From Swing Trade #swing#trade

Swing trading is a trading strategy that aims to profit from short to medium-term price swings or "swings" in the financial markets. To make a profit from swing trading, you'll need to develop a well-defined strategy and adhere to key principles. Here are steps to help you potentially profit from swing trading:

Educate Yourself: Start by gaining a solid understanding of the financial markets and trading principles. Learn about technical analysis, chart patterns, and trading strategies. Continuously educate yourself and stay updated on market news and trends.

Select a Trading Instrument: Choose a financial instrument you are comfortable with and that aligns with your trading goals. Common options include stocks, forex, commodities, and cryptocurrencies.

Develop a Trading Plan: Create a comprehensive trading plan that includes your objectives, risk tolerance, entry and exit strategies, position sizing rules, and risk management techniques. A trading plan is your roadmap to success and helps you stay disciplined.

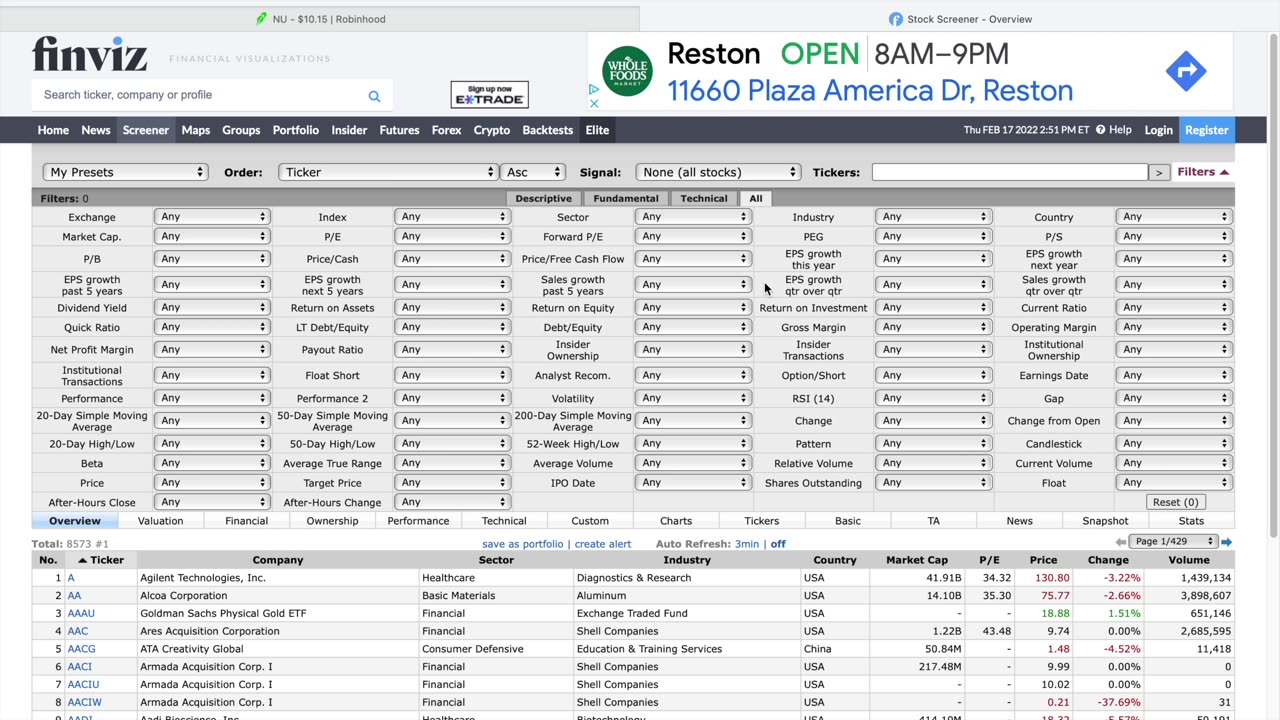

Technical Analysis: Utilize technical analysis to identify potential entry and exit points. Key technical indicators and tools include moving averages, Relative Strength Index (RSI), MACD, Fibonacci retracements, and trendlines. Analyze price charts to spot patterns and trends.

Fundamental Analysis (Optional): Depending on the asset you're trading (e.g., stocks or cryptocurrencies), consider incorporating fundamental analysis. Understand the factors that can influence the asset's price, such as earnings reports, economic data, or news events.

Risk Management: Implement strict risk management practices. Never risk more than you can afford to lose on a single trade. Use stop-loss orders to limit potential losses and take-profit orders to secure profits when the market moves in your favor.

Position Sizing: Determine the size of your positions based on your risk tolerance and trading plan. Avoid overleveraging, which can lead to substantial losses.

Entry and Exit Strategies: Define clear entry and exit criteria for your trades. These criteria should be based on your technical and/or fundamental analysis. You may use a combination of technical indicators, support/resistance levels, and chart patterns to identify these points.

Backtesting: Test your trading strategy using historical data to see how it would have performed in the past. This helps you assess the viability of your strategy before risking real capital.

Practice with a Demo Account: Before risking real money, practice your swing trading strategy using a demo trading account to gain experience and refine your approach.

Emotional Control: Keep your emotions in check. Fear and greed can lead to impulsive decisions and losses. Stick to your trading plan and remain disciplined even during periods of market volatility.

Continuous Learning and Adaptation: The financial markets are dynamic, and what works today may not work tomorrow. Stay informed, continuously learn, and adapt your strategy as market conditions change.

Monitor and Review: Regularly monitor your trades and review your trading performance. Analyze both your winning and losing trades to identify areas for improvement.

Risk-Reward Ratio: Ensure that your potential profit is significantly higher than your potential loss for each trade. A common guideline is to aim for a risk-reward ratio of at least 1:2.

Remember that there are no guarantees in trading, and losses are a part of the game. It's crucial to start with a small amount of capital that you can afford to lose and gradually increase your position size as you gain experience and confidence. Additionally, consider seeking advice from experienced traders, mentors, or financial advisors to help you refine your swing trading strategy. Always trade responsibly and in accordance with applicable regulations and guidelines.

-

LIVE

LIVE

ZiggySalvation

2 hours agoCoD HC Time

26 watching -

LIVE

LIVE

Spartan

1 hour agoSpartan - Pro Halo Player for OMiT | Scrims vs C9, Maybe Ranked after

84 watching -

Due Dissidence

7 hours agoNetanyahu DENIES Gaza Starvation, Chris Smalls ASSAULTED in IDF Custody, MTG RIPS Randy Fine

6.01K9 -

1:13:40

1:13:40

vivafrei

3 hours agoFire This Police Chief! Mass Shooting in New York! Sean Feucht Smoke Bomb Suspect ON VIDEO & MORE!

89K41 -

LIVE

LIVE

LFA TV

20 hours agoLFA TV ALL DAY STREAM - TUESDAY 7/29/25

1,491 watching -

2:03:25

2:03:25

The Quartering

4 hours agoNYC Lunatic Update, Doxxing Website For Men OWNED, Walmart Stabber Update, 2 Men Buy Baby...

111K23 -

2:48:20

2:48:20

Barry Cunningham

5 hours agoSYDNEY SWEENEY PROVES PRESIDENT TRUMP IS RIGHT! EVERYTHING WOKE TURNS TO....

37.9K8 -

1:18:16

1:18:16

The HotSeat

2 hours ago💥 Chuck Schumer MELTS DOWN Over Voter ID! Are Democrats Really This Delusional?

15.9K14 -

18:15

18:15

Clownfish TV

13 hours agoCartoon Network Just Got DROPPED!

14.3K12 -

1:13:26

1:13:26

Russell Brand

5 hours agoShooting RAMPAGE In NYC + Trump HUMILIATES Starmer During UK Visit - SF622

174K54