Premium Only Content

#105 Year-on-year (YOY)

Year-on-year comparisons can be important for several reasons in various contexts, including business, finance, and economics:

Performance Assessment: Year-on-year comparisons allow organizations to assess their performance and growth over time. By comparing current performance to the same period in the previous year, they can gauge whether they are progressing, stagnating, or experiencing declines in key metrics like revenue, profit, or market share.

Identifying Trends: These comparisons help identify trends and patterns. If a business consistently sees year-on-year growth in a particular metric, it may indicate a positive trend that can inform strategic decisions. Conversely, a decline might signal the need for corrective action.

Budgeting and Planning: Year-on-year data assists in budgeting and forecasting. Businesses can use historical performance data to set realistic goals and allocate resources effectively for the upcoming year.

Investor and Stakeholder Confidence: For publicly traded companies, demonstrating consistent year-on-year growth can boost investor and stakeholder confidence. It can lead to higher stock prices and attract more investment.

Competitive Analysis: Year-on-year comparisons also help assess a company's performance relative to competitors. If a business is growing faster than its competitors year on year, it may indicate a competitive advantage.

Economic Analysis: Economists and policymakers use year-on-year comparisons to assess the health of an economy. For instance, they may look at year-on-year changes in GDP, inflation rates, or employment numbers to understand economic trends and make informed decisions.

Marketing and Sales Strategies: Year-on-year data can guide marketing and sales strategies. For example, if a business knows that sales tend to spike during a particular season, they can allocate resources accordingly and tailor marketing campaigns to capitalize on this trend.

Risk Management: Year-on-year comparisons can help identify potential risks and vulnerabilities. Sudden declines in year-on-year performance may prompt organizations to investigate and mitigate underlying issues.

Resource Allocation: Understanding year-on-year changes in various business functions can inform resource allocation decisions. For instance, if a department consistently experiences declining performance year on year, the organization might reevaluate its staffing, budget, or strategy for that department.

Long-Term Planning: By examining year-on-year data over several years, organizations can make more informed long-term strategic decisions. This can include decisions about expansion, diversification, or entering new markets.

In summary, year-on-year comparisons provide valuable insights into a company's or economy's performance and can inform decision-making at various levels. They help organizations stay competitive, identify areas for improvement, and make data-driven decisions for the future.

www.antharas.co.uk/ companies website or top book distributors!

#BusinessStrategy

#Entrepreneurship

#Leadership

#Management

#Marketing

#Finance

#Startups

#Innovation

#Sales

#SmallBusiness

#CorporateCulture

#Productivity

#SelfDevelopment

#SuccessStories

#PersonalBranding

#Networking

#Negotiation

#BusinessEthics

#TimeManagement

#GrowthStrategies

#MarketAnalysis

#BusinessPlanning

#FinancialManagement

#HumanResources

#CustomerExperience

#DigitalTransformation

#Ecommerce

#SocialMediaMarketing

#BusinessCommunication

#ChangeManagement

-

14:15

14:15

AV

10 months ago#1151 Press release - AUKUS real-time AI trials

182 -

LIVE

LIVE

DDayCobra

4 hours ago $0.49 earnedLos Angeles Riots - Marines Arrive in California

3,094 watching -

2:40:29

2:40:29

TimcastIRL

3 hours agoLA Riots Go NATIONAL, Spread Across US, Judge DENIES Newsom, Allows National Guard| Timcast IRL

126K93 -

36:40

36:40

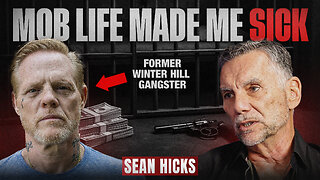

Michael Franzese

3 hours agoMob Life, Prison, Redemption: The Untold Story of Sean Scott Hicks

15.4K1 -

LIVE

LIVE

MyronGainesX

19 hours ago $2.51 earnedLA Has Fallen! Protestors Takeover And Trump Sends More Troops!

2,674 watching -

LIVE

LIVE

SpartakusLIVE

5 hours agoVerdansk EASTER EGG || #1 King of Content entertains the PEASANTS, multitudes REJOICE

529 watching -

52:57

52:57

Sarah Westall

4 hours agoMAHA the Real Deal or Just a Scam? Behind the Scenes in DC w/ Dr. Sherry Tenpenny

7.98K9 -

LIVE

LIVE

Razeo

3 hours agoIf I'm not here, I'm there.

139 watching -

1:41:57

1:41:57

megimu32

2 hours agoON THE SUBJECT: Jock Jams & Space Jam - Soundtracks of Our Childhoods

6.31K5 -

1:26:56

1:26:56

Glenn Greenwald

6 hours agoFederal Court Dismisses & Mocks Lawsuit Brought by Pro-Israel UPenn Student; Dave Portnoy, Crusader Against Cancel Culture, Demands No More Jokes About Jews; Trump's Push to Ban Flag Burning | SYSTEM UPDATE #466

89.7K72