Introduction To Personal Finance

#Personalfinance is the management of an individual's or a household's financial resources to achieve specific financial goals, such as saving for retirement, buying a home, #payingforeducation, or simply maintaining a comfortable standard of living. It involves making informed #decisions about earning, spending, saving, and investing money to secure one's financial future. Here's a brief overview of #keyconcepts in personal finance:

#Budgeting: Budgeting is the foundation of personal finance. It involves tracking income and expenses to create a financial plan. A budget helps you allocate your money wisely, #prioritizespending, and avoid #overspending.

#Income: Income is the money you earn from various sources, such as #employment, self-employment, investments, and rental properties. #Managingyourincome effectively is crucial for meeting financial goals.

#Expenses: Expenses include all the money you spend on necessities (like housing, food, and #transportation) and #discretionary items (like #entertainment and dining out). It's important to distinguish between needs and wants and cut #unnecessaryexpenses

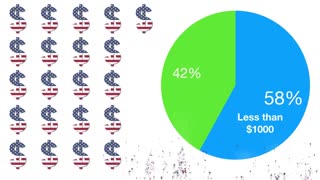

#Savings: Saving money is a fundamental aspect of personal finance. It involves #settingaside a portion of your income for emergencies, short-term goals (e.g., #vacations), and long-term objectives (e.g., retirement).

#Investing: Investing is the process of putting your money to work to generate returns over time. Common #investmentoptions include #stocks, #bonds, #mutualfunds, #realestate, and retirement accounts (e.g., 401(k) or IRA).

#DebtManagement: Managing debt is essential for financial well-being. High-interest debt, such as credit card debt, can be detrimental to your finances. Strategies like debt consolidation and repayment plans can help you #getcontrol over your #debts.

#EmergencyFund: An emergency fund is a #savingsaccount set aside for #unexpectedexpenses like medical bills or car repairs. It acts as a financial safety net, ensuring you don't have to rely on credit or loans during #emergencies.

#RetirementPlanning: Saving for retirement is a long-term goal that requires #carefulplanning. #Retirementaccounts like 401(k)s and #IRAs, along with employer-sponsored plans, can help you build a nest egg for your #retirement years.

Insurance: Adequate #insurancecoverage, including health, life, auto, and home #insurance, is essential to protect your financial well-being in case of #unexpectedevents

Financial Goals: Setting clear financial goals is crucial. These goals can be short-term (e.g., paying off #creditcard debt), medium-term (e.g., buying a home), or long-term (e.g., retiring comfortably). Having #specificgoals helps you stay #motivated and make #strategic financial decisions.

Financial Education: Continuous learning about personal finance is important. Staying informed about #financialconcepts, investment strategies, and #economic trends empowers you to make informed #financialdecisions

#Personalfinance is a lifelong journey, and everyone's #financialsituation is unique. It's important to tailor your #financialplan to your #goals, #income, and circumstances. By making smart financial choices and practicing good #financialhabits, you can achieve #financialsecurity and work toward a prosperous future.

-

2:28

2:28

wellnessvibe

8 months agopersonal finance guide

-

0:59

0:59

The Last Capitalist in Chicago

1 year ago4 Steps of Basic Personal Finance

75 -

4:18

4:18

Financial Corners

10 months agoPlease click on link provided! Personal Finance QuickStart Guide: The Simplified Beginner’s Gui...

35 -

9:38

9:38

Financer

10 months ago10 Commandments of Personal Finance

32 -

17:00

17:00

Jenny Logan, CFP®

1 year agoFoundational Financial Planning - Budget & Lifestyle Management

24 -

1:00

1:00

SupremeTeam20

8 months agoIntroduction to Financial Literacy Introduction – Why Care? It's Your Money

1 -

10:22

10:22

AV

7 months ago#310 Financial Literacy

7 -

5:41

5:41

pf101

1 year agoThe Ultimate Guide to Building Wealth: Tips and Tricks for Personal Finance Success

8 -

7:28

7:28

PositiveVortex

4 months agoPersonal Finance Secrets: The Money Matters Masterclass

36 -

3:30

3:30

financeforsingles

4 months ago🌟 Financial Planning for Millennials | Easy Steps to Secure Your Future

11