The BRICS Plus Six | The Gold Standard 2334

https://www.midasgoldgroup.com/

In this episode of The Gold Standard, host Jennifer Horn talks with her guest Ken Russo, Senior Vice President of the Midas Gold Group, about the country’s economy, global finance, and how you can protect your wealth by diversifying with precious metals. Amidst a backdrop of evolving economic landscapes, the recent expansion of the BRICS consortium has captured attention. With the addition of Iran, Ethiopia, the United Arab Emirates, Egypt, and Argentina, this development resonates as a clear call to seize control of your financial destiny.

The recent BRICS Summit held in Johannesburg ended with the addition of six new member nations. This is something they hadn’t done since 2010. The new member countries are Saudi Arabia, Argentina, Egypt, Ethiopia, Iran, and the United Arab Emirates. This bold expansion will further solidify the BRICS’ role as a potent counterbalance to the prevailing influence of the G7 nations. The numbers tell a compelling story: a projected 36% share of global GDP and a nearly half representation of the world’s population. It’s an unmistakable signal of a multipolar world order taking shape, steering away from the traditional dominance of Western powers. BRICS plus six is another marker of how the world is moving away from the dollar.

Fractional reserve banking is an integral part of modern economies. While facilitating credit and economic growth, this practice raises concerns due to its inherent risk. The concept of banks lending out more money than they hold in reserves leads to financial instability. Bank runs and crises are never too far from happening. All it takes are a few too many depositors simultaneously withdrawing their money, and you have a problem. We’ve seen plenty of examples of this already. Finding the balance between economic stimulation and safeguarding against systemic risks remains a pivotal challenge in fractional reserve banking.

In just over two decades, our national debt has ballooned from $5 trillion in 2000 to an eye-watering $33 trillion in 2023, a staggering trajectory that demands our attention. At a debt-to-GDP ratio of 119%, where GDP represents the total economic output of a country, the implications are profound. As taxpayers shoulder this mounting burden, a vivid picture emerges – each citizen would need to contribute a staggering $254,000 to erase this colossal debt. Join us as we unpack the intricate web of economic complexities, explore the ramifications of this unprecedented debt surge, and delve into strategies for safeguarding your financial future in a landscape shaped by these fiscal realities.

Silver holds a unique position in investment portfolios due to its diverse use cases. Unlike gold, silver is prized not only for its value as a store of wealth but also for its crucial role in various industries such as electronics and medical devices.

More affordable than gold, silver makes it more accessible to a wider range of investors. Its growth potential is another draw, as fluctuations in industrial demand and macroeconomic factors can lead to huge movements in the spot price.

The American one-ounce Silver Eagle stands as a shining testament to the enduring allure of precious metals. Launched under the visionary leadership of President Ronald Reagan in 1984, this remarkable coin holds immense significance in the world of bullion. Crafted with meticulous attention to detail, the American Silver Eagle program carries both historical weight and a timeless appeal.

Since its inception, the American Silver Eagle has emerged as a symbol of American excellence and a beacon of financial security. Its elegant design, featuring the iconic Walking Liberty on the obverse and the majestic heraldic eagle on the reverse, captures the spirit of liberty, freedom, and strength. This coin is not just a piece of metal; it embodies the values that America holds dear.

The American Silver Eagle occupies a preeminent position in the global bullion market. With its impeccable quality and guaranteed silver content, the American Silver Eagle has earned its place as one of the most sought-after bullion coins worldwide. Investors and collectors alike are drawn to its intrinsic value and historical resonance. Its legacy lives on, a testament to President Reagan’s foresight and a symbol of the resilience that underpins both the coin and the nation it represents.

____________________________________________________________________________________________________

Listen to The Gold Standard: https://www.midasgoldgroup.com/gold-standard-radio-show/

Gold IRA: https://www.midasgoldgroup.com/gold-ira/

Invest in Gold: https://www.midasgoldgroup.com/buy-gold/

Guide to Owning Bullion & Coins: https://www.midasgoldgroup.com/bullion-guide/

Read the latest precious metals news: https://www.midasgoldgroup.com/news/

-

25:04

25:04

Midas Gold Group

25 days agoThe Absolute Best Way to Own Gold | The Gold Standard 2424

30 -

56:18

56:18

Bare Knuckle Fighting Championship

2 hours agoBKFC FIGHT NIGHT PECHANGA FREE FIGHTS

14.1K4 -

30:15

30:15

Alexis Wilkins

6 hours agoBETWEEN THE HEADLINES WITH ALEXIS WILKINS: SAVE ACT, AOC VS. SCOTUS, NYC TURNS PURPLE, BIDEN CONF

17.2K4 -

1:24:14

1:24:14

Kim Iversen

23 hours agoHamas/Hezbollah Attorney Stanley Cohen Says The West Are The REAL Terrorists

48.9K43 -

3:42:47

3:42:47

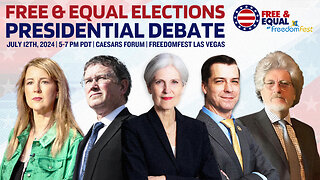

Free And Equal Elections

4 hours agoFree & Equal Presidential Debate at FreedomFest 2024

27.4K51 -

1:02:14

1:02:14

Bare Knuckle Fighting Championship

1 day agoBKFC FIGHT NIGHT PECHANGA FREE PREVIEW FIGHTS

26.7K10 -

1:36:53

1:36:53

Glenn Greenwald

6 hours agoOligarchs Overriding the Will of Democratic Voters; Many Democrats Claim Push Against Biden is Racist; What Happened to Gaza in Liberal Discourse? | SYSTEM UPDATE #296

66.7K134 -

5:04:23

5:04:23

Nerdrotic

9 hours agoACOLYTE Shills COPE! Woke Hollywood Regret, Marvel TRASH | Friday Night Tights 310, w/ It'sAGundam

85.7K72 -

2:25:26

2:25:26

WeAreChange

6 hours agoThey're "In Hell" — Obama And Clinton Inner Circles Plot Biden Ouster! W/ Justin Amash

50.3K24 -

1:12:17

1:12:17

Matt Kim

9 hours agoWhat's in Dallas and Nashville? | Matt Kim #105

44.9K4