Premium Only Content

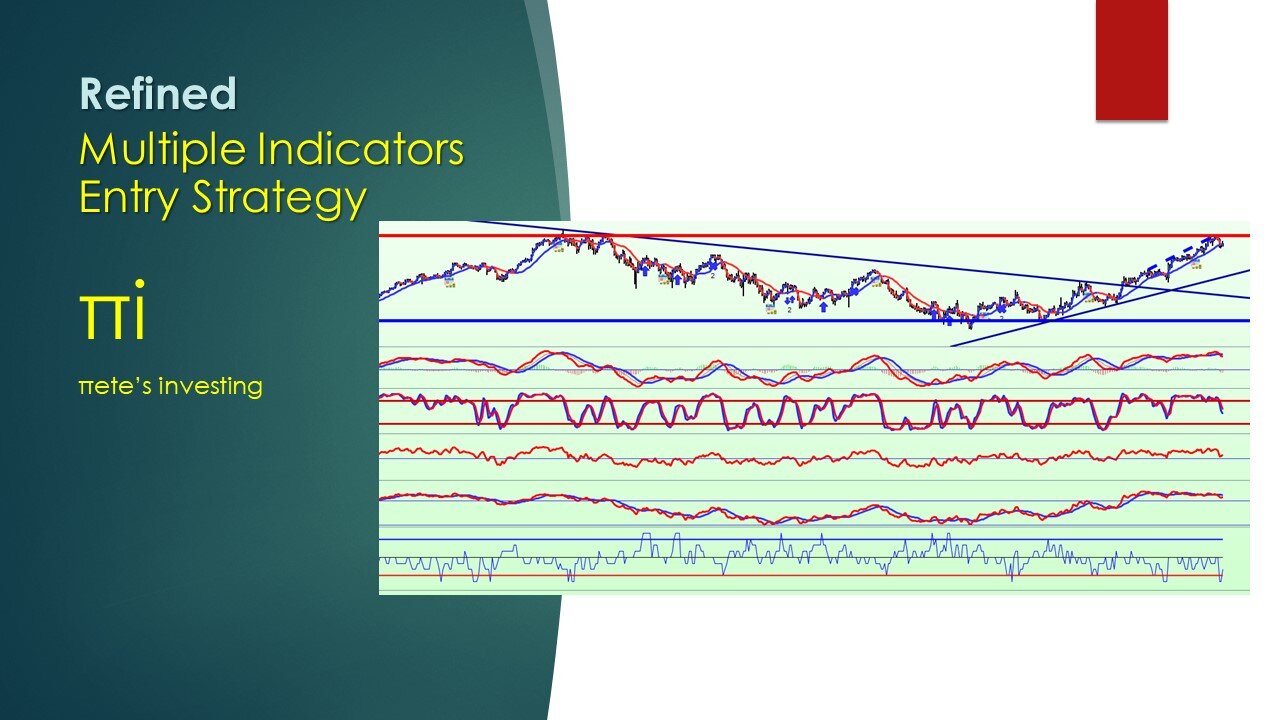

Multiple Indicator Strategy Sep 02 2023

Multiple Indicators Entry Strategy Sep 02 2023

We refined the entry strategy using MACD, Stochastic, RSI, CCI and MA.

This approach improves probability to enter trades near chart swing lows.

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

#MACD #Stochastic #RSI #RelativeStrengthIndex #CCI #CommodityChannelIndex #MA #MovingAverage

Please ensure you paper trade any strategy for at least 3 months to fully understand how the chosen strategy works and the effects on your trading account.

Don't forget...

First always remember to review petesinvesting channel playlists

Updated every weekend I look at the charts of some select blue chip shares as well as some key world sharemarket indices.

As always click on the SUBSCRIBE button as well as the NOTIFICATION bell and LIKE this video to support this channel.

If you want me to review an Index a share, a commodity or a FOREX pair, put it in the comments and I'll cover it in a future video

Things

to consider:

•We track and trade on a Daily chart since we want to back test and see results of trades back during the GFC as well as Covid effects.

•We track and back test Revenue over Drawdown requirements

(as a %) to optimize our returns with less exposure.

•Brokerage is included in our back testing. I use $8 per transaction each time we buy or sell. Revenue shown may change slightly depending on your brokerage costs.

•Our Back testing transacts with $2,000 per trade. ie everytime you purchase $2k worth of shares in the instrument you want to invest.

To increase Revenue (ie returns) simply increase this. But beware this will also increase your Drawdown, so ensure you factor in this with your money management strategy.

Lets get started

Remember...

Don't forget to subscribe / LIKE and hit the notification bell and review the PETESINVESTING channel playlists for further reference.

-

11:51

11:51

Petes Investing

1 day agoNatural Gas Breaks through RESISTANCE & STILL Rises

13 -

2:28:53

2:28:53

Inverted World Live

7 hours agoMurder Tourism, Truth Police, & ChatGPT Weddings | Ep. 141

183K8 -

2:58:44

2:58:44

TimcastIRL

6 hours agoTrump DOJ Opens Probe Into Democrat Swalwell For Mortgage Fraud | Timcast IRL

200K119 -

2:51:50

2:51:50

Laura Loomer

6 hours agoEP156: Trump Sounds The Alarm On The Nigerian Christian Genocide

54.5K46 -

1:11:27

1:11:27

Flyover Conservatives

1 day agoDAVID GREEN: “God Owns It All”: How Hobby Lobby Thinks About Money, Time & Eternity w/ Bill High | FOC Show

29.1K4 -

2:39:00

2:39:00

DLDAfterDark

4 hours ago $7.18 earnedThe Armory - God, Guns, and Gear - A Conversation About Preparedness

30.6K3 -

23:42

23:42

Robbi On The Record

5 hours ago $3.01 earnedMAGA 2.0? BTS of Michael Carbonara for Congress

30.7K5 -

4:46:47

4:46:47

Drew Hernandez

1 day agoSHAPIRO COOKS HIMSELF: SAYS YOU DON'T DESERVE TO LIVE WHERE YOU GREW UP?

49.3K25 -

1:59:26

1:59:26

Barry Cunningham

7 hours agoLIVE WATCH PARTY: J.D. VANCE ON THE SEAN HANNITY SHOW!

38.6K16 -

2:11:15

2:11:15

megimu32

5 hours agoOFF THE SUBJECT: Judging Strangers on Reddit 😭 PLUS! Fortnite Chaos!

36.8K7