Premium Only Content

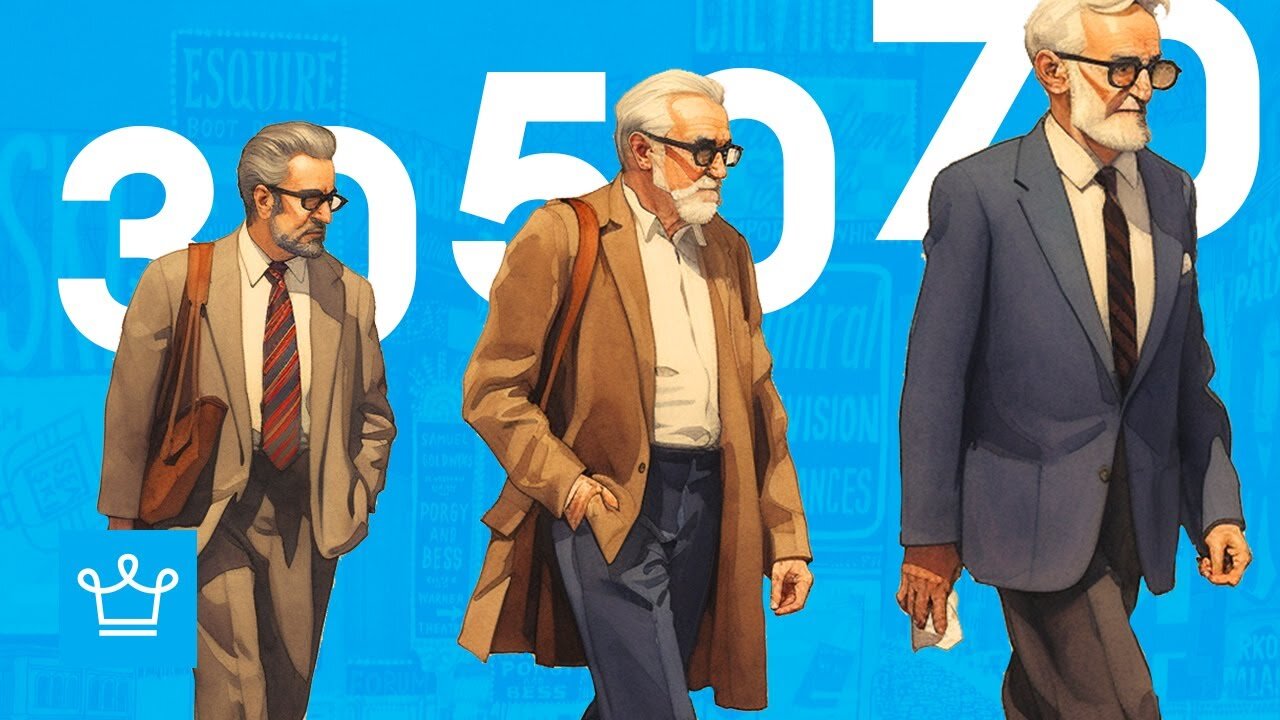

15 Smart Money Moves for For Every Stage Of Life

#bookishears

@bookishears

15 Smart Money Moves for For Every Stage Of Life

Here are 10 smart money moves for every stage of life:

**Teenage**

* **Get a part-time job.** This will help you learn the value of money and start saving for your future.

* **Open a savings account.** Start saving for a car, college, or other goals.

* **Get a credit card and use it responsibly.** Pay your bill in full each month to avoid interest charges.

* **Learn about budgeting and financial planning.** There are many resources available to help you.

**College student**

* **Take out student loans only if you need to.** And if you do, try to borrow as little as possible.

* **Work part-time or during the summer.** This will help you pay for school and living expenses.

* **Live on a budget.** Track your spending and make sure you're not overspending.

* **Get a part-time job after college.** This will help you build your resume and start saving for your future.

**Young adult**

* **Start saving for retirement.** Even if you can only save a little bit each month, it will add up over time.

* **Pay off your student loans as quickly as possible.** The interest on student loans can add up, so it's best to get rid of them as soon as you can.

* **Buy a home if you can afford it.** Homeownership can be a great way to build wealth.

* **Get married and have children if you want to.** This is a big decision, so make sure you're financially ready.

**Middle-aged**

* **Max out your retirement savings.** This is the time to really start saving for your golden years.

* **Pay off your mortgage.** This will free up money each month that you can use to save or invest.

* **Start saving for your children's education.** There are many ways to do this, such as opening a 529 plan.

* **Plan for your retirement.** This includes deciding when you want to retire, how much money you'll need, and how you'll generate income.

**Retired**

* **Live on a budget.** This will help you make sure your money lasts.

* **Take advantage of Social Security and Medicare.** These programs can provide a significant source of income in retirement.

* **Stay active and engaged.** This will help you stay healthy and happy in retirement.

* **Leave a legacy.** This could include donating to charity or leaving money to your loved ones.

These are just a few smart money moves that you can make at every stage of life. By taking steps to manage your money wisely, you can build a secure financial future for yourself and your loved ones.

Here are some additional tips for specific stages of life:

* **When you're first starting out, focus on building your emergency fund and paying off debt.** Once you have these two things under control, you can start saving for retirement and other long-term goals.

* **In your 30s and 40s, it's important to make sure you're on track for retirement.** This means saving enough money and investing it wisely.

* **In your 50s and 60s, you may need to start making adjustments to your budget to prepare for retirement.** This could mean downsizing your home or cutting back on expenses.

* **In retirement, it's important to make sure you have enough income to cover your expenses.** You may need to rely on Social Security, pensions, and investments to generate income.

No matter what stage of life you're in, it's important to stay informed about your finances and make smart money moves. By doing so, you can build a secure financial future for yourself and your loved ones.

-

1:05:09

1:05:09

Game On!

17 hours ago $2.17 earnedJustin Herbert LEADS Chargers to NFL Glory in 2025?

36.7K2 -

LIVE

LIVE

The Bubba Army

23 hours ago4 KILLED in Manhattan Shooting Rampage - Bubba the Love Sponge® Show | 7/29/25

1,309 watching -

40:41

40:41

World2Briggs

15 hours ago $3.25 earned50 Most Religious Towns in the USA Revealed! (Counties)

39.4K6 -

26:58

26:58

Esports Awards

19 hours agoHow Rosalie Parker Became the New Voice of Call of Duty Esports | Origins Podcast #18

20.5K3 -

6:02

6:02

Sugar Spun Run

1 day ago $1.50 earnedStrawberry Muffins

22.5K3 -

12:08

12:08

The Shannon Joy Show

15 hours ago🔥The GENIUS Act Isn’t Genius — It’s a Backdoor CBDC Wrapped in Red, White & Lies🔥

20.2K5 -

17:20

17:20

Nate The Lawyer

2 days ago $7.94 earnedFrench President Sues Candace Owens | Here's What the 219-Page Lawsuit Reveals

78.7K70 -

14:09

14:09

Zoufry

3 days agoThe Cartel's Genius Border Smuggling Tricks

36.1K10 -

2:00:26

2:00:26

MG Show

22 hours agoPresident Trump Making BIG Deals in UK & EU; Structure Change

67.5K28 -

23:09

23:09

GritsGG

18 hours agoQuad Domination w/ Bobby Poff!

61.2K4