Premium Only Content

The "Retirement Savings and Beyond: How to Make the Most of Your Investment Strategy" Diaries

https://rebrand.ly/Goldco1

Join Now

The "Retirement Savings and Beyond: How to Make the Most of Your Investment Strategy" Diaries, retirement savings investment plan

Goldco helps clients secure their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To learn exactly how safe house precious metals can help you develop and protect your wealth, and also also safeguard your retirement call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Protect your wide range and income with physical precious metals like gold ...retirement savings investment plan.

Retirement Savings and Beyond: How to Create the A lot of of Your Assets Strategy

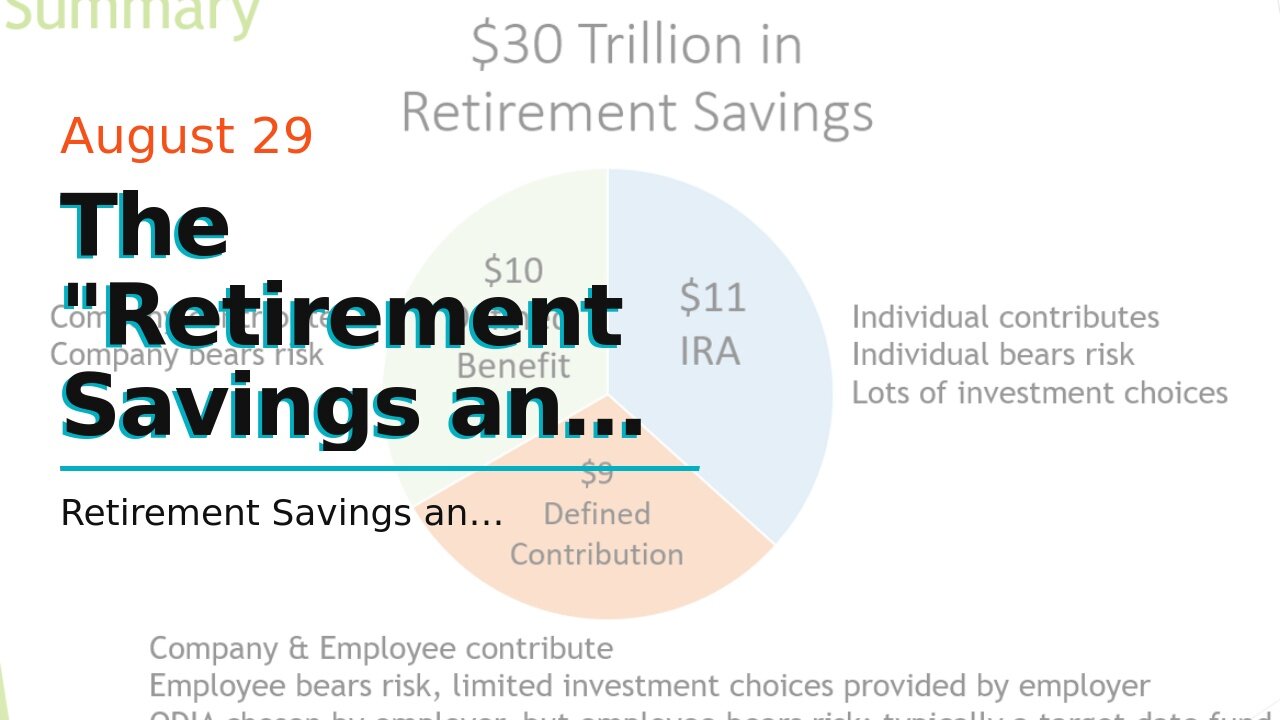

Intending for retired life is a essential step in making sure monetary safety eventually in life. Along with the normal life expectations boosting and the expense of living climbing, it is extra vital than ever to possess a sound investment approach that may aid you make the many of your retirement financial savings. In this article, we will definitely explain some key suggestions and approaches to help you optimize your expenditures and protect a relaxed retirement.

1. Begin Early: The energy of substance maynot be overstated when it happens to retirement cost savings. Through beginning early, you provide your financial investments additional time to develop. Also small contributions created regularly over time may result in significant gains as a result of to worsening rate of interest. Thus, don't stand by until it's also late - start sparing for retirement life as soon as achievable.

2. Branch out Your Portfolio: One common mistake investors help make is putting all their eggs in one basket. Transforming your profile around different asset training class such as inventories, connections, actual real estate, and cash money matchings may aid relieve danger and improve profits over the long condition. A varied portfolio is much less likely to be highly impacted by market fluctuations and financial downturns.

3. Think about Threat Resistance: It's significant to understand your risk tolerance when cultivating an expenditure method for retired life cost savings. Some people may be more comfy along with higher-risk financial investments that use possibly much higher profits, while others might like lower-risk possibilities with a lot more secure but lower returns. Assessing your threat endurance may assist lead you in the direction of the ideal assets selections.

4. Take Perk of Employer-Sponsored Strategy: Numerous employers give retirement life savings program such as 401(k)s or pension account plans along with matching additions. These strategy give an exceptional opportunity to develop your retired life savings a lot faster through taking perk of employer contributions or income tax perks like tax-deferred growth or tax-free withdrawals in certain cases.

5. Routinely Review and Change Your Approach: As you progress through various phases of life, it is crucial to examine your investment approach periodically and produce corrections as required. Your risk endurance, financial objectives, and market health conditions might transform over time, so it's vital to guarantee that your expenditure approach lines up with your advancing conditions.

6. Find Expert Advice: If you are unsure regarding how to build an effective retirement investment method or yearn for personalized advice, think about speaking with a financial expert. A professional can easily help you get through the intricacies of the market and generate a adapted strategy that suits your specific needs and targets.

7. Stay Informed: It's crucial to remain informed regarding the most up-to-date fads in the monetary markets and retirement life program. Regularly reading monetary information, complying with expert suggestions, and teaching yourself regarding different expenditure choices can help you make a lot more informed decisions pertaining to your retirement life financial savings.

8. Reduce Expenses: Be watchful of the expenses connected with several expenditure products such as shared funds or exchange-traded funds (ETFs). Higher expenses can consume into your returns over opportunity. Look for low-cost options that deliver affordable yields to maximize the growth of your retirement cost savings.

9. Ready for Healthcare Expenses:...

-

16:39

16:39

Exploring With Nug

6 hours ago $2.77 earnedI Found a Car Underwater… and a Bag I Wish I Hadn’t Opened!

13K11 -

LIVE

LIVE

NAG Entertainment

2 hours agoRUMBLE ROUNDTABLE: Twitter/X Space W/ChavezFlexingtn

121 watching -

21:54

21:54

MYLUNCHBREAK CHANNEL PAGE

21 hours agoIstanbul Should Not Exist - Pt 2

37.4K11 -

3:44:38

3:44:38

Michael Franzese

2 days agoOperation Freedom Fighter: Emergency Live

79.3K49 -

1:08:10

1:08:10

Jeff Ahern

5 hours ago $4.48 earnedThe Saturday Show With Jeff Ahern

40.3K11 -

6:11:36

6:11:36

Grant Cardone

9 hours agoGrant Cardone LIVE: The 10X Truth That Made My First $1 Million In Real Estate

52.7K8 -

2:28:37

2:28:37

putther

6 hours ago $3.18 earned⭐ Bounty Hunting on GTA⭐

36.5K1 -

11:14:06

11:14:06

Total Horse Channel

1 day agoAMHA 2025 9/20

110K3 -

1:53:15

1:53:15

I_Came_With_Fire_Podcast

18 hours agoThe Satanic Cults Convincing Kids to Commit Violence

64.8K31 -

![Mr & Mrs X - [DS] Created Antifa To Push An Insurgency In This Country - Ep 8](https://1a-1791.com/video/fww1/f9/s8/1/k/f/O/j/kfOjz.0kob-small-Mr-and-Mrs-X-DS-Created-Ant.jpg) 1:02:13

1:02:13

X22 Report

11 hours agoMr & Mrs X - [DS] Created Antifa To Push An Insurgency In This Country - Ep 8

173K78