Listener Q&A with Mike Jesowshek, CPA

How can business owners minimize taxes and maximize growth? In this episode of the Small Business Tax Savings Podcast, Mike dives into strategies to help business owners minimize taxes and maximize growth. He discusses the advantages of hiring family members and avoiding FICA taxes by staying below the standard deduction rate.

Mike covers topics such as setting up an LLC or DBA, using cloud-based bookkeeping software, converting 1099 contractors into W2 employees, taking advantage of retirement plan options like solo 401K or 401K plans, and more.

Tune in now and listen as Mike answers listener questions such as queries from how to structure a short-term rental business to setting up Simple IRA accounts while becoming an S-Corp!

00:24 Listener Questions And Answers With Mike Jesowshek, CPA

03:58 Save On Taxes With Your Vacation Rental Cleaning Business

13:54 Maximize Your Retirement Savings With Solo 401K And Simple IRA Options

33:31 Closing Segment

______

Podcast Host: Mike Jesowshek, CPA - Founder and Host of Small Business Tax Savings Podcast

Join Our Tax Minimization Program: https://www.taxsavingspodcast.com/tax

IncSight Packages: https://incsight.net/pricing/

Book an Initial Consultation: https://app.simplymeet.me/o/incsight/sale

-------

Podcast Website: https://www.TaxSavingsPodcast.com

Facebook Group: https://www.facebook.com/groups/taxsavings/

--------

To find out more on this topic and many others visit our website at www.TaxSavingsPodcast.com. You can also give us a call at 844-327-9272 or send your questions to us at: Ask@TaxSavingsPodcast.com

-

1:02:24

1:02:24

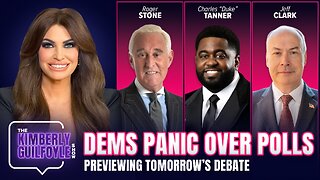

Kimberly Guilfoyle

5 hours agoDems’ Poll Panic, Plus Previewing Debate,Live with Roger Stone, Duke Tanner, and Jeffrey Clark | Ep. 156

12.5K14 -

1:09:34

1:09:34

Redacted News

3 hours agoThe 9/11 Hijacking Myth is Being EXPOSED, Cell Phone 5G Cancer Cover-Up? | Redacted w Clayton Morris

60.1K125 -

2:13:01

2:13:01

The Nerd Realm

4 hours agoHollow Knight Voidheart Edition #01 | Nerd Realm Playthrough

7.46K1 -

1:37:59

1:37:59

Mostly Sports With Mark Titus and Brandon Walker

5 hours agoMostly Sports College Football Dynasty League | Week 7 Session 3

12.1K -

33:55

33:55

World Nomac

5 hours agoThe ultimate 3 days in Tokyo Japan 🇯🇵

2.81K1 -

1:03:08

1:03:08

In The Litter Box w/ Jewels & Catturd

20 hours agoKamala's Haitian Invasion | In the Litter Box w/ Jewels & Catturd – Ep. 642 – 9/9/2024

37K46 -

17:30

17:30

Breaking Points

5 hours agoKamala LOSING To Trump In Latest NYT Poll

29.6K31 -

1:19:13

1:19:13

marygracemedia

3 hours agoMARY GRACE: SPYTALK WITH SAM THE SPY | LAWFARE, TREASON, ENEMY INSIDE THE WIRE

23.5K6 -

LIVE

LIVE

FusedAegisTV

4 days ago24 HOUR LIVESTREAM! 1st Edition | Games, Music, MAGA Politics, Mod Mondays, 100% Free Speech CHAT

360 watching -

1:12:29

1:12:29

The Quartering

6 hours agoShock Trump Poll Has Liberals Melting Down, Haitian Illegals Are Eating Pets & Debate Predictions

52.5K62