Premium Only Content

Fix These Problems If You Want To Be Rich

#bookishears

@bookishears

Fix These Problems If You Want To Be RichOf course, here are ten financial issues to address if you want to improve your chances of building wealth:

High-Interest Debt: Prioritize paying off high-interest debts like credit card balances. The interest on these debts can quickly erode your wealth-building efforts.

Lack of Budget: Create a detailed budget to track your income and expenses. Without a clear understanding of your finances, it's difficult to make informed decisions about saving and investing.

No Emergency Fund: Build an emergency fund with three to six months' worth of living expenses. It acts as a safety net during unexpected financial challenges.

Neglecting Retirement Savings: Start contributing to retirement accounts early. Compound interest over time can significantly grow your retirement nest egg.

Not Investing: Holding onto cash without investing can lead to missed opportunities for growth. Educate yourself about different investment options and start putting your money to work.

Ignoring Financial Goals: Define clear financial goals, both short-term and long-term. Goals provide direction and motivation for your wealth-building journey.

Failing to Diversify: Putting all your money into a single investment or asset class is risky. Diversification spreads risk and helps you take advantage of different market opportunities.

No Passive Income Streams: Create passive income sources, such as investments, rental properties, or royalties. Passive income can supplement your active earnings and accelerate wealth accumulation.

Neglecting Tax Efficiency: Learn about tax-efficient strategies, like utilizing tax-advantaged accounts and optimizing deductions. Minimizing taxes can significantly impact your wealth over time.

Not Seeking Continuous Learning: The financial landscape evolves. Stay informed about personal finance, investing, and economic trends to make informed decisions.

Remember, building wealth takes time and disciplined effort. Addressing these problems will put you on a more solid financial path, but it's essential to remain patient, adaptable, and committed to your financial goals.

-

30:58

30:58

SouthernbelleReacts

2 days agoWe Didn’t Expect That Ending… ‘Welcome to Derry’ S1 E1 Reaction

57 -

13:51

13:51

True Crime | Unsolved Cases | Mysterious Stories

4 days ago $0.15 earned7 Real Life Heroes Caught on Camera (Remastered Audio)

190 -

LIVE

LIVE

Total Horse Channel

10 hours ago2025 IRCHA Derby & Horse Show - November 1st

27 watching -

4:19

4:19

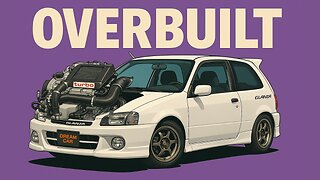

PistonPop-TV

6 days agoThe 4E-FTE: Toyota’s Smallest Turbo Monster

36 -

43:07

43:07

WanderingWithWine

5 days ago $0.04 earned5 Dreamy Italian Houses You Can Own Now! Homes for Sale in Italy

621 -

LIVE

LIVE

Spartan

18 hours agoFirst playthrough of First Berserker Khazan

318 watching -

28:01

28:01

Living Your Wellness Life

2 days agoTrain Your Hormones

2.92K -

43:28

43:28

The Heidi St. John Podcast

1 day agoFan Mail Friday: Faith Over Fear and Finding Strength in Every Season

1.13K -

1:05:30

1:05:30

SGT Report

1 day agoTHE HORRIBLE TRUTH ABOUT EVERYTHING -- Harley Schlanger

41.1K77 -

11:04

11:04

Blackstone Griddles

15 hours agoCountry Fried Steaks on the Blackstone Griddle

86.1K13