Premium Only Content

The Best Strategy To Use For "Exploring Different Ways to Invest in Gold for Maximum Returns"

https://rebrand.ly/Goldco5

Join Now

The Best Strategy To Use For "Exploring Different Ways to Invest in Gold for Maximum Returns", gold and investment

Goldco assists customers shield their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other competent retirement account to a Gold IRA. ... To discover exactly how safe haven precious metals can aid you build and protect your wealth, and also also secure your retired life telephone call today gold and investment.

Goldco is one of the premier Precious Metals IRA firms in the United States. Safeguard your wealth and livelihood with physical precious metals like gold ...gold and investment.

The Golden Rule of Investing: Expand Your Portfolio with Gold

In the world of investing, there is actually a saying that goes, "Don't put all your eggs in one basket." This simple yet powerful part of insight can easily be administered to different facets of investing, consisting of collection diversity. Transforming your investment portfolio is essential to mitigating danger and optimizing gains. One resource training class that has been verified to be an effective diversity device is gold.

Gold has been a symbol of wide range and worth for centuries. Its glamor and worth have stood the exam of time, helping make it a dependable retail store of market value around various cultures and societies. In contemporary opportunities, gold proceeds to play a significant task in financial investment collections as a hedge versus inflation, money variations, and geopolitical uncertainties.

One key cause why gold must be part of any type of well-diversified profile is its capability to function as a secure sanctuary during times of economic chaos. When supply markets tumble or unit of currencies cheapen, clients usually crowd to gold as a means to safeguard their wealth. This flight-to-safety actions develops requirement for gold and steers up its price, creating it an desirable resource for investors looking for reliability.

Gold's inverse connection with various other assets additionally creates it an exceptional diversity tool. Historically, gold has exhibited low or adverse relationship with supplies and bonds. This implies that when traditional financial resources drop in value, the price of gold tends to rise or stay steady. By including gold in your expenditure profile together with stocks and connections, you can easily potentially reduce total volatility while sustaining the possibility for much higher profits.

On top of that, gold's scarcity adds to its value as an investment asset. Unlike fiat unit of currencies that can easily be imprinted at will through main banks or inventories that can be released through firms at their discernment, the source of gold is limited through nature. The finite source ensures that gold preserves its intrinsic market value over opportunity and functions as a reliable establishment of wealth.

An additional conveniences of committing in gold is its capacity to provide as a hedge against rising cost of living. Rising cost of living wears away the investment power of fiat currencies, triggering the prices of goods and services to climb over time. As a substantial asset, gold has traditionally maintained its worth and also appreciated throughout time periods of high inflation. Through designating a portion of your collection to gold, you may guard your riches versus the abrasive impacts of inflation.

In addition to its job as a diversity tool and bush versus financial anxieties, gold likewise uses prospective returns on its very own benefit. Over the long term, gold has revealed constant development in value, exceeding a lot of other resource training class. Depending on to historical data, the cost of gold has enhanced at an common annual fee of around 7% since the early 1970s. While past functionality is not suggestive of potential outcome, this keep track of file highlights gold's potential for funding recognition.

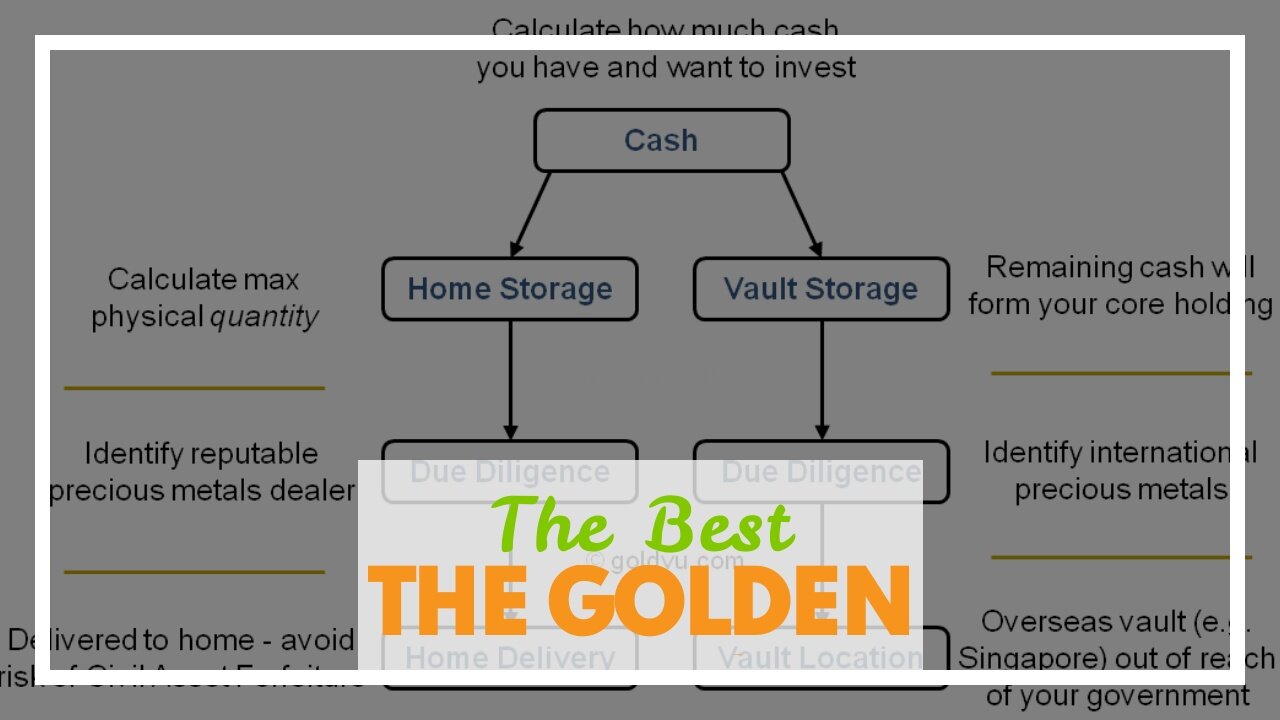

Capitalists possess several options when it comes to including gold in their portfolios. One popular strategy is by means of bodily ownership in the form of gold pubs or coins. Possessing physical gold gives clients straight direct exposure to the metallic and makes it possible for for effortless storing and liquidity. Having said that, it also entails costs linked along with storage and insurance coverage.

Additionally, investors can easily gain visibility to go...

-

LIVE

LIVE

Akademiks

1 hour agoSheck Wes exposes Fake Industry. Future Not supportin his mans? D4VD had help w disposing his ex?

1,143 watching -

LIVE

LIVE

SpartakusLIVE

4 hours agoTeam BUNGULATORS || From HUGE WZ DUBS to TOXIC ARC BETRAYALS

1,571 watching -

LIVE

LIVE

BlackDiamondGunsandGear

56 minutes agoAre You that guy? / After Hours Armory

78 watching -

LIVE

LIVE

Camhigby

1 hour agoLIVE - Riot Watch Portland, DC, NC

208 watching -

LIVE

LIVE

CAMELOT331

3 hours agoYouTube Just Told Me I OWE THOUSANDS $ TO THEM... update

217 watching -

LIVE

LIVE

Tundra Tactical

10 hours ago🛑LIVE AT 9PM CST!! Your Government Hates Your Guns : DOJ Holds Firm On National FIREARMS ACT

110 watching -

LIVE

LIVE

DLDAfterDark

1 hour agoAre YOU The Guy That Ruins Thanksgiving?? - God Guns & Gear

102 watching -

DVR

DVR

NewsTreason

2 hours agoDECLAS w/ Rambo & Dave: Nuremberg 2.0 | MTG Exits Stage Left | Mamdani Psyop Confirmed, 8pm EST

39.7K45 -

LIVE

LIVE

meleegames

2 hours agoSONG REQUESTS CLOSED - Melee Music - Beat Hazard 3 - Devil Inside

108 watching -

LIVE

LIVE

The Connect: With Johnny Mitchell

9 hours agoIs Garth Brooks A Serial Killer? Exposing The Dark Secrets Of Country Music's Biggest Star

187 watching