Premium Only Content

Does it make sense to refinance or purchase with these higher rates

Whether it makes sense to refinance or purchase with higher interest rates depends on several factors, including your individual financial situation and the specific terms of the loan or mortgage you're considering. Here are some factors to consider:

Current Interest Rates: If the interest rates are significantly higher than what is currently available in the market, it might not be the best time to refinance or make a purchase. However, if rates are only slightly higher, other factors might outweigh the impact of the interest rate.

Loan Term: Consider the length of the loan. If you're looking at a short-term loan, the impact of a higher interest rate might be less significant compared to a long-term loan.

Loan Amount: The amount of the loan also matters. A higher loan amount with a higher interest rate can result in significantly higher overall interest costs.

Monthly Payment: Even with a higher interest rate, if the monthly payment fits comfortably within your budget and financial goals, it might still be a reasonable option.

Other Financial Goals: If you have other financial goals, such as paying down high-interest debt or building an emergency fund, it might be wiser to prioritize those before refinancing or making a new purchase.

Credit Score: Your credit score plays a role in the interest rate you're offered. If your credit score has improved since you last borrowed, you might still get a competitive rate despite a slightly higher market rate.

Future Rate Predictions: Consider whether interest rates are expected to rise further in the future. If rates are expected to increase, locking in a slightly higher rate now might still be beneficial in the long run.

Closing Costs: When refinancing, consider the closing costs associated with the new loan. If the closing costs are substantial, they might offset the potential benefits of a lower interest rate.

Duration of Ownership: If you're purchasing a property, consider how long you plan to own it. If you're planning to sell or refinance again in the near future, the impact of the higher interest rate might be less significant.

Tax Implications: Depending on your location and the laws in your area, there might be tax benefits associated with mortgage interest payments. This could potentially mitigate the impact of a higher interest rate.

Market Conditions: Economic conditions and housing market trends can also influence the decision. If property values are expected to increase, it might make sense to proceed even with slightly higher rates.

It's important to run the numbers and consider all these factors before making a decision. You could use online calculators to estimate the total cost of the loan at different interest rates and terms. Additionally, consulting with a financial advisor or mortgage professional can provide personalized guidance based on your specific situation.

tune in and learn more at https://www.ddamortgage.com/blog

Didier Malagies nmls#212566

DDA Mortgage nmls#324329

-

1:54:06

1:54:06

Russell Brand

5 hours agoHas he done it? Ukraine Accepts Core Peace Terms — Nobel Prize incoming? - SF655

113K16 -

24:37

24:37

Stephen Gardner

4 hours agoTrump JUST Exposed 2 HUGE LIES meant to TAKE HIM DOWN!!

23.2K28 -

1:09:52

1:09:52

vivafrei

4 hours agoCBS News "Debunks" The Blaze Pipe Bomber Story? Thomas Massie Threatened by Kash Patel? AND MORE!

38.3K22 -

1:21:16

1:21:16

The White House

8 hours agoVice President JD Vance Celebrates Thanksgiving with Servicemembers and Delivers Remarks

33.7K17 -

59:49

59:49

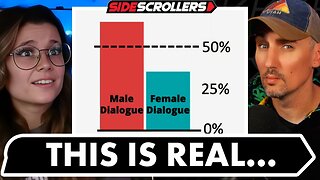

The Quartering

5 hours agoMTG MELTDOWN On X, Hasan Piker Runs From Ben Shapiro & AI Nightmare!

112K48 -

1:16:24

1:16:24

DeVory Darkins

6 hours agoDISTURBING: Eric Swalwell left DUMBFOUNDED after he gets confronted about trans athletes

95.6K59 -

2:06:36

2:06:36

Side Scrollers Podcast

8 hours agoThis is the Dumbest Story We’ve Ever Covered… | Side Scrollers

51.2K10 -

1:13:26

1:13:26

Steven Crowder

10 hours ago🔴 Jay Dyer on Hollywood, The Occult, and the Attack on the American Soul

276K211 -

1:26:28

1:26:28

Sean Unpaved

7 hours agoNFL Thanksgiving Games Are Going To Be ELECTRIC! | UNPAVED

38.7K5 -

29:07

29:07

The Rubin Report

9 hours agoAre Megyn Kelly & Erika Kirk Right About Our Political Divisions?

79.8K59