Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

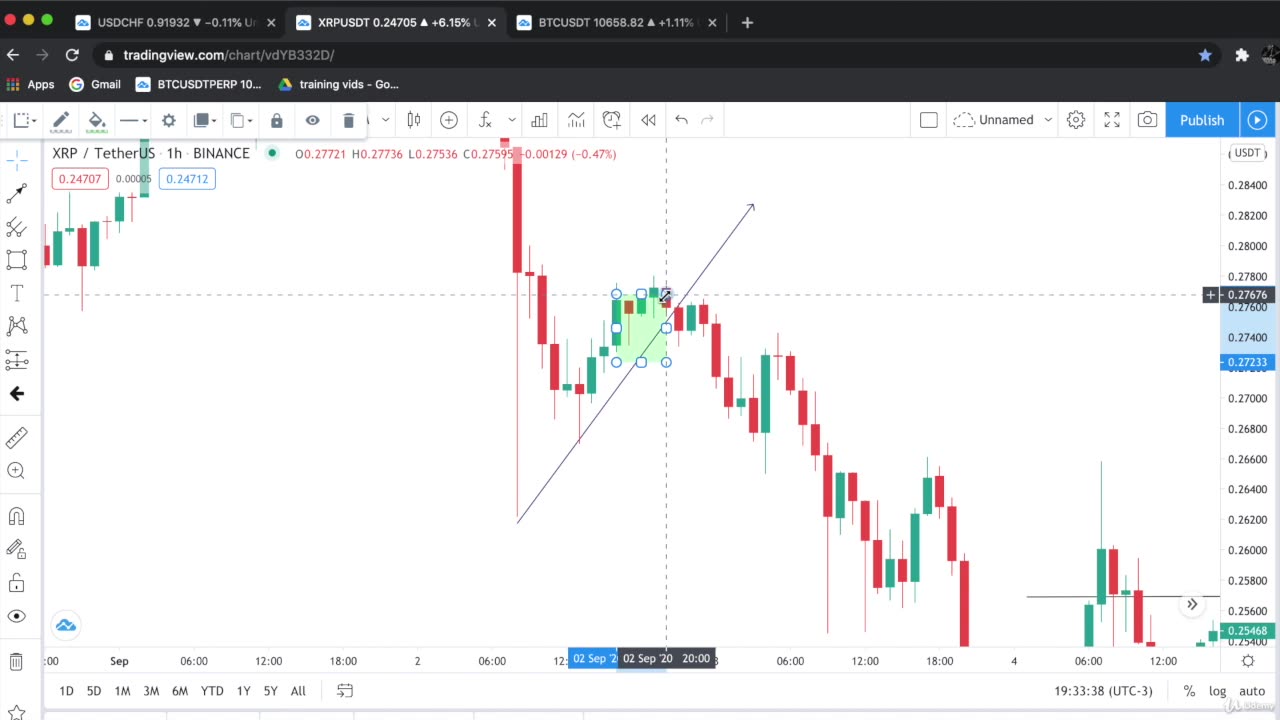

How to Trade the Hanging Man Candlestick Pattern

2 years ago

2

technical analysis

trading

candlestick pattern

hanging man candlestick pattern

Forex trading

stock trading

crypto trading

The hanging man candlestick pattern is a bearish reversal pattern that occurs after an uptrend. It is formed when the price opens at a high, then falls further, but closes near the opening price. The long lower wick of the hanging man indicates that there was buying pressure, but the bears were able to overcome it and close the candle near the opening price.

Loading comments...

-

4:38

4:38

Michael Heaver

4 hours agoBetrayed UK Reaches CRITICAL Moment

483 -

39:13

39:13

SGT Report

16 hours agoAMERICA'S ZIMBABWE FUTURE -- Guy Gotslak

22.5K24 -

1:13:02

1:13:02

Simply Bitcoin

4 hours ago $3.21 earnedINSIDER CONFIRMS 1M Bitcoin Buy INCOMING!! | EP 1319

33.9K1 -

1:03:00

1:03:00

Sean Unpaved

3 hours agoCFB Deep Dive: Matt Moscona's Expert Takes on the Gridiron

27.9K -

27:39

27:39

Crypto.com

1 day ago2025 Live AMA with Kris Marszalek, Co-Founder & CEO of Crypto.com

99.6K7 -

LIVE

LIVE

SternAmerican

1 day agoElection Integrity Call – Wed, Aug 27 · 2 PM EST | Featuring Arizona

262 watching -

1:00:05

1:00:05

Timcast

3 hours agoMASS SHOOTING At Catholic Church In Minneapolis, Children Reportedly Targeted

154K95 -

1:34:01

1:34:01

Tucker Carlson

2 hours agoChristopher Caldwell: Is It Too Late to Save the English-Speaking World?

31.3K52 -

2:14:40

2:14:40

Steven Crowder

6 hours agoBreaking: Minneapolis Catholic Church Shooting Live Coverage

357K333 -

LIVE

LIVE

Major League Fishing

5 days agoLIVE! - Fishing Clash Team Series: Challenge Cup - Day 4

243 watching