Premium Only Content

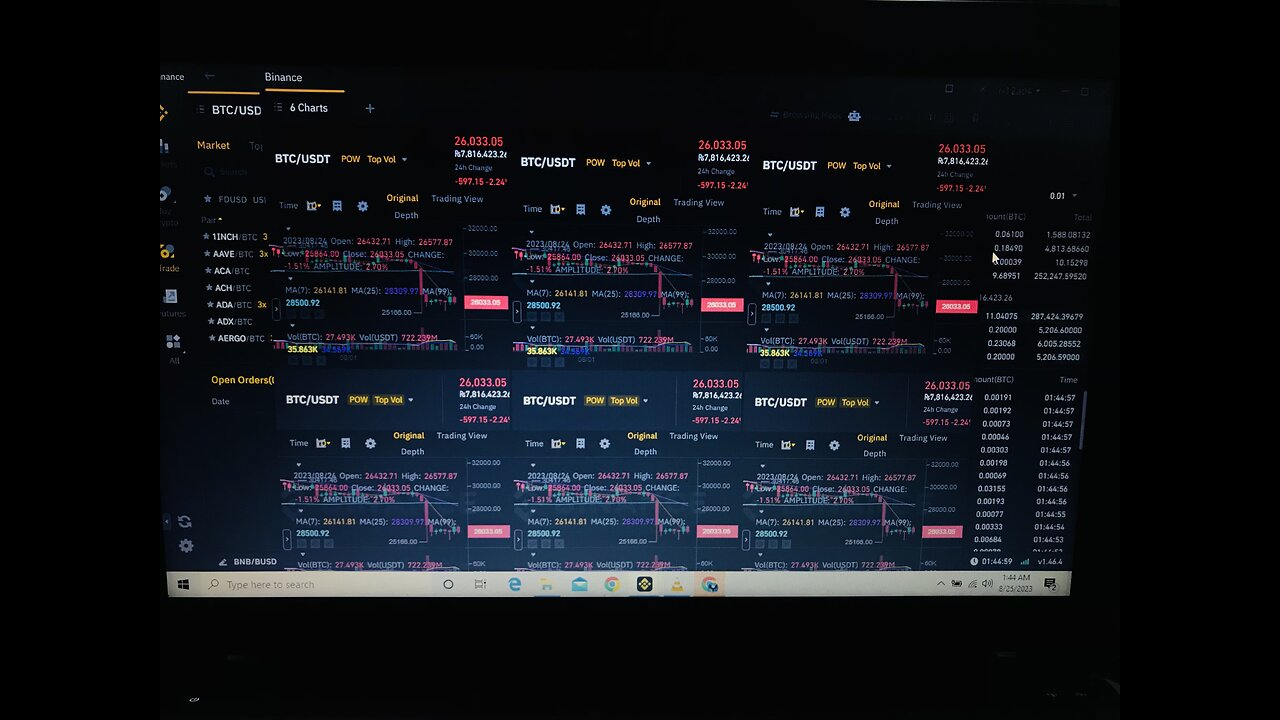

Crypto trading

Cryptocurrency and trading involve various key aspects:

Cryptocurrency Basics:

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security.

Bitcoin, Ethereum, and Ripple are some well-known cryptocurrencies, but there are thousands of others.

Blockchain Technology:

Cryptocurrencies are built on blockchain technology, a decentralized ledger that records all transactions across a network of computers.

Volatility:

Cryptocurrencies are highly volatile, with prices often experiencing significant fluctuations in a short time.

Exchanges:

Cryptocurrency trading occurs on online platforms called exchanges, such as Coinbase, Binance, or Kraken.

Exchanges facilitate the buying, selling, and trading of various cryptocurrencies.

Wallets:

Cryptocurrency wallets are digital tools used to store, send, and receive cryptocurrencies securely.

There are hot wallets (connected to the internet) and cold wallets (offline for added security).

Investment vs. Trading:

Investors buy cryptocurrencies with a long-term perspective, hoping their value will increase over time.

Traders buy and sell cryptocurrencies in the short term to profit from price fluctuations.

Risk Management:

Trading involves significant risks. It's essential to have a clear strategy and risk management plan.

Never invest more than you can afford to lose.

Research:

Before investing or trading, research the cryptocurrency you're interested in, including its use case, team, and market trends.

Regulation:

Cryptocurrency regulations vary by country and can impact trading and taxation. Stay informed about your local regulations.

Security:

Protect your investments with strong passwords, two-factor authentication, and by avoiding suspicious websites and offers.

Liquidity:

Liquidity refers to how easily you can buy or sell a cryptocurrency. Major cryptocurrencies usually have higher liquidity.

Trading Strategies:

There are various trading strategies, including day trading, swing trading, and HODLing (holding for the long term).

Taxes:

Cryptocurrency transactions may be subject to taxation. Consult a tax professional for guidance on reporting and compliance.

Scams:

Be cautious of scams, Ponzi schemes, and fraudulent projects in the crypto space. Always verify information and avoid promises of guaranteed returns.

Diversification:

Diversifying your crypto portfolio can help manage risk. Don't put all your funds into a single cryptocurrency.

Market Sentiment:

Cryptocurrency markets can be influenced by news, social media, and sentiment. Stay updated on relevant information.

Long-Term Viability:

Consider the long-term viability and utility of a cryptocurrency when making investment decisions.

Wallet Security:

Safeguard your wallet's private keys, as losing them means losing access to your funds.

Remember that cryptocurrency markets are speculative and can be unpredictable. It's crucial to do your due diligence, understand the risks, and consider seeking advice from financial experts before getting involved in cryptocurrency trading or investment.

-

LIVE

LIVE

Major League Fishing

3 days agoLIVE! - Bass Pro Tour: Heavy Hitters - Day 2

18,317 watching -

LIVE

LIVE

Total Horse Channel

11 hours ago2025 Gem State Stock Horse Show | Sunday

917 watching -

13:07

13:07

Bearing

6 hours agoJoe Biden’s Cognitive Decline on FULL DISPLAY 🤪 “An Insurrection .. I started ” ⁉️

24.6K51 -

LIVE

LIVE

CassaiyanGaming

1 hour agoCall of Duty | Saturday

376 watching -

5:23

5:23

Talk Nerdy Sports - The Ultimate Sports Betting Podcast

1 hour ago🎯 8 Bets Sharper Than a Sunday Fade – May 18 Picks with Vas

6 -

LIVE

LIVE

xBattledROid

20 minutes ago🔴LIVE - Testing my internet and playing some Marvel Rivals!

38 watching -

37:19

37:19

Athlete & Artist Show

20 hours ago $3.66 earnedZach Boychuk Says Farewell To Berlin, World Championships Experience, NHL Draft and MORE!

32.9K6 -

LIVE

LIVE

TwinGatz

3 hours ago🔴LIVE - It's All So Tiresome | DOOM: The Dark Ages

507 watching -

LIVE

LIVE

STGKAMZZ

3 hours agoSUNDAY FUNDAY WIT KAMZ*WARZONE ACTION

91 watching -

LIVE

LIVE

STXReaper

4 hours agoWarzone resurg

107 watching