Premium Only Content

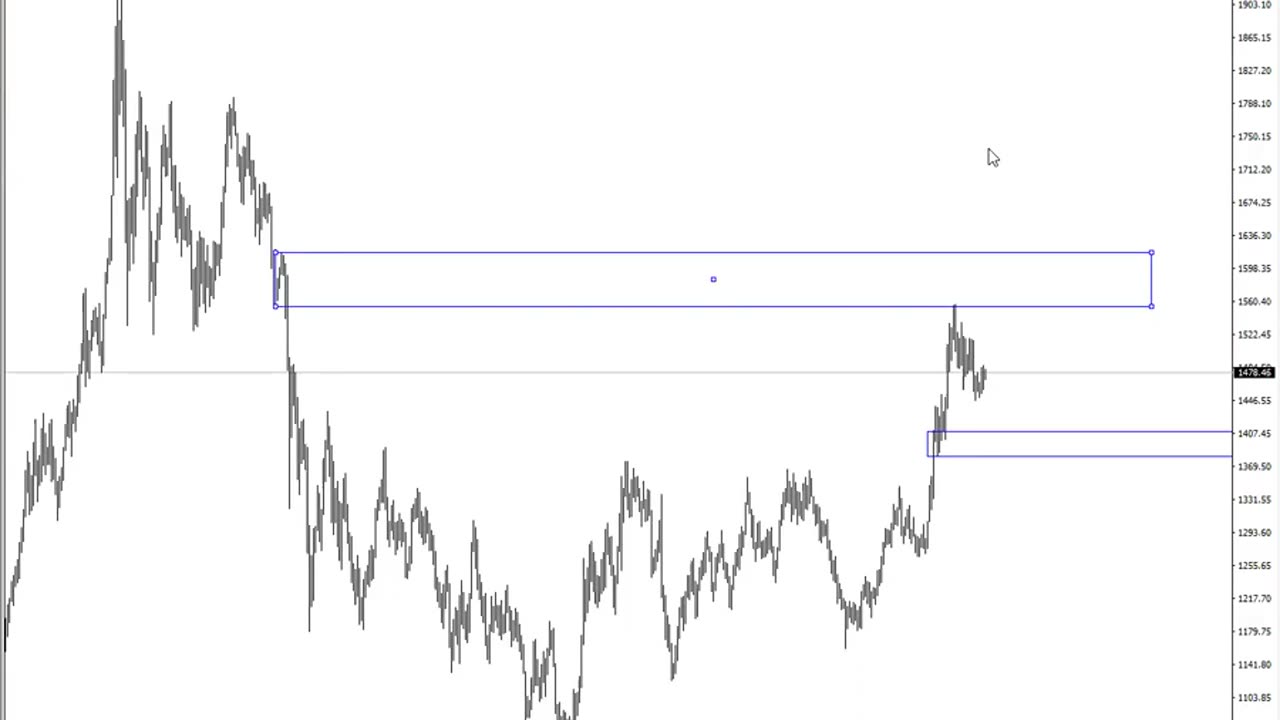

How Supply and Demand Does Work

Supply and Demand is a fundamental concept in economics, and it also plays a crucial role in forex trading. In forex trading, the interaction between supply and demand levels can help traders identify potential areas of market reversal, continuation, and price movement. Here's how Supply and Demand works in forex trading:

Supply and Demand Zones:

Supply zones are price levels where there is a higher concentration of sellers compared to buyers. These levels are considered areas of potential resistance, where price may stall or reverse.

Demand zones are price levels where there is a higher concentration of buyers compared to sellers. These levels are considered areas of potential support, where price may stall or reverse.

Market Dynamics:

When price reaches a supply zone, sellers may be more inclined to sell, believing that the price is likely to decline. This increased selling pressure can lead to a potential reversal or a temporary halt in an upward trend.

Conversely, when price reaches a demand zone, buyers may be more inclined to buy, anticipating a potential price increase. This increased buying pressure can lead to a potential reversal or a temporary halt in a downward trend.

Price Reactions:

Price tends to react to supply and demand zones due to the imbalance between buyers and sellers at those levels. These reactions can result in price reversals, bounces, or consolidations.

A strong reaction from a supply or demand zone could lead to significant price movement, while a weaker reaction might result in a smaller price fluctuation.

Identifying Supply and Demand Zones:

Traders often identify supply and demand zones by looking for areas where price previously reversed or exhibited a significant change in direction.

These zones can be identified using tools like support and resistance levels, trendlines, chart patterns, and volume analysis.

Trading Strategies:

Traders often use supply and demand zones as part of their trading strategies. They might look for opportunities to buy near demand zones in uptrends or sell near supply zones in downtrends.

Some traders combine supply and demand analysis with other technical indicators or candlestick patterns to enhance the accuracy of their trading decisions.

Confirmation and Risk Management:

It's important to remember that not all supply and demand zones lead to significant price movements. Traders often look for confirmation signals before entering trades.

Proper risk management is crucial, as trading based solely on supply and demand zones can still involve risks and uncertainties.

Supply and Demand analysis is a versatile tool used by both technical and price action traders. However, it's important to note that while supply and demand zones can be effective, no trading strategy is infallible. It's recommended to practice, backtest, and gain experience before incorporating supply and demand concepts into your trading strategy

-

7:53

7:53

Rethinking the Dollar

11 hours agoForget AI & War: This Is What Will Break You in 2026

2.28K2 -

20:03

20:03

Bearing

7 days agoGIRLFRIEND Reveals Her SECRET KINK 😂 (It Doesn’t Go Well) 💥

8.31K83 -

56:23

56:23

Coin Stories with Natalie Brunell

1 day agoLyn Alden: Bullish on Bitcoin & Hard Assets

4.44K -

8:10

8:10

MattMorseTV

17 hours ago $14.20 earnedSchumer's PLAN just IMPLODED.

25.9K61 -

2:11:52

2:11:52

Side Scrollers Podcast

19 hours agoYouTube ADMITS BLATANT Censorship + California Wants to FINE “Hate Speech” + More | Side Scrollers

77.1K15 -

15:18

15:18

GritsGG

15 hours agoSweaty Quads w/ Bobby Poff!

18.5K5 -

17:11

17:11

Nikko Ortiz

1 day agoIs Poverty Your Fault?

39.7K37 -

1:25:15

1:25:15

The HotSeat

1 day agoIn Less Than Two Weeks, Here We Are Again.....

24.2K17 -

12:55

12:55

The Pascal Show

14 hours ago $3.83 earned'THAT'S HIS GIRLFRIEND!' D4vd's Friends Speak Out Revealing They Thought Celeste Was His Girlfriend!

15K3 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

280 watching