Premium Only Content

The 20-Second Trick For "5 Essential Tips for Building Your Retirement Savings Investment Plan"

https://rebrand.ly/Goldco

Join Now

The 20-Second Trick For "5 Essential Tips for Building Your Retirement Savings Investment Plan", retirement savings investment plan

Goldco aids customers safeguard their retirement savings by surrendering their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To learn just how safe house precious metals can assist you construct and secure your riches, and also also safeguard your retirement phone call today retirement savings investment plan.

Goldco is among the premier Precious Metals IRA business in the United States. Secure your riches as well as income with physical precious metals like gold ...retirement savings investment plan.

Understanding Risk and Reward in Retirement Savings Investments

When it comes to retired life savings, one of the key factors to look at is risk and benefit. Investing in retired life may be a great way to develop your wealth, but it also comes with potential dangers. It's crucial to understand these dangers and perks prior to making any kind of financial investment selections.

Danger is an integral component of investing. No assets is without danger, as there is consistently the potential for loss. Having said that, various financial investments bring different amounts of risk. Understanding the degree of threat connected along with each investment may aid you produce even more informed options regarding where to placed your cash.

One common measure of danger is dryness. Volatility refers to the level of variety in an investment's worth over time. Investments that possess higher dryness are extra very likely to experience notable cost swings, while those along with low dryness tend to possess a even more secure value.

Another action of threat is the chance of dropping cash. Some financial investments, such as sells and common funds, lug a higher danger of loss contrasted to others like connections or certificates of deposit (CDs). It's significant to examine your very own endurance for risk when deciding which expenditures are suitable for you.

On the other palm, incentive recommends to the possible return on an expenditure. The greater the possible profit, the greater the incentive may be. Having said that, high yields often happen along with much higher dangers.

For instance, sells in the past provide much higher yields matched up to bonds or CDs but also happen with greater volatility and possibility for losses. Connects tend to use lower yields but are commonly considered much less high-risk than sells.

Diversity is one tactic that can aid deal with both threat and reward in retirement life savings expenditures. Branching out your collection indicates spreading out your financial investments around different asset training class such as inventories, bonds, genuine estate, and cash matchings.

By transforming your profile, you decrease the focus danger connected with putting in in only one asset training class or company. If one financial investment does badly or experiences a downturn, the influence on your general profile might be reduced by the performance of various other expenditures.

Another important aspect to consider when reviewing danger and reward is your investment opportunity perspective. The longer your opportunity horizon, the more risk you might be capable to allow. This is because you have even more time to recoup coming from any type of possible losses and benefit from the substance result of gains over opportunity.

On the other hand, if you have a shorter opportunity horizon, such as nearing retired life, it may be prudent to lessen your direct exposure to high-risk expenditures and focus even more on protecting funds rather than finding much higher returns.

It's also crucial to assess your very own economic objectives and purposes when considering threat and incentive in retirement savings financial investments. What are you trying to accomplish along with your expenditures? Are you looking for consistent revenue, long-term growth, or a mix of both?

Understanding your targets may assist guide your expenditure decisions and establish which dangers are appropriate for you. It's significant to strike a harmony between taking enough risk to likely attain your financial goals while staying within your comfort zone.

Finally, it's consistently suggested to seek qualified advice when it happens to investing for retired life. A economic consultant may...

-

1:01:50

1:01:50

VINCE

3 hours agoThe Rabbit Hole Goes MUCH Deeper Than Anyone Thought | Episode 158 - 10/30/25

177K85 -

1:04:23

1:04:23

Benny Johnson

2 hours agoBehind the Scenes With JD Vance on Air Force 2 | VP Gives FLAMETHROWER Speech as Stadium Crowds ROAR

33.7K10 -

LIVE

LIVE

Athlete & Artist Show

18 hours agoBombastic Bets & Games w/ Canadian World Champion!

24 watching -

LIVE

LIVE

The Mel K Show

1 hour agoMORNINGS WITH MEL K - Reversal of Fortune for Lawfare Operatives & Their Benefactors - 10-30-25

726 watching -

LIVE

LIVE

The Shannon Joy Show

2 hours agoConservative CRACK UP Over Nick Fuentes, Tucker Carlson & Candace Owens * TACO Trump’s China Deal * SNAP Riots & America’s Gold Plated Economy LIVE With Bonk DaCarnivore!

236 watching -

LIVE

LIVE

Grant Stinchfield

23 hours agoColleges Cash In While Taxpayers Get Robbed

68 watching -

1:36:10

1:36:10

Graham Allen

4 hours agoBiden Admin EXPOSED For Spying On Senators!! + Erika Kirk/JD Vance Take Over Ole Miss!

106K48 -

2:17:22

2:17:22

LadyDesireeMusic

2 hours ago $0.08 earnedLive Piano & Convo

26.2K3 -

1:07:17

1:07:17

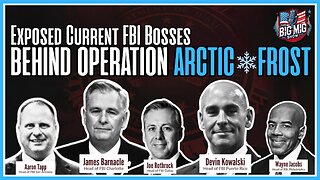

The Big Mig™

3 hours agoExposed, Current FBI Bosses Behind Operation Arctic Frost

7.02K13 -

2:03:26

2:03:26

Badlands Media

5 hours agoBadlands Daily: October 30, 2025 – SNAP Crash, Deep State Desperation & the Return of the Storm

47.4K24