Premium Only Content

"Retirement Planning Made Easy: Expert Tips for Choosing the Right Investment Plan" Fundamental...

https://rebrand.ly/Goldco3

Get More Info Now

"Retirement Planning Made Easy: Expert Tips for Choosing the Right Investment Plan" Fundamentals Explained, retirement savings investment plan

Goldco assists customers safeguard their retired life savings by surrendering their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To find out exactly how safe haven precious metals can help you construct and also secure your wealth, and even safeguard your retired life call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Shield your wide range and livelihood with physical rare-earth elements like gold ...retirement savings investment plan.

Retirement Planning Made Easy: Professional Tips for Selecting the Right Investment Plan

Retired life is a period of life that everyone appears ahead to. It's a time when you can lastly kick back and appreciate the fruits of your work. Having said that, in purchase to create the most of your retired life years, it's essential to possess a sound program in spot. One critical facet of retirement life planning is selecting the right assets program. With thus numerous options offered, it may be mind-boggling to decide which one is most effectively suited for your needs. In this short article, we will certainly provide expert recommendations on how to pick the best investment program for your retirement.

1. Find out Your Goals and Risk Endurance

Before picking an investment program, it's necessary to evaluate your monetary goals and danger endurance. Are you appearing for long-term development or reliability? Can you manage short-term dryness or are you extra comfy with conservative financial investments? Understanding these elements will aid narrow down your options.

2. Take into consideration Your Time Horizon

Another factor to consider when opting for an expenditure strategy is your opportunity horizon until retired life. If you have several years up until retired life, you might be capable to take on additional risk and spend in growth-oriented resources such as supplies or shared funds. On the other palm, if you are nearing retired life grow older, it might be a good idea to concentrate on keeping funds and choose for extra conservative expenditures.

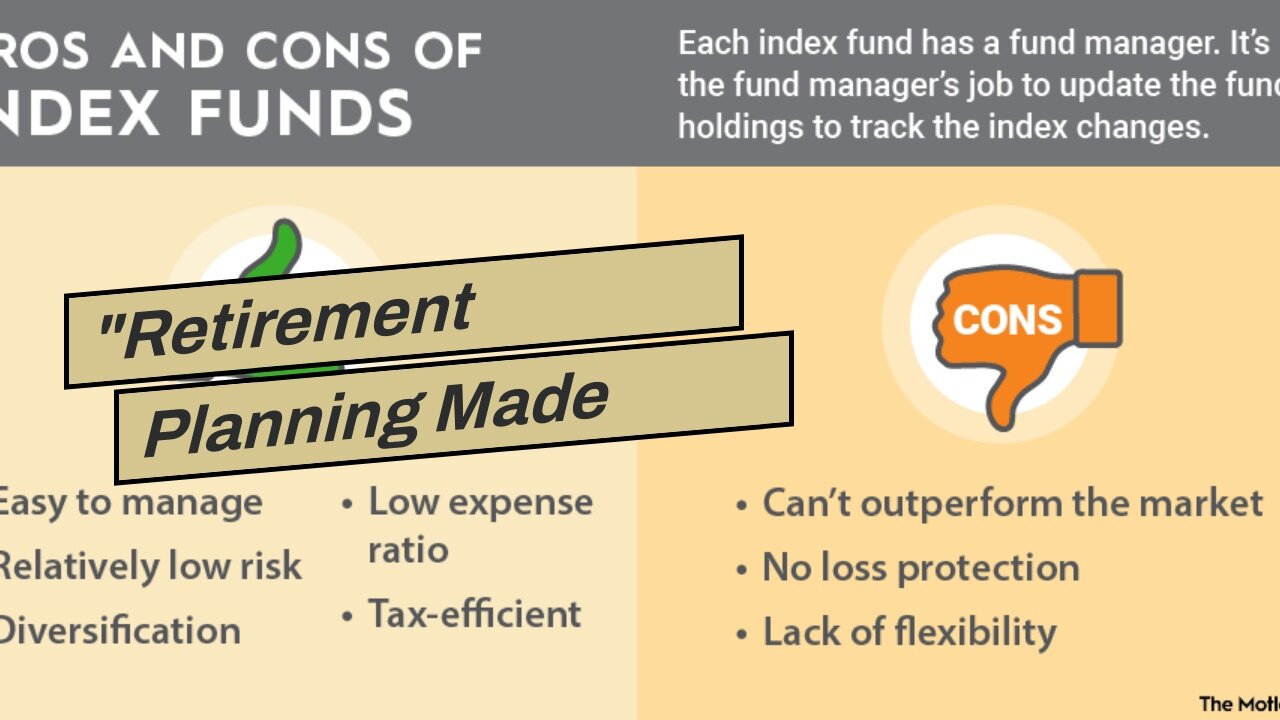

3. Examine Different Types of Investment Plans

There are different styles of expenditure program available, each with its very own perks and downsides. Some popular choices consist of Individual Retirement Accounts (IRAs), 401(k) strategy, pensions, and stock broker accounts.

- IRAs: IRAs use tax perks and can easily be either conventional or Roth IRAs. Traditional IRAs permit tax-deductible additions but demand taxes upon drawback during retirement. Roth IRAs give tax-free withdrawals but do not offer quick tax rebates.

- 401(k) Plans: 401(k) strategy are employer-sponsored retirement strategy that make it possible for employees to provide a part of their wage. Several companies additionally provide suit additions, helping make it an attractive choice for retirement financial savings.

- Annuities: Allowances are insurance policy products that provide normal income during the course of retired life. They can deliver a dealt with or adjustable price of profit, relying on the kind of annuity.

- Stock broker Profiles: Stock broker profiles provide flexibility and permit you to invest in a variety of assets such as sells, connections, and reciprocal funds. They do not have the exact same tax perks as retirement-specific accounts but supply additional command over your expenditures.

4. Find Specialist Advice

Retirement program can easily be complex, specifically when it comes to picking the appropriate financial investment program. Look at speaking to along with a financial specialist who concentrates in retirement planning. They can easily assist evaluate your condition, understand your goals, and encourage appropriate expenditure possibilities located on your threat endurance and opportunity horizon.

5. Expand Your Profile

Diversity is crucial to managing risk in any investment program. By spreading out your investments around various possession courses such as sells, connections, genuine estate, and cash substitutes, you decrease the influence of any type of singular financial investment's functionality on your general profile.

6. Review and Monitor Your Investment Plan Frequently

On...

-

LIVE

LIVE

Redacted News

27 minutes agoEMERGENCY! BILL GATES CULT MEMBERS FOUND PLANTED INSIDE MULTIPLE FEDERAL AGENCIES, RFK FURIOUS

18,846 watching -

UPCOMING

UPCOMING

Kimberly Guilfoyle

1 hour agoFull Breaking News Coverage: Live with John Nantz & Steve Moore | Ep250

289 -

LIVE

LIVE

vivafrei

2 hours agoShameless Politicization of Tragedy! Susan Monarez is OUT! Pritzker is an IDIOT! & MORE!

10,698 watching -

LIVE

LIVE

Major League Fishing

6 days agoLIVE! - Fishing Clash Team Series: Challenge Cup - Day 5

430 watching -

The Quartering

3 hours agoCount Dankula Live On Migrant Crisis In Europe, Whiteness & More

90.8K102 -

3:46:59

3:46:59

Barry Cunningham

6 hours agoBREAKING NEWS: KAROLINE LEAVITT HOLDS WHITE HOUSE PRESS CONFERENCE (AND MORE NEWS)

49.8K37 -

47:21

47:21

Stephen Gardner

19 hours ago🔥Elon Just Exposed the Most Corrupt Man on Earth - Trump Makes BOLD MOVE!

13.2K65 -

LIVE

LIVE

The HotSeat

1 hour agoI'm NOT Sorry! Guns Aren’t the Problem—Godless Culture Is

450 watching -

![[Ep 737] Media & Left Attack Prayer and God | Media Loses Control of Narrative | CDL Fraud](https://1a-1791.com/video/fww1/ca/s8/1/m/N/f/d/mNfdz.0kob-small-Ep-736-Make-Gender-Dysphori.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

1 hour ago[Ep 737] Media & Left Attack Prayer and God | Media Loses Control of Narrative | CDL Fraud

140 watching -

2:53:12

2:53:12

Right Side Broadcasting Network

7 hours agoLIVE REPLAY: White House Press Secretary Karoline Leavitt Holds a Press Briefing - 8/28/25

97.9K41