Premium Only Content

"Investing in Gold Mining Companies: Risks and Rewards" Things To Know Before You Buy

https://rebrand.ly/Goldco5

Sign up Now

"Investing in Gold Mining Companies: Risks and Rewards" Things To Know Before You Buy, gold and investment

Goldco aids clients protect their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To learn just how safe house precious metals can assist you build as well as safeguard your wide range, and also protect your retirement phone call today gold and investment.

Goldco is one of the premier Precious Metals IRA companies in the United States. Safeguard your wide range and source of income with physical precious metals like gold ...gold and investment.

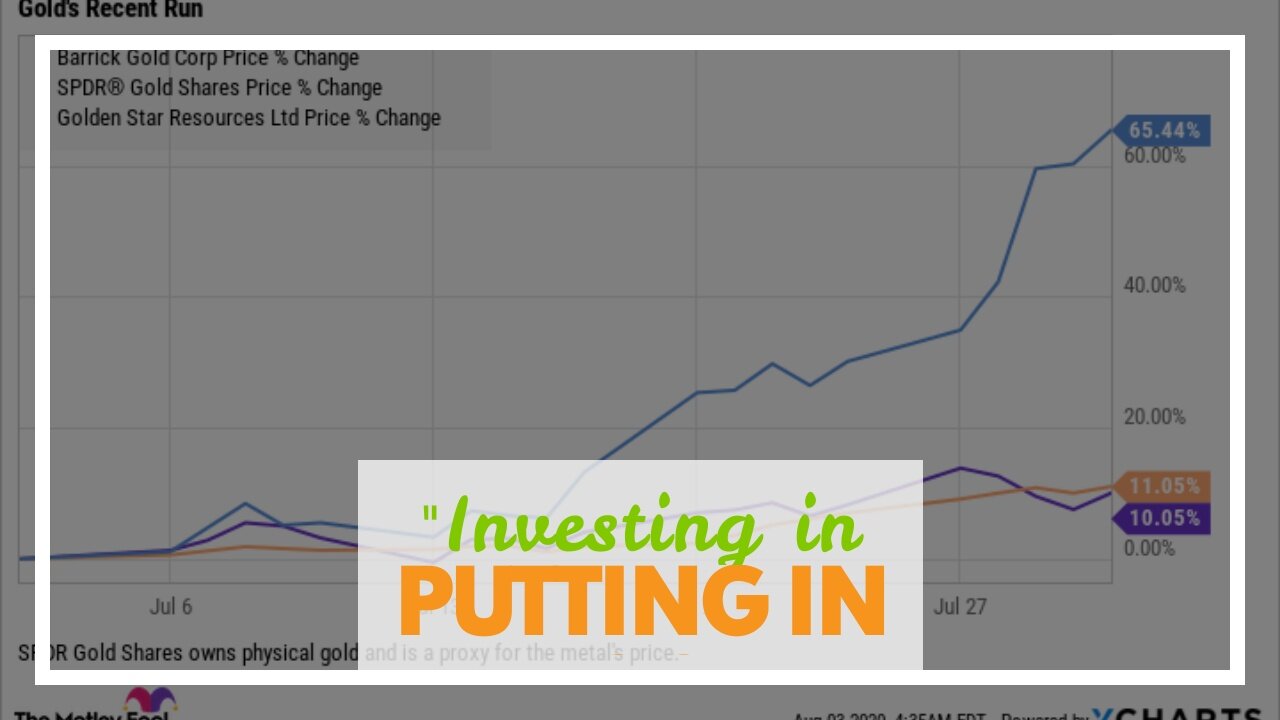

Putting in in Gold ETFs (Exchange-Traded Funds): What You Need to have to Know

Spending in precious metallics has long been a preferred tactic for branching out one's assets profile. One of the several options readily available, gold has regularly been a beloved one of investors due to its perceived security and value loyalty. Customarily, committing in gold entailed obtaining physical gold bars or pieces, keeping them tightly, and offering them when the rate boosted. However, with advancements in financial musical instruments and technology, clients now have gain access to to more hassle-free means of spending in gold, such as Gold ETFs or Exchange-Traded Funds.

What are Gold ETFs?

Gold ETFs are assets funds that trade on supply exchanges like normal reveals but embody possession of a particular quantity of gold. They aim to track the performance of the rate of gold by keeping either bodily gold gold or derivatives arrangements linked to the precious metal's cost.

Perks of Investing in Gold ETFs

1. Diversification: Investing in Gold ETFs provides an chance for variation within an financial investment profile. By including direct exposure to an resource training class like gold which has a tendency to act in a different way than traditional possessions like stocks and connections, capitalists can easily possibly decrease risk and raise total collection stability.

2. Access: Unlike physical gold financial investments that require storage and security measures, Gold ETFs deliver effortless gain access to to the precious metallic market via routine sell brokerage profiles. This accessibility creates it beneficial for both retail and institutional real estate investors identical to take part in the market without the logistical challenges affiliated with owning bodily gold.

3. Assets: Gold ETFs profession on significant supply exchanges simply like any type of other noted security. This implies that clients can purchase or offer their holdings at any opportunity in the course of market hrs at dominating market prices, offering liquidity that is not regularly quickly available with physical holdings.

4. Cost-effective: Investing in physical gold generally involves additional expense such as storage space fees and insurance policy costs. In comparison, Gold ETFs make it possible for clients to get direct exposure to gold's price movements without acquiring these additional expenses.

Considerations just before Putting in in Gold ETFs

1. Understanding the Structure: It is vital for investors to know the underlying structure of a Gold ETF before investing. Some Gold ETFs store bodily gold gold, while others hold by-products deals linked to gold's price. This difference can impact the efficiency and threat account of the ETF.

2. Expense Ratio: Like any other expenditure fund, Gold ETFs possess an cost proportion that covers monitoring fees and working expense. Clients must very carefully evaluate cost ratios when comparing different Gold ETF possibilities, as higher expenditures can deteriorate possible gains over time.

3. Tracking Inaccuracy: While a lot of Gold ETFs strive to track the rate of gold properly, some might experience monitor errors as a result of to variables like control fees or imperfect replication strategies. Real estate investors need to analyze a Gold ETF's historical keep track of efficiency before dedicating their financing.

4. Market Conditions: The price of gold is determined through several variables such as financial disorders, rising cost of living rates, and geopolitical activities. Prior to investing in a Gold ETF, capitalists must take into consideration how these market conditions might impact gold prices and their financial investment returns.

Final thought

Gold has long been ta...

-

Barry Cunningham

4 hours agoBREAKING NEWS: PRESIDENT TRUMP THIS INSANITY MUST END NOW!

53.7K117 -

LIVE

LIVE

StevieTLIVE

3 hours agoWednesday Warzone Solo HYPE #1 Mullet on Rumble

142 watching -

5:58

5:58

Mrgunsngear

4 hours ago $0.78 earnedBreaking: The New Republican Party Chairman Is Anti 2nd Amendment

4.46K5 -

LIVE

LIVE

Geeks + Gamers

3 hours agoGeeks+Gamers Play- MARIO KART WORLD

231 watching -

![(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism](https://1a-1791.com/video/fww1/d1/s8/6/G/L/3/c/GL3cz.0kob.1.jpg) 29:34

29:34

QNewsPatriot

4 hours ago(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism

6.93K1 -

25:12

25:12

Jasmin Laine

9 hours agoDanielle Smith’s EPIC Mic Drop Fact Check Leaves Crowd FROZEN—Poilievre FINISHES the Job

13.6K20 -

11:33:26

11:33:26

ZWOGs

12 hours ago🔴LIVE IN 1440p! - SoT w/ Pudge & SBL, Ranch Sim w/ Maam & MadHouse, Warzone & More - Come Hang Out!

6.94K -

LIVE

LIVE

This is the Ray Gaming

2 hours agoI'm Coming Home Coming Home Tell The World... | Rumble Premium Creator

29 watching -

9:42:31

9:42:31

GrimmHollywood

11 hours ago🔴LIVE • GRIMM HOLLYWOOD • GEARS OF WAR RELOADED CUSTOMS • BRRRAP PACK •

5.61K -

1:13:28

1:13:28

Glenn Greenwald

5 hours agoGlenn Takes Your Questions on the Minneapolis School Shooting, MTG & Thomas Massie VS AIPAC, and More | SYSTEM UPDATE #506

111K65