Premium Only Content

The 7-Second Trick For "Maximizing Returns with Diversification: The Importance of Including Bi...

https://rebrand.ly/Goldco

Sign up Now

The 7-Second Trick For "Maximizing Returns with Diversification: The Importance of Including Bitcoin in Your Investment Portfolio", bitcoininvest

Goldco aids clients shield their retired life savings by rolling over their existing IRA, 401(k), 403(b) or other competent pension to a Gold IRA. ... To find out exactly how safe haven rare-earth elements can assist you construct and also secure your riches, and also even safeguard your retired life phone call today bitcoininvest.

Goldco is just one of the premier Precious Metals IRA business in the United States. Secure your wealth and income with physical precious metals like gold ...bitcoininvest.

Optimizing Profits along with Diversification: The Importance of Consisting of Bitcoin in Your Investment Portfolio

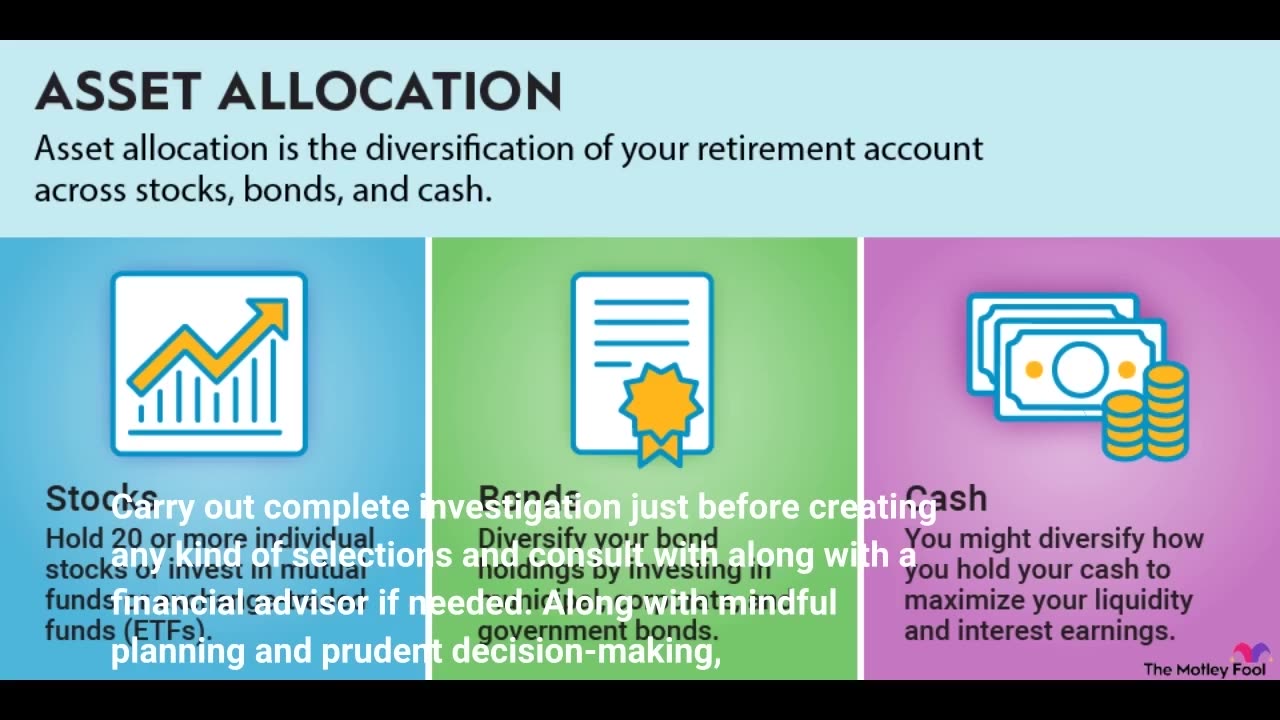

Diversification is a vital concept of investing that involves dispersing your investments all over various resource courses, markets, and geographic locations. Through carrying out therefore, you may likely minimize the total threat of your profile while optimizing yields. While typical asset lessons like inventories, connections, and actual property have been the go-to options for diversification, the introduction of cryptocurrencies has opened up a brand new pathway for clients to consider.

Bitcoin, the world's very first decentralized cryptocurrency, has acquired substantial interest since its beginning in 2009. Along with its decentralized attribute and potential for higher profits, featuring Bitcoin in your expenditure collection can be an helpful technique to optimize your overall gains by means of diversification.

One of the essential benefits of including Bitcoin in your expenditure collection is its low relationship along with standard asset classes. Standard asset courses such as sells and connects are influenced through a multitude of variables such as economic ailments, enthusiasm rates, and geopolitical celebrations. On the various other palm, Bitcoin operates independently coming from these elements due to its decentralized attributes.

This lack of connection means that when typical markets experience dryness or declines, Bitcoin might not be impacted to the very same magnitude. In truth, historical data has revealed that in the course of time frames of economic unpredictability or market turbulence, Bitcoin has typically acted as a safe haven asset. This indicates that by including Bitcoin in your expenditure collection alongside standard possessions like supplies and connections, you can easily likely decrease the overall risk direct exposure while still preserving solid ability for profits.

Additionally, featuring Bitcoin in your assets collection makes it possible for you to tap into the possible growth opportunities delivered through cryptocurrencies. Over the previous decade or so since its creation, Bitcoin has experienced amazing growth in worth. From being basically worthless at beginning to getting to an all-time higher rate of over $60k per coin in 2021, Bitcoin has verified itself as a highly profitable financial investment possibility.

While previous functionality does not guarantee potential end result, the simple fact that Bitcoin has consistently outshined most conventional asset classes can easilynot be overlooked. By featuring Bitcoin in your investment collection, you can easily take advantage of the capacity for notable gains and take perk of the increasing acceptance and fostering of cryptocurrencies.

Yet another advantage of featuring Bitcoin in your assets portfolio is its assets. Unlike lots of typical properties that might have limited assets, Bitcoin can be effortlessly bought or offered on a variety of cryptocurrency exchanges around the world. This liquidity guarantees that you can easily access your investment promptly if required, offering you along with greater flexibility and command over your portfolio.

However, it's essential to keep in mind that investing in Bitcoin does come with its own risks. The cryptocurrency market is highly unstable and subject to rapid cost changes. This dryness may lead to substantial gains but also significant losses. Therefore, it's important to come close to putting in in Bitcoin with a long-term perspective and a extensive understanding of the risks included.

To reduce these risks, it's a good idea to assign merely a portion of your overall investment portfolio to Bitcoin or other cryptocurrencies. B...

-

1:22:15

1:22:15

Glenn Greenwald

5 hours agoCharlie Kirk Assassination Fallout: U.S. Reps Call for Censorship; Do Graphic Videos Serve the Public Interest? Plus: WIRED Reporter on the Dark Side of Surrogacy | SYSTEM UPDATE #513

125K128 -

1:48:36

1:48:36

Right Side Broadcasting Network

11 hours agoLIVE: President Trump Attends the Yankees Baseball Game - 9/11/25

108K24 -

1:54:32

1:54:32

Badlands Media

5 hours agoBadlands Media Special Coverage - FBI Press Conference on Charlie Kirk's Assassination

81.3K9 -

1:06:19

1:06:19

BonginoReport

6 hours agoManhunt Underway for Charlie Kirk’s Assassin - Nightly Scroll w/ Hayley Caronia (Ep.132)

236K167 -

1:11:42

1:11:42

Flyover Conservatives

14 hours agoStructural Architect Destroys 9.11 Narrative... What Really Happened? - Richard Gage AIA | FOC Show

25.8K9 -

Precision Rifle Network

10 hours agoS5E1 Guns & Grub - Charlie Kirk's "sniper"

15.7K6 -

LFA TV

17 hours agoLFA TV ALL DAY STREAM - THURSDAY 9/11/25

387K90 -

1:01:56

1:01:56

The Nick DiPaolo Show Channel

7 hours agoDems + Media Killed Kirk | The Nick Di Paolo Show #1792

102K89 -

1:35:10

1:35:10

LIVE WITH CHRIS'WORLD

9 hours agoLIVE WITH CHRIS’WORLD - WE ARE CHARLIE KIRK! Remembering a Legend

26.1K3 -

50:24

50:24

Donald Trump Jr.

8 hours agoFor Charlie

378K442