Premium Only Content

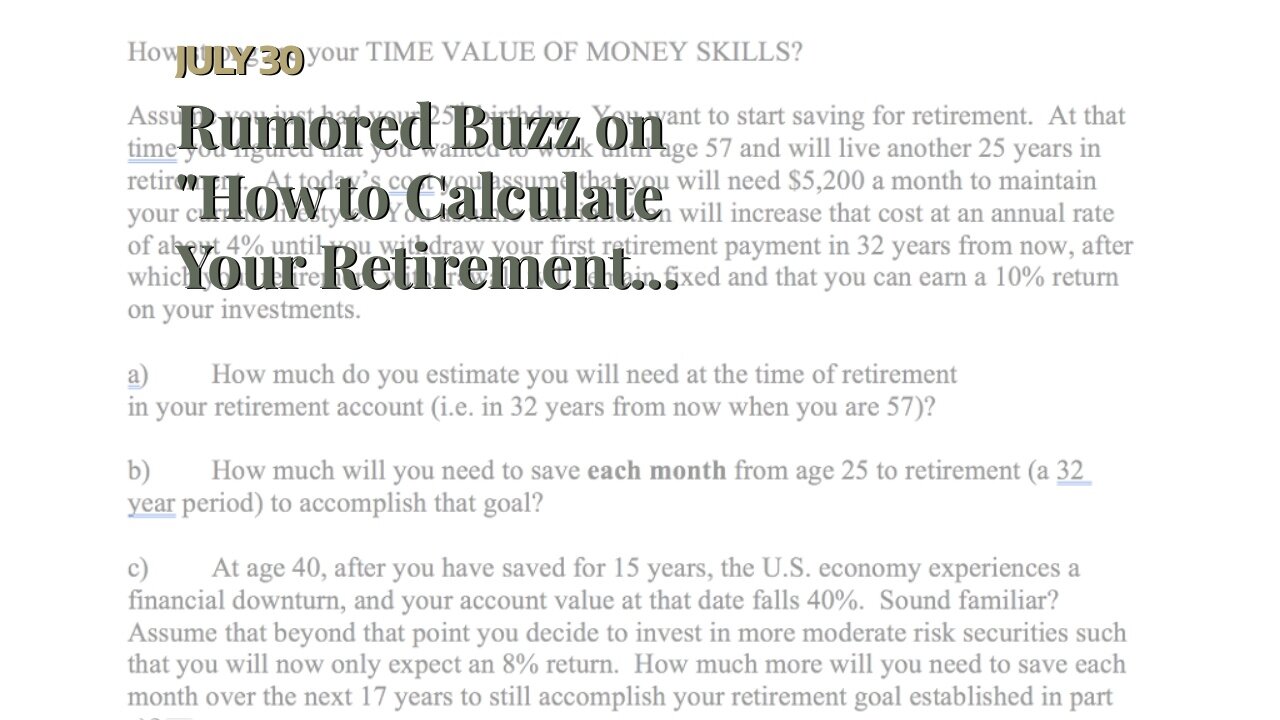

Rumored Buzz on "How to Calculate Your Retirement Savings Goals"

https://rebrand.ly/Goldco4

Join Now

Rumored Buzz on "How to Calculate Your Retirement Savings Goals", retirement investing basics

Goldco helps clients shield their retirement financial savings by rolling over their existing IRA, 401(k), 403(b) or various other certified pension to a Gold IRA. ... To discover how safe house rare-earth elements can help you develop and also safeguard your wide range, and even safeguard your retired life telephone call today retirement investing basics.

Goldco is one of the premier Precious Metals IRA business in the United States. Safeguard your wide range and also income with physical precious metals like gold ...retirement investing basics.

Usual Mistakes to Prevent in Retirement Investing

Retirement life is a time many people look forward to. It's a period of leisure, fulfillment, and the option to seek activities and passions that might have been put on hold during the working years. Having said that, in order to genuinely delight in retirement life, it's significant to have a strong financial plan in area. This features making smart expenditure selections that are going to give a stable income flow throughout those golden years.

Regrettably, many individuals make popular oversights when it comes to retirement life investing. These oversights may have major consequences and endanger their financial protection. In this short article, we will certainly cover some of the most common oversights people create in retired life investing and how you can easily avoid them.

1. Neglecting to begin early: One of the biggest blunders individuals make is not beginning their retirement financial savings early enough. The electrical power of worsening interest can easilynot be took too lightly. The faster you begin sparing for retirement life, the additional time your amount of money has to develop and collect wealth. Starting early permits you to take advantage of long-term financial investments that often tend to give much higher profits.

2. Neglecting property allowance: Resource allowance refers to how you split your investments one of different property lessons such as inventories, connections, and cash equivalents. Lots of seniors make the error of putting all their eggs in one container by putting in only in one kind of resource course without thinking about diversification. Diversifying your portfolio helps reduce risk and offers security in the course of market variations.

3. Dismissing rising cost of living: Rising cost of living deteriorates purchasing power over opportunity, which suggests that if you don't account for rising cost of living when planning for retired life, your financial savings might not be enough to cover your expenses down the road. It's essential to commit in properties that use protection against rising cost of living such as inventories or real property.

4. Forgeting fees: Fees linked with expenditure products can eat into your yields over opportunity if left untreated. Higher management fees or extreme investing expense can considerably affect your total financial investment efficiency. Be certain to contrast expenses and expenditures just before picking an investment item or working along with a financial consultant.

5. Falling short to reassess risk endurance: As you near retirement, it's essential to reassess your risk resistance and readjust your investment tactic correctly. When you possess a longer time perspective, you may manage to take on more danger in quest of greater returns. Nevertheless, as retirement life strategy, it's smart to progressively switch in the direction of much more conservative expenditures that focus on funds maintenance.

6. Psychological decision-making: Helping make expenditure decisions based on emotions rather than audio economic study is a typical error several retirees make. Concern and piggishness can easily shadow opinion and lead to impulsive choices that may not line up with long-term goals. It's important to continue to be disciplined and adhere to your expenditure plan irrespective of short-term market variations.

7. Counting solely on Social Security: While Social Security perks are an crucial component of several retired people' revenue flows, relying entirely on these advantages might not be adequate to maintain the wanted standard of living during retirement. It's essential to nutritional supplement Social Security profit with personal financial savings and expenditures....

-

LIVE

LIVE

Surviving The Survivor: #BestGuests in True Crime

1 hour agoCourt Stream: Donna Adelson Trial DAY 3 of Testimony

87 watching -

LIVE

LIVE

Wendy Bell Radio

5 hours agoWhat Hill Will Democrats Choose To Die On?

7,937 watching -

LIVE

LIVE

LFA TV

4 hours agoLFA TV ALL DAY STREAM - TUESDAY 8/26/25

5,221 watching -

1:15:15

1:15:15

JULIE GREEN MINISTRIES

3 hours agoTHE CIA HAS BEEN A GIANT IN THIS LAND THAT WILL BE TAKEN OUT

67.7K135 -

3:58:26

3:58:26

The Bubba Army

1 day agoBURN The FLAG, Go to JAIL! - Bubba the Love Sponge® Show | 8/26/25

54.5K25 -

29:45

29:45

DeVory Darkins

18 hours ago $7.39 earnedDemocrat Governor suffers EMBARRASSING LOSS to Trump as ICE takes Garcia into custody

27.1K74 -

18:22

18:22

World2Briggs

22 hours ago $2.99 earnedThe New York Rant: Point Blank With No Fluff or BS. A Warning

19.3K8 -

42:52

42:52

The Finance Hub

16 hours ago $4.23 earnedBREAKING: ALINA HABBA JUST SHOCKED THE WORLD!

22.7K39 -

2:00:44

2:00:44

BEK TV

1 day agoTrent Loos in the Morning - 8/26/2025

23K1 -

12:15

12:15

Nikko Ortiz

20 hours agoMonday Gun Fails

82.3K19