Premium Only Content

How The Impact of Geopolitical Events on the Value of Gold: Insights for Investors can Save You...

https://rebrand.ly/Goldco

Join Now

How The Impact of Geopolitical Events on the Value of Gold: Insights for Investors can Save You Time, Stress, and Money., gold investor gold

Goldco assists customers protect their retired life savings by surrendering their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To learn exactly how safe haven precious metals can help you construct and also protect your riches, and also even safeguard your retired life telephone call today gold investor gold.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Safeguard your wealth and also income with physical precious metals like gold ...gold investor gold.

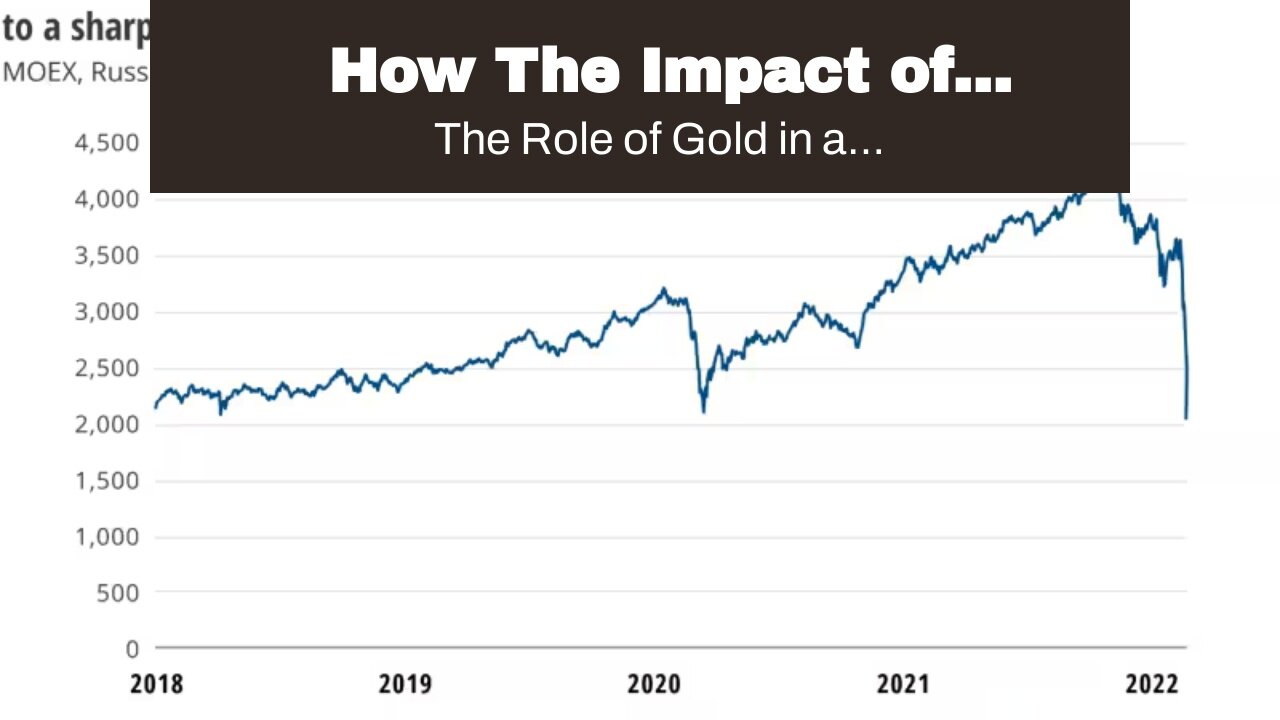

The Role of Gold in a Diversified Investment Portfolio

Gold has long been thought about a safe sanctuary asset and is often found as a bush against financial anxiety. In recent years, it has obtained popularity as an investment option for those finding to expand their profiles. In this blog article, we will definitely look into the task of gold in a diversified investment profile and talk about its potential advantages and downsides.

One of the key main reasons why entrepreneurs consist of gold in their profiles is its capacity to act as a outlet of worth. Unlike paper unit of currencies, which can easily be topic to rising cost of living and decrease, gold has preserved its market value over time. This produces it an appealing alternative for entrepreneurs looking to safeguard their wide range against economic recessions or unit of currency changes.

One more benefit of gold is its reduced relationship with other asset courses such as supplies and bonds. This means that when various other expenditures are performing poorly, gold has actually the potential to hold its worth or also enhance in cost. This may help countered reductions in other locations of the profile and decrease overall threat.

Gold likewise provides diversification perks due to its special qualities. It is a substantial possession that can easilynot be replicated or made through any kind of federal government or central bank. Its shortage and intrinsic value make it less vulnerable to market dryness compared to other financial investments. This produces it an outstanding addition to a varied profile, as it can easily aid reduce overall risk by providing an different property course that acts in a different way than standard financial investments.

In enhancement, gold has historically conducted effectively throughout opportunities of financial unpredictability or market turmoil. When investors are worried concerning inflation, geopolitical tensions, or inventory market volatility, they often switch to gold as a safe haven asset. Its recognized security and potential to retain market value have produced it a popular selection for risk-averse clients looking for long-term wide range preservation.

Despite these possible advantages, there are likewise some disadvantages linked along with investing in gold. One primary disadvantage is the absence of revenue production from keeping bodily gold or also many kinds of newspaper gold. Unlike stocks or connections that offer frequent rate of interest repayments or rewards, gold does not create any type of income on its very own. This implies that investors may miss out on out on potential earnings chances through designating a significant part of their portfolio to gold.

Yet another drawback is the volatility of gold costs. While gold has in the past been a relatively dependable expenditure, it can still experience significant rate fluctuations in the brief phrase. This can make it challenging for clients to time their entry and departure factors, likely leading to losses if not dealt with appropriately.

Furthermore, putting in in gold requires mindful point to consider of storing and safety issues. Physical gold need to have to be stashed firmly, which can entail additional price and logistical problem. As an alternative, investors may pick to invest in paper forms of gold such as exchange-traded funds (ETFs) or futures agreements, but these possibilities come with their own collection of threats and factors to consider.

In verdict, the task of gold in a varied expenditure collection ought to be very carefully taken into consideration located on an financier's specific targets and threat endurance. Gold may offer valuable diversity perks by functioning as a retail s...

-

LIVE

LIVE

Ben Shapiro

2 hours agoEp. 2264 - Democratic Party BLEEDING Voters!

11,637 watching -

LIVE

LIVE

Side Scrollers Podcast

2 hours agoDISASTROUS Cracker Barrel Rebrand + Destiny PDF Allegations + More | Side Scrollers Live

470 watching -

LIVE

LIVE

Sean Unpaved

1 hour agoRicky Cobb's Bucket List: Sports, Jokes, & Jabs

1,131 watching -

LIVE

LIVE

Reidboyy

40 minutes agoNEW FREE FPS OUT ON CONSOLE NOW! (Delta Force = BF6 with Killstreaks)

31 watching -

LIVE

LIVE

GloryJean

3 hours agoAggressive Solos on MnK 🖱️ 6.7 K/D

99 watching -

1:03:22

1:03:22

Timcast

1 hour agoTrump Civil Fraud Judgement OVERTURNED On Appeal, PROVING Corruption

22.4K38 -

LIVE

LIVE

Viss

1 hour ago🔴LIVE - Learn PUBG Tactics Here and Dominate The Battleground!

129 watching -

LIVE

LIVE

GritsGG

5 hours agoWin Streaking! Most Wins 3390+ 🧠

54 watching -

LIVE

LIVE

The Charlie Kirk Show

1 hour agoTrump the Unbreakable + The Anti-Abstraction Presidency | Marlow, Morris, Hanson, Nuclear | 8.21.25

3,464 watching -

2:02:51

2:02:51

Steven Crowder

4 hours agoWoke CNN Host's Meltdown Over Trump Slavery Truth Needs to Be Examined

188K173