Premium Only Content

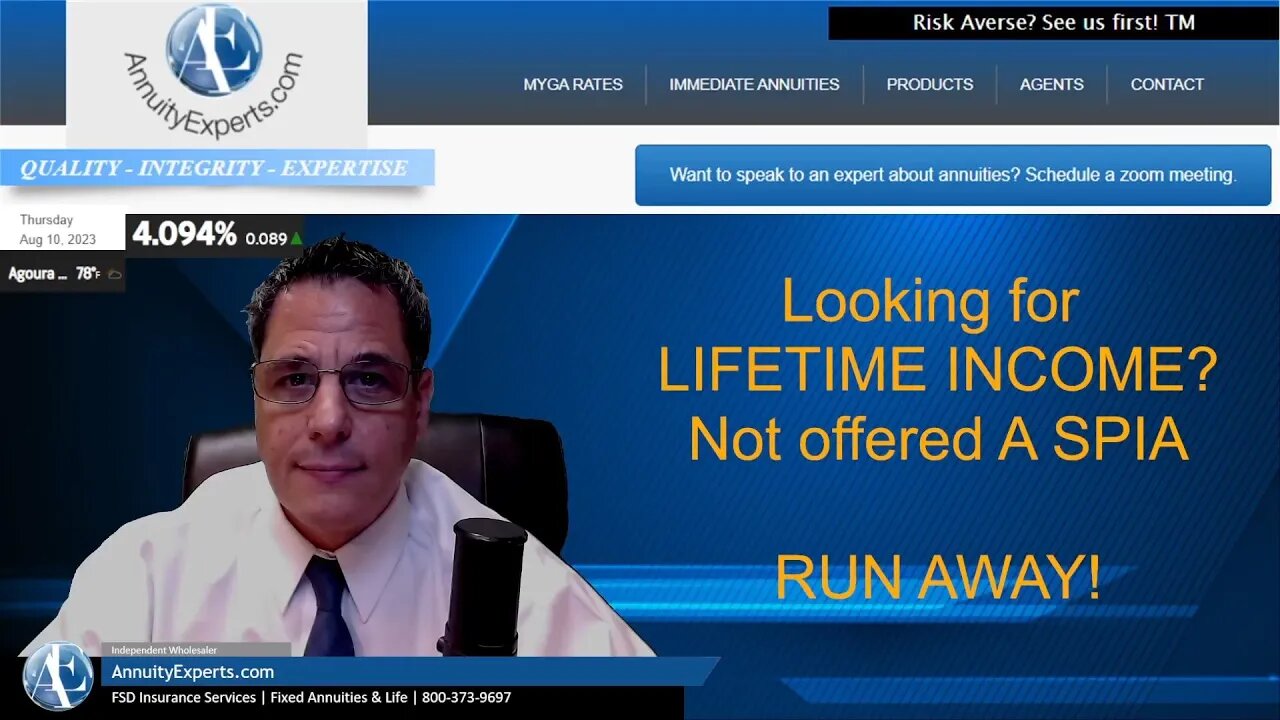

Seeking to optimize clients' Income NOW? Compare that income rider to the Immediate Annuity (SPIA)!!

LIFE AGENTS: Seeking to optimize your clients' Income NOW? Compare that income rider to the Single Premium Immediate Annuity (SPIA)! Most carriers are not mentioning this!

Single Premium Immediate Annuity is back on top for Lifetime Income NOW Income now, look at the SPIA!

Less premium for the same income.

More income for the same premium.

Stronger Guarantees - 20 Year Period certain

Higher Rated Carriers

A certain conglomerate recently advertised a 5.90% lifetime income offer at age 65. Curious, I delved into SPIA Life with a 20-year guarantee, yielding astonishing results in comparison:

👨 For gentlemen: 6.80%

👩 For ladies: 6.70%

I shared my findings through a comment, complete with SPIA quote visuals, only to witness the company promptly remove it. Why the secrecy around SPIA? Could it be a reluctance to unveil this impressive option to potential clients? $$$

Agent you have to understand that most companies prefer to sell income rider over SPIA because of the profit margins. Those carriers do not have your clients best interest in mind, but you should.

For lifetime income NOW please compare a SPIA to all other options before the client decides!

IMPORTANT INFORMATIONThis material is for informational or educational purposes & is not a recommendation to buy, sell, hold or rollover any asset. It does not take into account the specific financial situation, investment objectives, or need of an individual person. Withdrawals may be subject to ordinary income taxes and, if made prior to age 59½, may be subject to a 10% IRS penalty. Surrender charges may also apply. All guarantees are backed by the claims-paying ability of the issuer. Available in jurisdictions where approved.

#immediateannuities #spiaquote #lifetimeincome #SPIA #insurance #periodcertain #longevityprotection

-

1:10:08

1:10:08

Donald Trump Jr.

6 hours agoWhat Real Leadership Looks Like, Live with Sen Bernie Moreno | TRIGGERED Ep.210

93.2K151 -

LIVE

LIVE

The Jimmy Dore Show

3 hours agoCIA Backs Wuhan Lab Leak Theory! Trump Calls for Ethnic Cleansing in Gaza!

13,254 watching -

57:43

57:43

The StoneZONE with Roger Stone

1 hour agoWhat Will The JFK Assassination Files Reveal? | The StoneZONE w/ Roger Stone

3.4K6 -

18:24

18:24

Tundra Tactical

4 hours ago $0.96 earnedWhats New With HRT Tactical Gear at SHOT Show 2025

13.7K2 -

23:27

23:27

Rethinking the Dollar

3 hours agoWealth Protection SECRETS Learned from Wildfires w/ Paul Stone

6203 -

UPCOMING

UPCOMING

Flyover Conservatives

20 hours agoInsider Reacts to Trump’s 100 Hours: Davos, WHO, Climate Change, DEI… - Alex Newman | FOC Show

6.36K -

1:04:30

1:04:30

Battleground with Sean Parnell

7 hours agoPresident Trump Is Flooding The Zone

81.3K8 -

LIVE

LIVE

megimu32

2 hours agoON THE SUBJECT: 90s Toys, Fat Phobia, and Crying Libs!

177 watching -

LIVE

LIVE

Right Side Broadcasting Network

10 hours agoLIVE REPLAY: President Trump Addresses House GOP in Doral, FL - 1/27/25

5,579 watching -

2:37:19

2:37:19

Robert Gouveia

5 hours agoTrump Addresses House Republicans; Tulsi Confirmation Fight; CIA Lab Leak

35.3K12