Premium Only Content

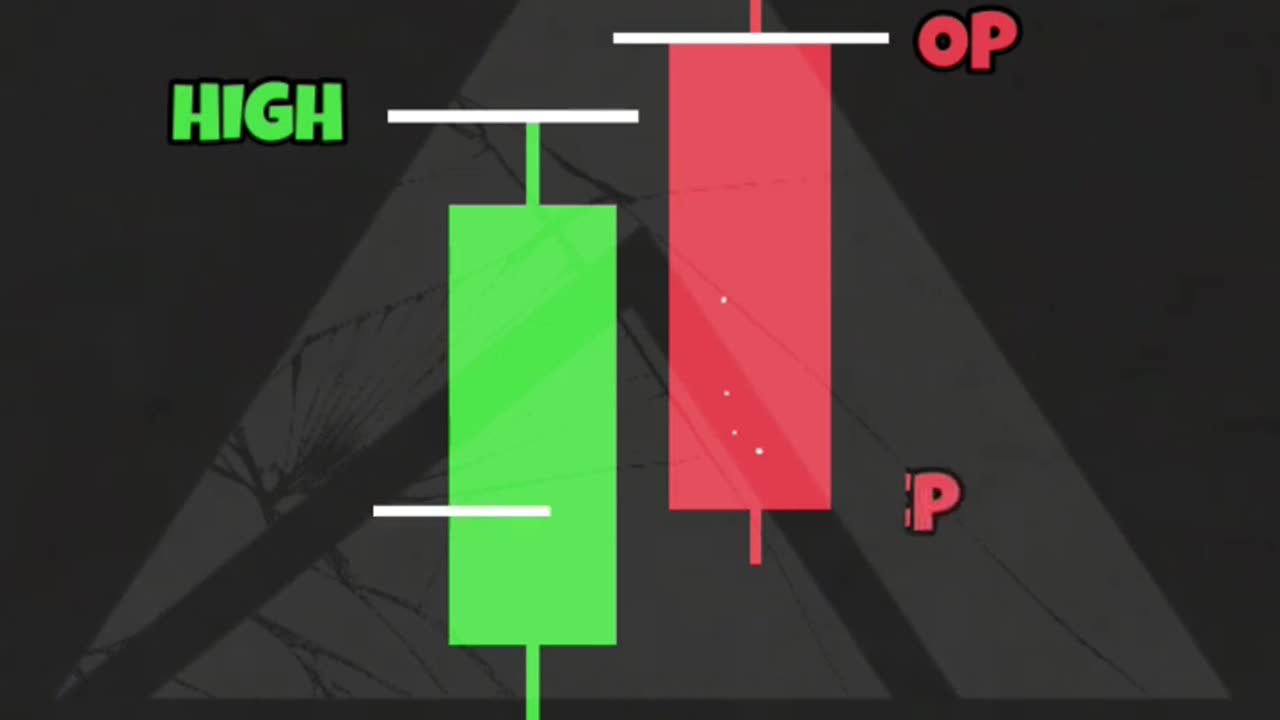

Dark Cloud Cover

Dark Cloud Cover candlestick pattern hai jo bearish trend reversal ko darshaata hai. Ye pattern price chart par ek uptrend ke baad dikhta hai aur generally trend reversal ke indication ke roop mein istemaal kiya jata hai.

Dark Cloud Cover mein do candlesticks hote hai. Pehla candlestick green (bullish) hai aur dusra candlestick red (bearish) hai. Niche diye gaye hote hain is pattern ke important elements:

1. Pehla Candlestick: Ye bullish candlestick hai jo trend ke continuation ko darshaata hai. Ise ye represent karta hai ki buyers dominate kar rahe hain market ko aur price upar jaa raha hai.

2. Dusra Candlestick: Ye bearish candlestick hai jo pehle candlestick ke oopar open hota hai aur price mein drop karti hai. Ise ye indicate karta hai ki sellers strong ho rahe hain aur trend reversal ka indication ho sakta hai.

Is pattern ki aur bhi kuch important characteristics hai:

- Pehle candlestick ki body bahut bada hona chahiye aur dusre candlestick ki body pehle wale candlestick ki body ke kam se kam 50% tak pahuchni chahiye.

- Dusre candlestick ki closing price pehle wale candlestick ke body ke andar honi chahiye.

- Dark Cloud Cover ka impact jab zyada hota hai jab ye pattern major support ya resistance level ke paas form hota hai.

Agar is pattern ko confirm karna hai, to traders stop loss orders aur confirmation from other technical indicators jaise ki trend lines, moving averages, aur momentum oscillators ki madad lenge.

-

2:07:35

2:07:35

Steven Crowder

4 hours agoThe Murder of A Ukrainian Refugee is A Tipping Point in American History

277K264 -

1:03:37

1:03:37

The Rubin Report

3 hours agoMedia Caught Trying to Ignore Ugly New Details of Charlotte Train Stabbing Caught on Tape

36K57 -

LIVE

LIVE

Rebel News

1 hour agoConservative MP rips Doug Ford, Carney's decarbonization scheme, Security cam rules | Rebel Roundup

274 watching -

58:13

58:13

Badlands Media

2 hours agoThe Daily Herold: Sept. 8, 2025

8.19K1 -

LIVE

LIVE

LFA TV

15 hours agoLFA TV ALL DAY STREAM - MONDAY 9/8/25

3,758 watching -

1:39:10

1:39:10

Nikko Ortiz

3 hours agoDont Be A Chicken Turns Into Fails...

25.2K1 -

1:44:56

1:44:56

The Mel K Show

2 hours agoMORNINGS WITH MEL K -Won’t Be Fooled Again? America Must Know the Hidden Truth About Post WWII Globalization 9-8-25

17.6K5 -

DVR

DVR

The Shannon Joy Show

2 hours agoThe Vaccine Wars Intensify - DeSantis & Ladapo To END Medical Mandates - Trump Slams Initiative

11K7 -

1:01:13

1:01:13

Grant Stinchfield

2 hours ago $0.58 earnedIf the Races Were Reversed… It’d Be National News, But White Victims Don’t Fit the Narrative

11.6K3 -

3:28:16

3:28:16

Right Side Broadcasting Network

6 hours agoLIVE REPLAY: President Donald J. Trump Delivers Remarks to the WH Religious Liberty Commission - 9/8/25

52.5K19