Premium Only Content

The "The Role of Gold in a Diversified Investment Portfolio" Diaries

https://rebrand.ly/Goldco6

Get More Info Now

The "The Role of Gold in a Diversified Investment Portfolio" Diaries, gold and investment

Goldco helps customers secure their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified retirement account to a Gold IRA. ... To discover how safe house rare-earth elements can aid you develop as well as secure your wide range, and also even safeguard your retirement call today gold and investment.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Secure your wealth and also source of income with physical precious metals like gold ...gold and investment.

The Pros and Cons of Investing in Gold

Gold has long been looked at a useful resource, sought after by entrepreneurs appearing to branch out their profiles. It is frequently viewed as a risk-free haven in the course of opportunities of financial uncertainty, offering stability and functioning as a bush versus rising cost of living. Nevertheless, like any type of investment, there are pros and cons to take into consideration when putting in in gold.

Pros:

1. Retail store of worth: Gold has been regarded as a outlet of value for centuries. Unlike fiat currencies that can easily be quickly adjusted through federal governments or central banks, gold sustains its worth over time. It is not subject to the exact same risks affiliated with newspaper unit of currency or other financial properties.

2. Hedge versus rising cost of living: Inflation deteriorates the investment electrical power of loan over opportunity. Gold has traditionally been an successful bush versus inflation since its value usually tends to increase when prices are enhancing swiftly. Through investing in gold, you may guard your wide range from the abrasive results of inflation.

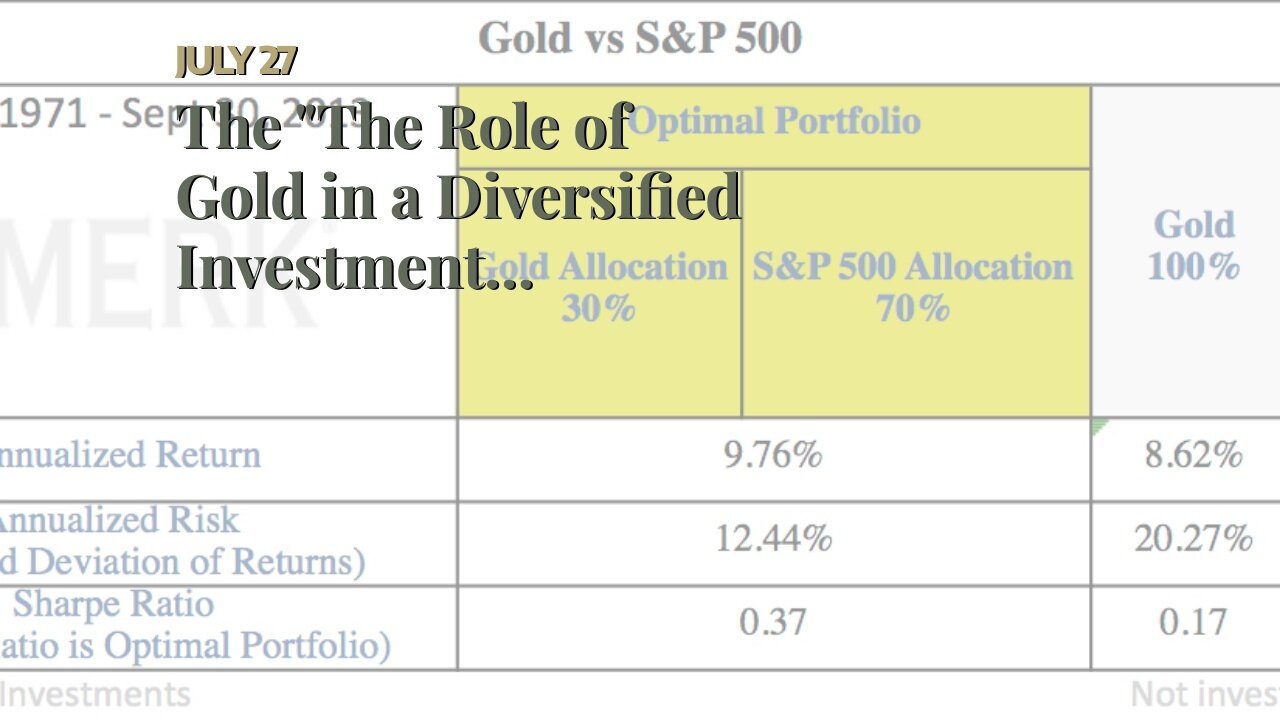

3. Collection diversification: Diversity is crucial to reducing risk in an expenditure profile. Gold supplies variation perks because it normally has a low relationship along with various other property training class such as sells and bonds. When inventories are conducting improperly, gold may behave as a counterbalance, assisting to alleviate losses.

4. Limited supply: Unlike newspaper unit of currency that can easily be printed at will, the source of gold is finite. This limited source makes it an desirable expenditure possibility for those worried regarding the possible devaluation of fiat currencies due to too much funds printing.

5. Concrete property: One advantage of investing in bodily gold is that it is a positive resource you can easily keep in your palm. This component provides capitalists along with tranquility of thoughts recognizing they possess something substantial backing their assets.

Disadvantages:

1. Volatility: While gold might deliver reliability in the course of unclear economic opportunities, it may also be topic to significant rate volatility in the quick phrase. The cost of gold can easily vary based on different elements such as economic conditions, geopolitical occasions, and investor sentiment. This volatility can easily produce it a difficult expenditure for those looking for consistent returns.

2. No profit production: Unlike sells or connections that may create profit with rewards or interest remittances, gold does not deliver any sort of regular income stream. Financiers who count on routine cash circulation may locate this facet of gold putting in much less appealing.

3. Storage and protection: When putting in in physical gold, storage and safety and security become necessary points to consider. Gold can be huge, and saving it at house may present dangers such as fraud or damage. Additionally, making use of a safe storage space center might sustain additional expense.

4. Absence of management: Putting in in gold typically means relying on aspects beyond an individual investor's management. The price of gold is influenced through global market forces that can be complicated to anticipate or affect straight. This absence of management may be aggravating for entrepreneurs who favor to have even more effect over their investment outcomes.

5. Chance cost: Spending in gold ties up funding that can be made use of somewhere else. While gold has the ability to maintain wide range over time, it might not produce the very same amount of returns as other financial investments such as supplies or actual estate. Through allocating a notable porti...

-

2:04:24

2:04:24

Side Scrollers Podcast

16 hours agoColbert CANCELLED, Donkey Kong Bananza “Disappointing”, $100k in Pokémon STOLEN | Side Scrollers

3.14K4 -

1:17:57

1:17:57

Omar Elattar

1 month ago"The #1 Health Protocol" – Gary Brecka REVEALS The Longevity Secrets of Ronaldo, Dana White & Top 1%

1.36K -

21:29

21:29

GritsGG

12 hours agoUpdate Your Loadout w/ This KILO Sniper Support Build!

9861 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

223 watching -

DVR

DVR

SpartakusLIVE

10 hours agoFriday Night HYPE || WZ Solos, PUBG, and maybe even OFF THE GRID?!

90.5K -

3:24:24

3:24:24

megimu32

6 hours agoOFF THE SUBJECT: FAFO FRIDAY - Bodycam Madness + Mortal Kombat Mayhem!

49.3K10 -

2:08:59

2:08:59

I_Came_With_Fire_Podcast

13 hours agoTRUMP WANTS TO KILL TRANS KIDS | CHINA IN TROUBLE | NYC IS RETARDED | WHO WILL WIN THE MIDTERMS

65.5K16 -

2:05:52

2:05:52

TimcastIRL

7 hours agoTrump Russia HOAX DECLASSIFIED, Obama Officials EXPOSED In “TREASONOUS CONSPIRACY”

173K154 -

2:58:12

2:58:12

SavageJayGatsby

8 hours agoLockdown Protocol - Wedding in 3 Months! - Halftway to 100!

59.9K2 -

2:41:27

2:41:27

Mally_Mouse

11 hours agoFriend Friday!! - Let's Play! - Lockdown Protocol

49.4K4