Premium Only Content

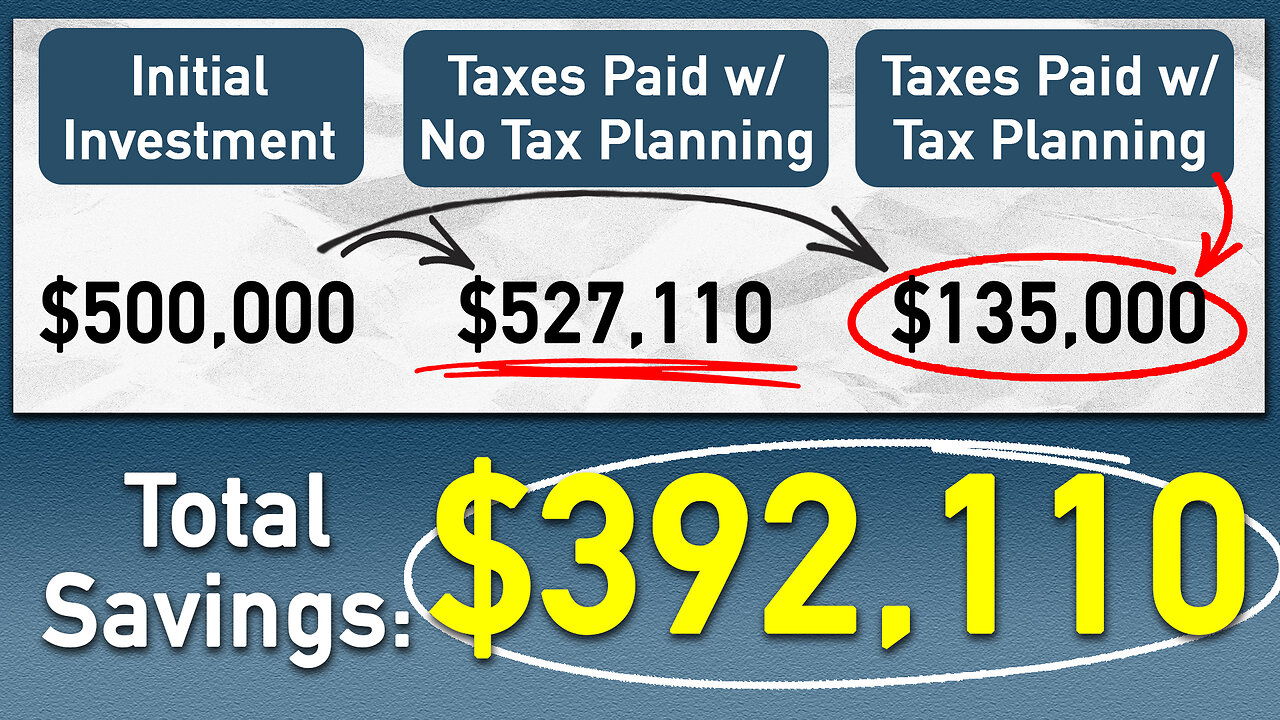

How to Save Over $300k in Taxes Over Your Lifetime!

In this video, we discuss a tax planning strategy that can help you save over $300,000 in taxes over your lifetime. We walk through a case study of a couple who are 64 years old and have $500,000 in tax-deferred dollars. We explore their current plan, which involves paying taxes on required minimum distributions (RMDs), the impact of social security taxes, and taxes paid by beneficiaries. We then introduce a simple strategy of converting their $500,000 to a Roth IRA over the next three years, which involves paying $120,000 in taxes upfront, but offers tax-free growth and eliminates taxes on RMDs, social security, and taxes paid by beneficiaries. By implementing this strategy correctly, you can save a significant amount in taxes over your lifetime. If you're interested in running your personal numbers in this tax calculator, please reach out to us for a consultation!

Please note, this video discusses factors that could apply to a hypothetical couple. Your specific circumstances may vary materially.

Are you interested in receiving expert help in planning for your financial future?

If so, give us a call at (614)500-4121 or visit us at https://peakretirementplanning.com/schedule-a-meeting/

🟥 I Love Roth IRAs and Roth Conversions! 🟥

https://www.kiplinger.com/retirement/retirement-plans/roth-iras/604539/i-love-roth-iras-and-roth-conversions

🎥 Subscribe to our channel:

https://bit.ly/430T9Lv

🤝 Join our Insider's List:

https://peakretirementplanning.com/resources/

📞 Talk with us:

https://peakretirementplanning.com/schedule-a-meeting/

#retirement #retirementplanning #taxes

Disclaimer: Since we do not know your specific situation, none of this information can serve as tax, legal, financial, insurance, or financial advice, and may be outdated or inaccurate. The information comes from sources believed to be reliable but cannot be guaranteed. This content is prepared for educational purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Peak Retirement Planning, Inc. is an Ohio based registered investment adviser and able to offer advisory services in Ohio and in other states where registered or exempt from registration.

-

LIVE

LIVE

Nerdrotic

3 hours agoCancel Kurtzman Trek | The Fate of the Superhero Film - Nerdrotic Nooner 502

505 watching -

2:07:13

2:07:13

Steven Crowder

4 hours ago🔴Game Over: Trump's EU Trade Victory Shows How Stupid "Experts" Really Are

228K129 -

DVR

DVR

Neil McCoy-Ward

1 hour agoTHE UK 🇬🇧 JUST ENDED 140 YEARS OF FREE SPEECH! (How Did It Come To THIS?!)

3.87K -

LIVE

LIVE

The Charlie Kirk Show

1 hour agoTHE CHARLIE KIRK SHOW IS LIVE 07.28.25

5,202 watching -

LIVE

LIVE

JuicyJohns

4 hours ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢 !loadout

1,177 watching -

52:11

52:11

Anthony Pompliano

1 hour agoWhy Bitcoin Will EXPLODE During The AI Era

4.67K -

1:06:00

1:06:00

The Rubin Report

2 hours agoMajor Company’s Must-See Ad May Be the Official Death of Woke

24.9K39 -

LIVE

LIVE

Robert Gouveia

2 hours agoBongino's "SHOCKING" Bombshell! Peter Strozk PANIC! Trump Assassin Case! Climate Change PLOT!

1,616 watching -

LIVE

LIVE

LFA TV

18 hours agoLFA TV ALL DAY STREAM - MONDAY 7/28/25

3,191 watching -

48:37

48:37

Grant Stinchfield

1 hour agoImporting Capital, Not Chaos: The Pro-America Visa

8.02K